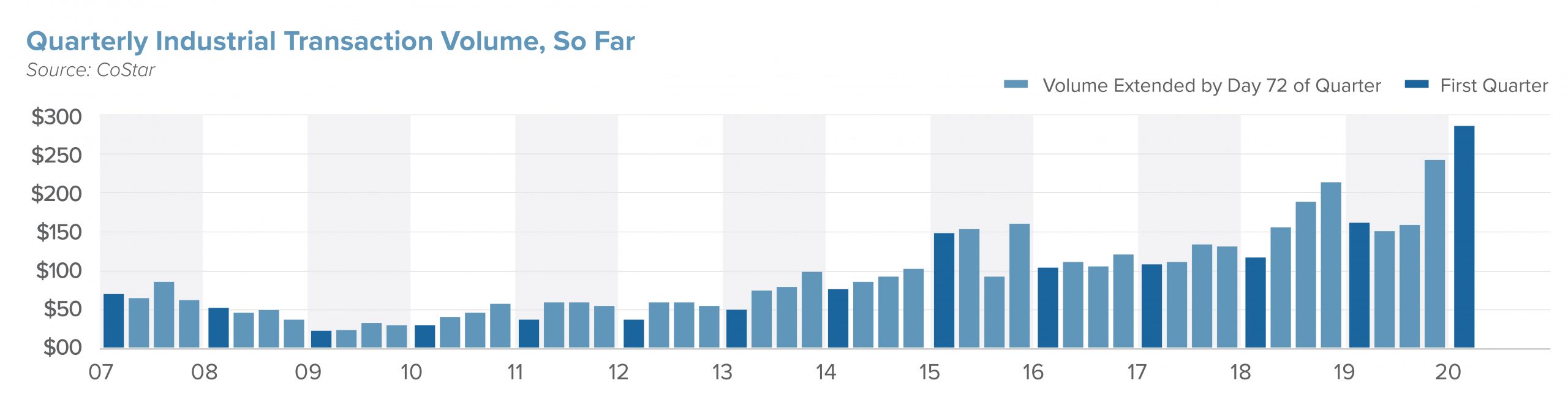

Prior to the COVID-19 outbreak, the industrial market and economy was strong. The industrial transaction market boosted positive momentum, demand outweighed supply, and vacancy rates were at the lowest levels. Overall transaction activity had been up 18 percent from the peak of the last cycle, but COVID-19 presents a new kind of disruption to the market by impacting supply chains globally. This report will help commercial real estate investors navigate the challenges and opportunities in the industrial market.

Optimistic Future For U.S. Industrial Real Estate

With states all over the nation enacting quarantines, curfews, and social distancing, industrial and warehouse space is feeling short-term impacts from interruptions in the shipping supply chain.

- Domestic transportation is seeing a temporary surge in activity as demand spikes for inland trucking capacity as grocers and retailers look to restock their shelves with essentials. Retailers like Costco, Target, and Walmart, among others, have been struggling to keep some items in stock.

- E-commerce delivery fulfillment has increased in the short-term, as well, but remains on its current trajectory for the long haul. Amazon, for example, is adjusting their operation to focus on shipping the essentials related to COVID-19 relief. To handle this influx, Amazon announced plans to hire 100,000 employees.

- Industrial leasing activity expects an increase in short-term leases related to storage of products that retailers cannot sell.

Long-term effects on this sector are bullish, to the extent that this experience encourages more online shopping in the years that follow, warehouse development could be stimulated. On the contrary, the disruptions in supply chains and the flow of goods could translate to less demand for space, thus affecting the returns for investors. However, industrial leasing reached all-time highs so far in 2020, with retail accounting for 40 million square feet the first quarter, and investment activity reaching $30 billion. During these events, some subtypes are projected to remain unphased, such as data centers as they have minimal employees and are of increased importance due to higher telecommuting demands. Data center growth paired with the use of artificial intelligence in warehouses to reduce supply chains are what make the industrial sector a safe haven during these events.

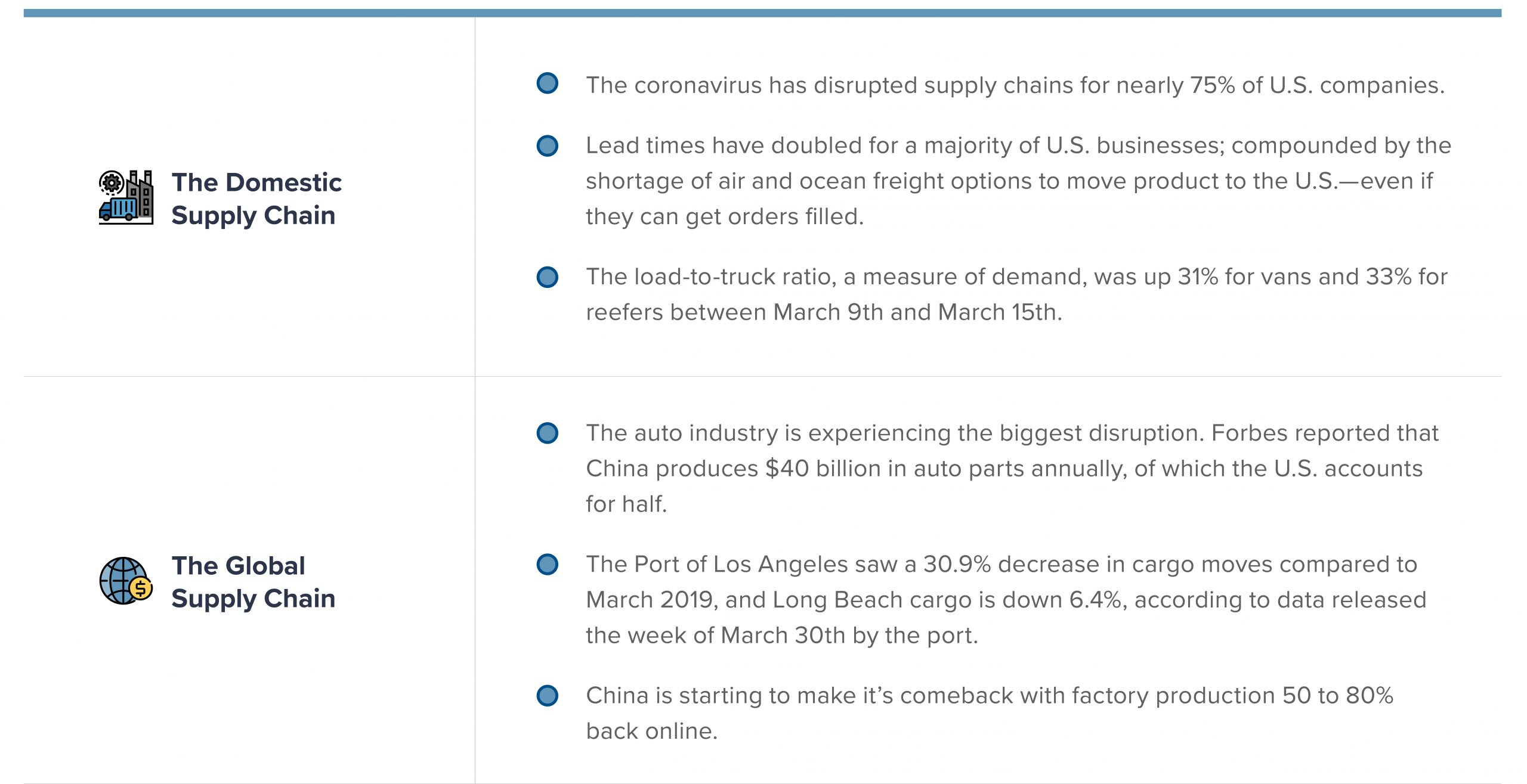

Impact to Supply Chains

The outbreak has disrupted global and domestic supply chains, especially in businesses relying on China for materials and components. Data shows global production out of China fell to an all-time low in February, with freight and shipping slowing dramatically as the virus shuttered factories and container ports. The United States has faced two shocks to the supply chain recently—first the trade war between the U.S. and China and now the COVID-19 pandemic.

Advice From Our Agents

Distributors are operating at capacity, with a focus on in-demand products, and although there are short-term challenges, industrial owners and tenants are optimistic for the future. In the long term, behavior established during quarantines will induce growth for the industrial sector, and logistical processes will become more streamlined. Despite the drop in speculative or opportunistic plays from investors, industrial transactions located in core markets with strong credit are moving forward.

Matthews™ is committed to keeping the commercial real estate community informed and continuing to offer our services during these market changes. With updates and challenges released daily, please contact a Matthews™ specialized agent for guidance during this uncertain time, and for more insights on COVID-19 and CRE, visit our dedicated coronavirus website.

The Centers for Disease Control and Prevention is offering information and updates on the novel coronavirus (COVID-19) outbreak, the World Health Organization is tracking the number and location of confirmed cases of the virus and Building Owners and Managers Association International has provided the following emergency preparedness guidelines for commercial and residential property managers and landlords.