Multifamily Trends in Los Angeles Markets

Following the outbreak of the novel coronavirus, supply constraints continue to be the defining trait in the Los Angeles multifamily market. In 2019, Los Angeles achieved $11 billion in multifamily trades, and Q1 2020 held $2 billion. Even as one of the highest renter-to-owner ratios in the United States, with roughly half of households renting, Los Angeles still faces struggles. Local opposition to new development combined with the high price in land, construction restraints, and a complex permitting process has constricted multifamily development. Vacancy levels are higher than the Financial Crisis levels and are projected to continue rising. For the first time in a decade, Los Angeles rents are decreasing.

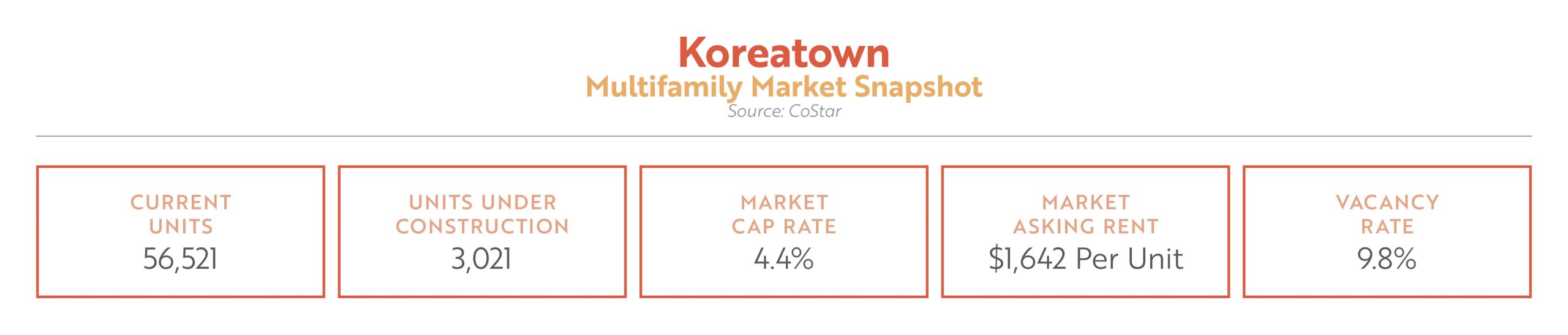

Koreatown

Koreatown boasts one of the largest multifamily inventories in the Los Angeles metro, totaling 56,500 units, or six percent of Los Angeles’ inventory, even though the submarket stretches across a mere six square miles. Tight vacancies and densely located renters should cushion investments for the short-term

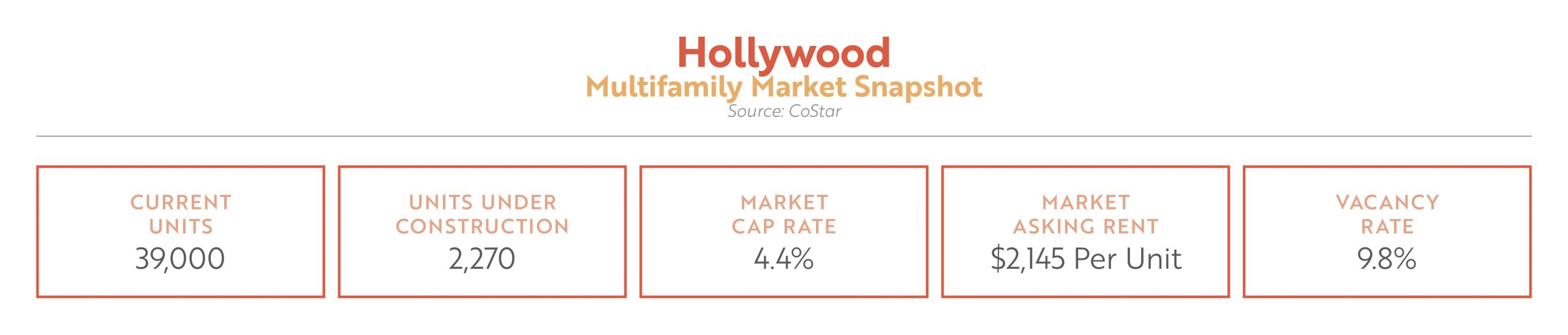

Hollywood

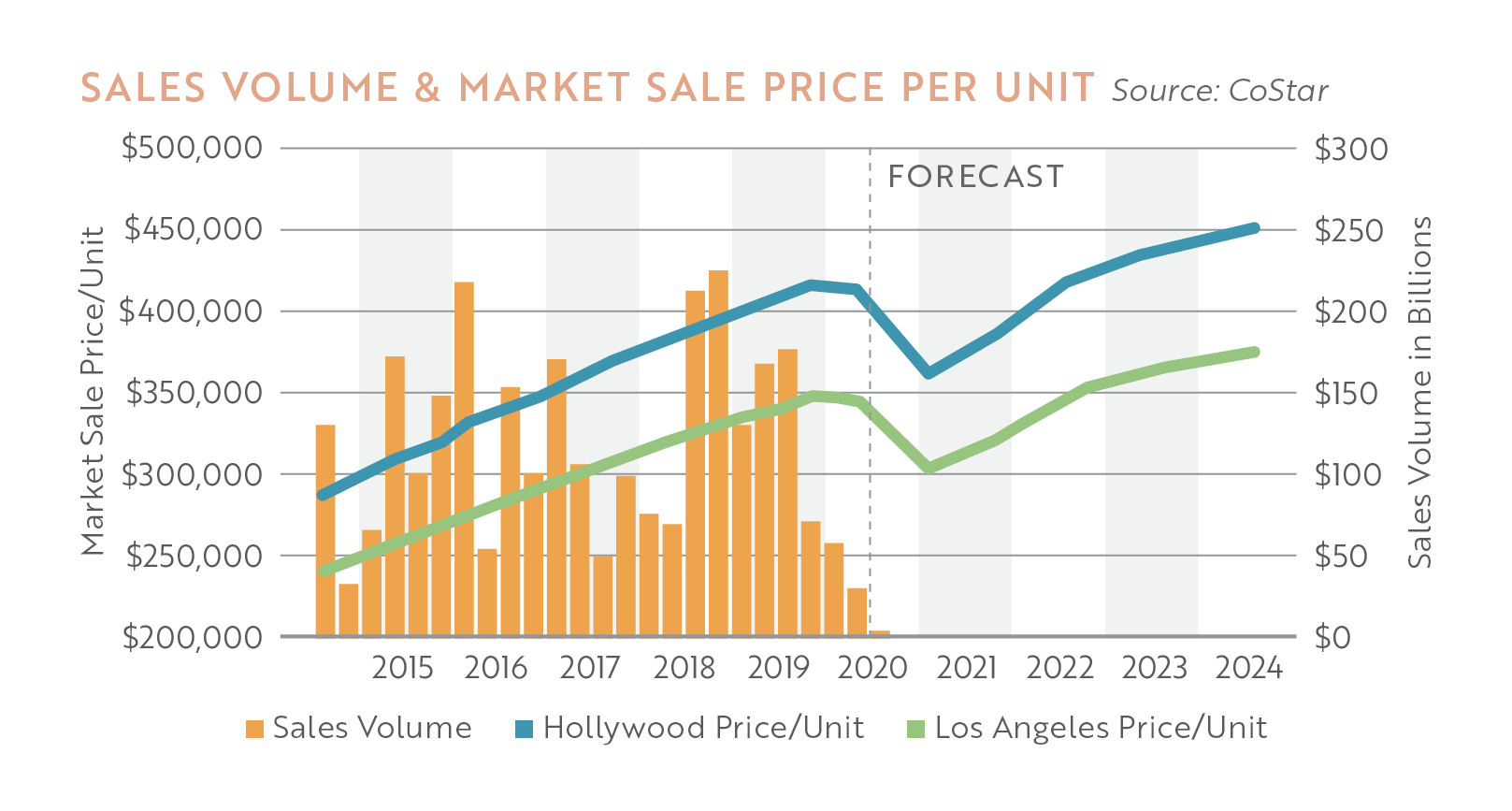

The introduction of the coronavirus has brought on concerns, however, with Hollywood’s central location, significant name value, and evolving economy, tech companies have flocked here to collaborate with the entertainment industry. Since 2010, Hollywood’s average pricing has doubled with an average $275 million annually in multifamily sales, but has only reached $90 million thus far in 2020.

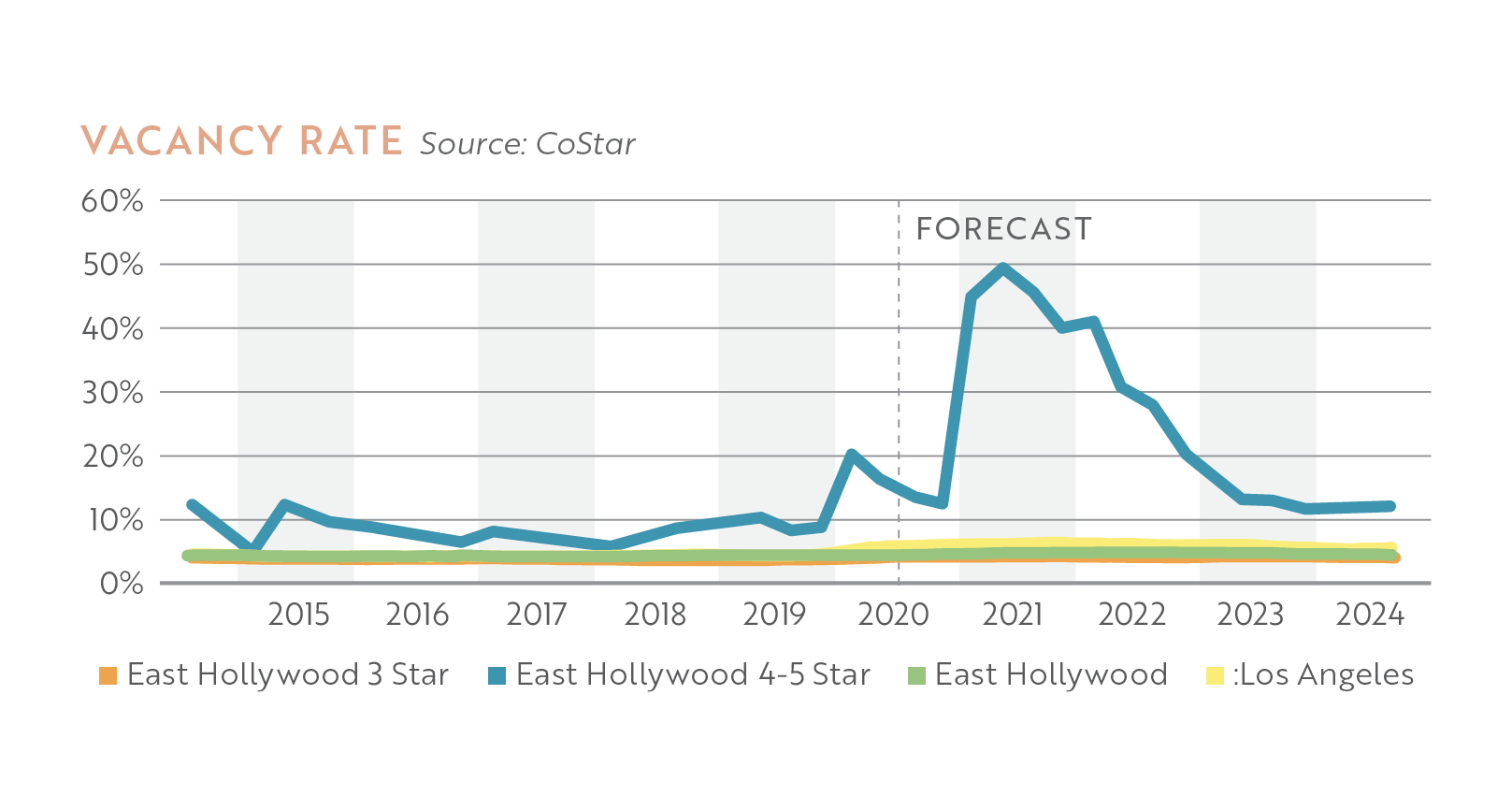

East Hollywood

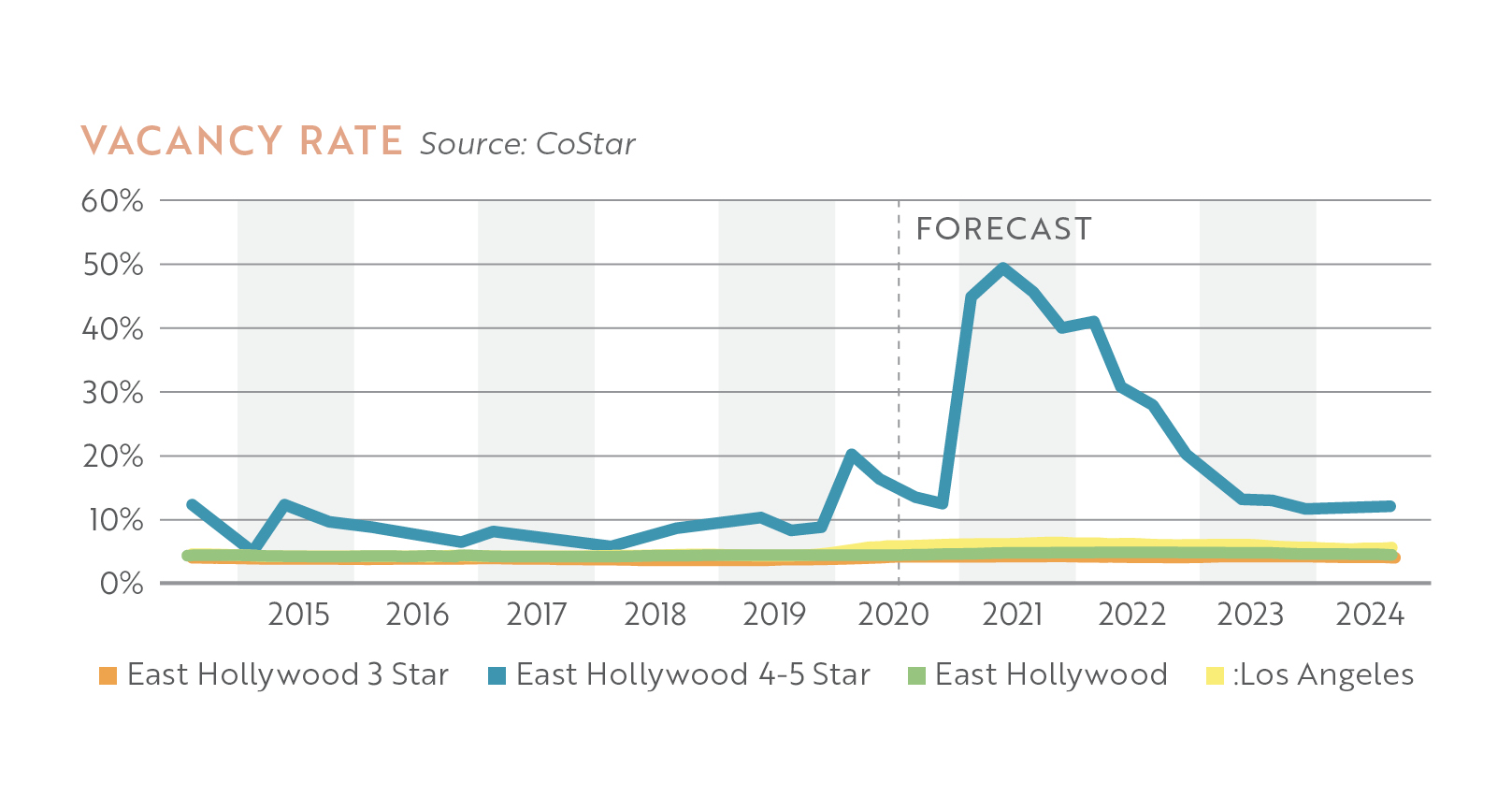

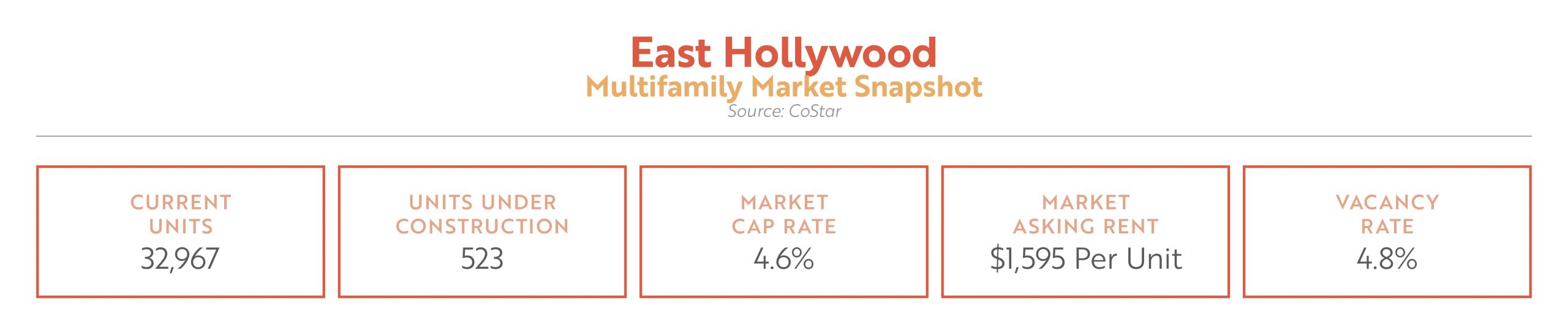

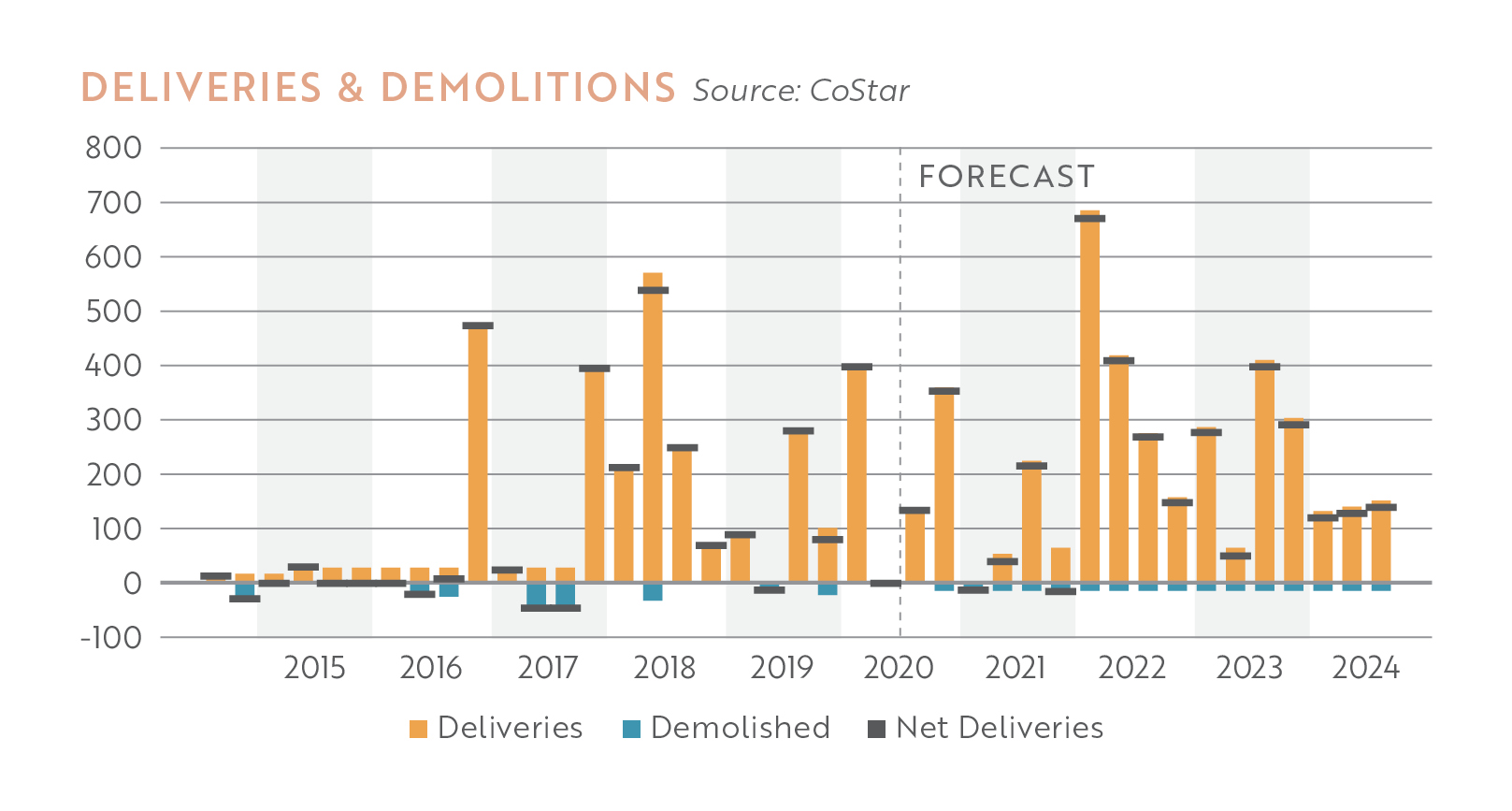

East Hollywood has achieved the lowest vacancy rates of any Los Angeles submarket, holding below four percent over the last ten years. The submarket’s affordability is what draws cost-conscious renters to the area, with major employers and job hubs a short commute away.