CLICK HERE TO DOWNLOAD THE ARTICLE

Industry Overview

As one of the few asset classes to continue development and transaction activity throughout the economic and financial fallout sparked by the global pandemic, self-storage has remained a strong performer. The self-storage sector is often deemed recession-resistant by investors, as the demand for storage remains consistent, and facilities continue to remain stable during economic downturns. Rental rates declined during the first few months of the pandemic but have since recovered and shown growth year-over-year. The sector has long seen oversaturated markets, but COVID-19 has brought the supply-demand balances closer to equilibrium in certain areas.

Vacancy & Rent Fundamentals

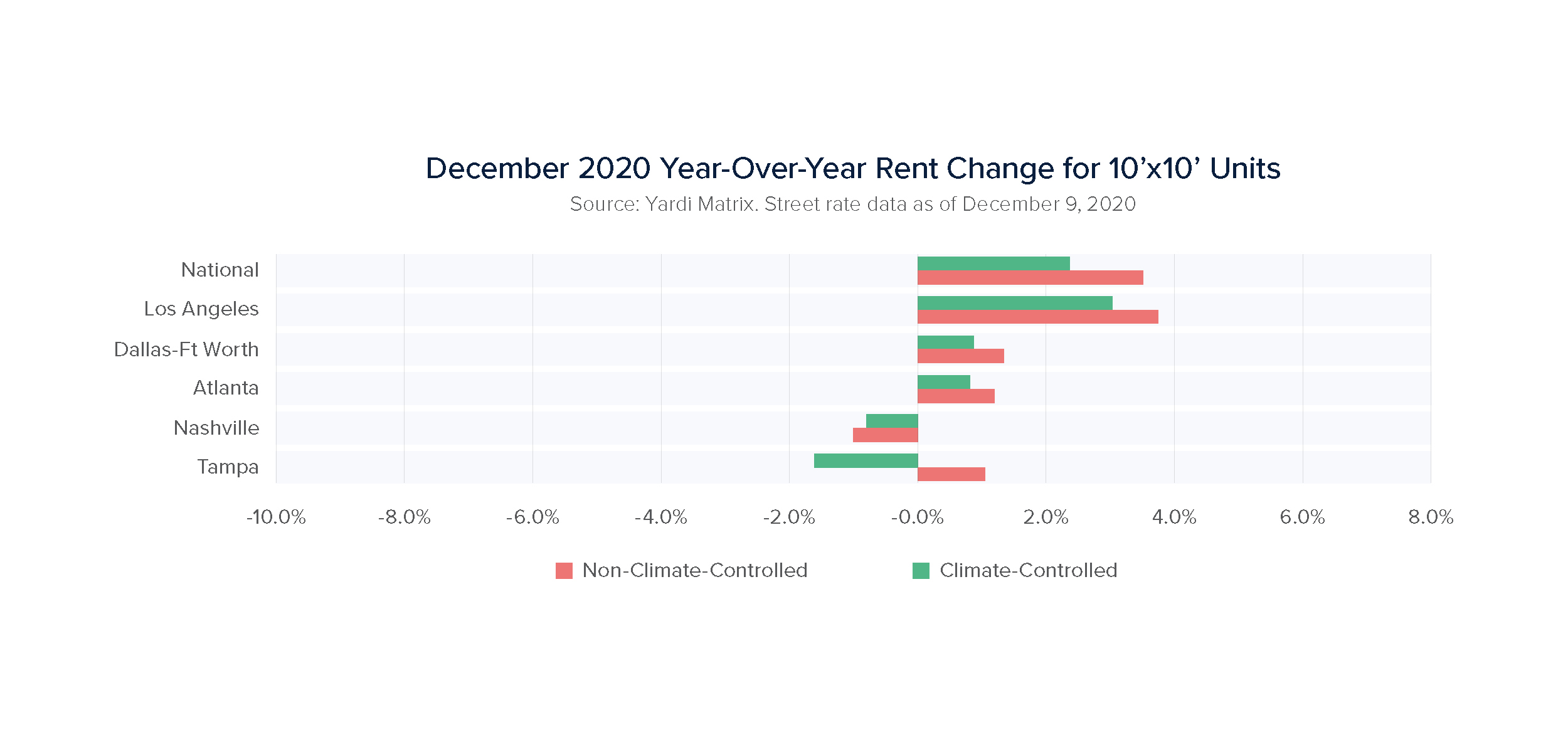

Nationally, rental rates improved in December 2020 by 3.5 percent year-over-year for non-climate-controlled, while climate-controlled units grew 2.3 percent. While rents took an initial hit upon the arrival of COVID-19, it mainly stemmed from operators discounting move-in rates and halting rent increases, and soon returned to the original levels around the summertime. Since September 2020, rental rates have continued to increase, maintaining the momentum from the summer. November 2020 marked the first time in over three years that the top four Texas metros, Austin, Dallas-Fort Worth, Houston, and San Antonio, did not see negative rent growth despite each market seeing a record in new deliveries. Another market to note is Columbus, with an annual growth of two percent in 10×10 climate-controlled unit rents and remained unchanged month-over-month as of December 2020. For the most part, occupancy levels remained consistent in 2020 as move-in and move-out activity was less than usual. As 2021 begins, occupancy is relatively strong in most markets, and is expected to remain at stabilized levels as the year progresses.

According to CoStar, there were 1,829 transactions in 2020, totaling $4.9 billion, compared to the 1,929 transactions in 2019 that totaled $5.2 billion. Stabilized facilities in major metros with positive cash flow are still the most sought-after. Secondary and tertiary markets have also become targets for many investors and private equity groups, as competition for assets in top MSA’s remain extremely high. Certificate of Occupancy deals, along with new construction facilities still in the lease-up phase, are of interest to investors if they are located in supply-constrained markets with strong demographics. However, the velocity of new construction high vacancy deals has declined tremendously compared to 2017 and 2018. Moving forward in 2021, due to historically low interest rates and favorable debt terms, transaction velocity of facilities in all stages of lease-up is expected to increase.

Construction

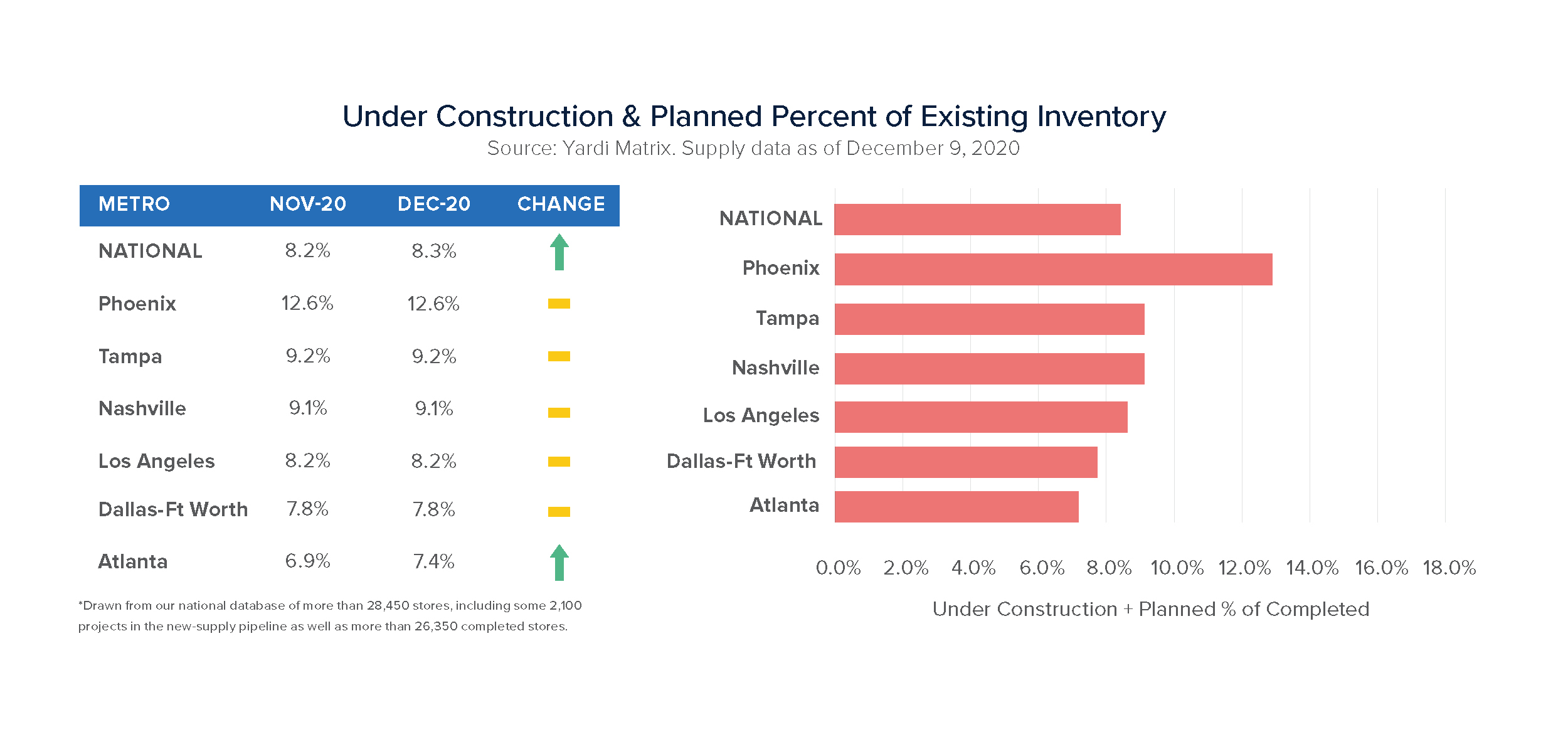

Across the nation, self-storage properties in the development pipeline account for approximately 8.3 percent of existing inventory in December 2020, a ten basis point increase compared to October 2020. For example, despite Tampa experiencing negative rental rate growth, the market still saw a 0.5 percent month-over-month increase in new supply, possibly due to Tampa Bay Economic Development Council’s projected area population growth of 8.3 percent by 2025. However, new supply across the U.S. appears to remain stable even though 53 projects were abandoned in Q3 2020.

According to the National Self-Storage Report by Yardi Matrix, the top-performing markets as of December 2020 are Columbus, Tampa, and New York. Both Tampa and New York pose impressive development activity, with 10.3 percent and 17.8 percent of existing inventory currently in development, respectively. Another top market for self-storage is Atlanta, although the market took a hit due to overbuilding potentially causing rates to take a few years to stabilize. Despite this, investors continue to eye the metro due to its projected population and economic growth. The projected population and economic growth in the Atlanta metro will boost demand for self-storage space. Additionally, the amount of self-storage in Atlanta has grown 14 percent in recent years, for a total of 41 million square feet, according to Radius+, a self-storage analysis platform.

While the self-storage sector suffers from high levels of existing supply in some markets, and other markets have limited developable land available, developers look to other property types for creative solutions. Extensive industrial facilities and vacant big-box retail space offers the perfect structure and foundation needed for converted self-storage facilities. U-Haul has a long track record of repurposing historical buildings for storage complexes, with the most notable conversion being the Portland Motor Sales Ford dealership built in 1963.

2021 Outlook

With the vaccine being distributed throughout the country, along with supply levels and rents stabilizing, the self-storage industry is poised for a strong year of performance. Additionally, as investors become more accustomed to the adjustments needed to be made for successful transactions amid the pandemic, an uptick in sales volume is forecasted this year compared to 2020. Lastly, with interest rates remaining at historic lows, cap rates will stay at compressed levels, if not compress even more due to an increased amount of capital chasing favorable opportunities.