CLICK HERE TO DOWNLOAD THE FULL ARTICLE

For many apartment landlords, COVID-19 has impacted their bottom line; many are under pressure and in a short supply of optimism. Renters in Class B and C apartments have been the most affected by the pandemic and struggle to make rent payments. For small to midsized apartment owners, revenue is down, expenses are rising or holding steady, and relief from state and federal governments is slim or non-existent. The traditional methods of maintaining income are off-limits, even in states without eviction bans, and the federal government halted evictions in 2020. With renters demanding newer finishes and amenities that align with the new norm and numerous renters moving home to their parents, many multifamily owners are at a loss of what to prioritize – upgrading the unit to maximize rent or filling the vacancy as soon as possible. The following article will specify what private owners can do to improve their property value by capitalizing on market rents, how to address a vacancy, and improve operational efficiencies.

Smaller individual landlords make up almost 20 million of the nation’s 48 million rental units, according to the most recent Rental Housing Finance Survey conducted by the Census Bureau in 2018. Another 18 million units are owned by a limited partnership or limited liability corporation, which tend to be owned or controlled by smaller partnerships, the Bureau reported. REITs own a mere 1.1 million units, large real estate corporations own another 1.3 million, and a similar amount are owned by non-profits.

Apartment Finishes & Amenities to Maximize Market Rent

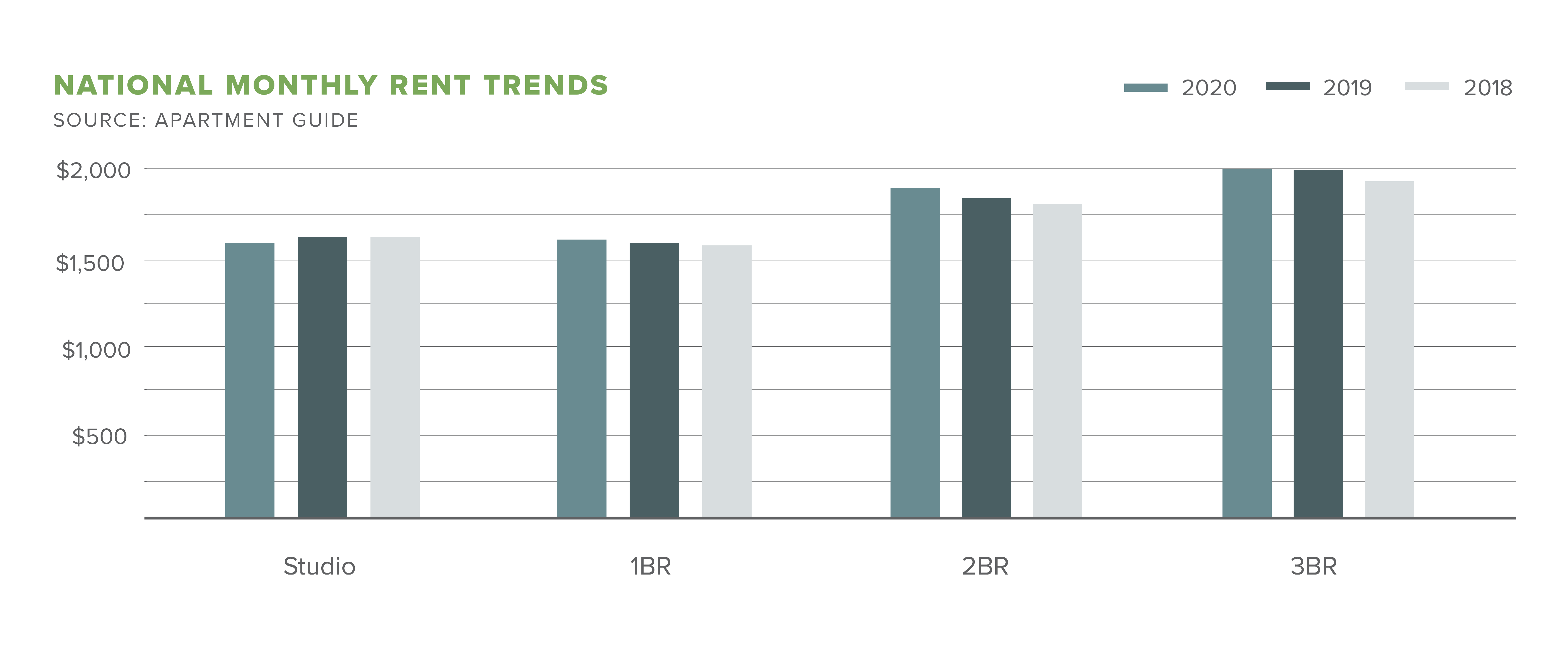

Multifamily owners need to know the top amenities in the area, tenant profile, and what makes properties competitive in the market. Today, as more and more people stay home, updating finishes and amenities could mean less vacancy and higher rent. A cost-benefit analysis will have to be completed, especially with renters looking for cheaper rent. According to the National Multifamily Housing Council, this is a 1.6 percentage point decrease from the share of renters who paid rent through November 20th, 2019. Although this might not seem like a big difference, for smaller landlords, this could mean one or two tenants being unable to pay rent and thus interrupting a property’s cash flow significantly.

Across the U.S., apartments have closed off or limited the use of building amenities to prevent the spread of the coronavirus. For the most part, renters have accepted these restrictions, understanding that these steps are necessary during a public health crisis. However, there will come a time when renters will want to know why they can’t use the pool, gym, or shared areas, especially when it’s included in their rent.

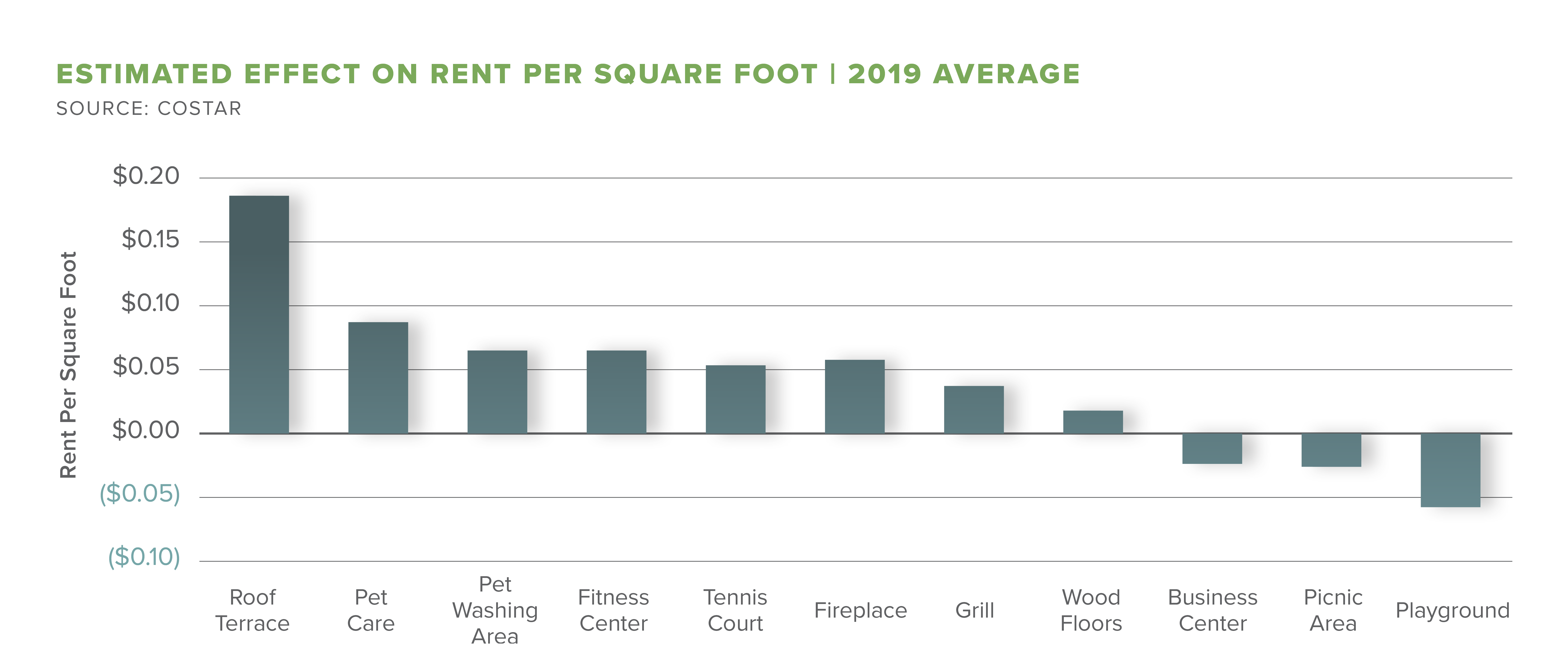

Over the past several years, it has been no secret that the multifamily asset class has been engaging in an amenities war, with buildings offering more luxurious add-ons to draw in residents. The demand for amenities will likely shift in the long-term, but it is debatable by how much. Millennials still make up more than 60 percent of renters, and landlords who invest in the right mix of property amenities and upgrades can shorten their sales cycle, or optimize their rental revenue and improve operating efficiencies. Branding will be essential as renters will want to know they live in a community known for high standards of cleanliness.

Apartment Amenity Trends

- Instead of a fluid floor plan in a clubhouse, new designs include smaller, separate rooms.

- With more employees working from home, apartments will accommodate by offering communal work-from-home space.

- Business centers will be equipped with reliable and robust Wi-Fi.

- Landscaping and access to green outdoor space will become of increased importance.

Apartment Finishes Trends

- Lighter colors illuminate larger living spaces. Many renters are looking for more space after quarantine and telework left renters in apartments for extended periods.

- Updating the space to be more attractive to renters could be the tipping point between a renter choosing an apartment versus another. Small upgrades make all the difference, especially when it comes to productivity.

- Since COVID-19 was introduced, people have been spending more time in their kitchen than ever before. As a result, renters have started to demand more appealing kitchens.

- Many renters will be wary of shared spaces, so in-unit washer and dryers will be necessary for many.

Operational Efficiencies

In March 2020, owners were forced to pivot to address the new challenges with stay-at-home orders caused by the pandemic. As renters spend more time at home, there is increased pressure on building resources. As a result, in anticipation of collecting less rent, owners froze repairs unless they were emergencies. It became more evident that as more residents stayed at home, the amount of trash and the pickups necessary to remove it increased. Other areas also saw upticks, such as cleaning contractors, the need for personal protective equipment for on-site staff, and technology. Therefore, many landlords began to price shop vendors and found other ways to save costs, such as increasing the energy efficiency of older buildings and reducing water use.

Applying technology to operations also became increasingly important, especially when it came to paying rent online. Much of the smaller multifamily buildings hadn’t fully implemented this technology, which turned out to be essential for rent collection. Collecting rent from each unit is important for owners because little relief has been provided from property taxes, utility bills, or maintenance. Therefore, making rent payment as seamless and easy as possible will decrease the likelihood of late payments. Before COVID-19, renters often had to pay an additional fee to complete rent payments online, but with many leasing offices closed due to state and social distancing guidelines, many waived the online fees, pushing more people to submit payment online. It is anticipated that this new normal that many renters and owners find themselves in will continue in the future.

Moving forward, multifamily properties need to use performance management software to track performance, inventory, and supplies. By planning ahead and using technology to find cost savings even as other expenses rise, landlords can get a leg up on operational efficiency without breaking the bank.

Here’s how some landlords have lowered expenses during COVID-19

- Reduce the Water Bill: Low-flow toilets, faucets, and showerheads

- Reduce the Heating Bill: Programmable thermostat

- Reduce the Electrical Bill: Energy-saving bulbs or LED/green lights

- RUBS (Ratio Utility Billing System)

- Price Shop Vendors

What to do when a vacancy pops up?

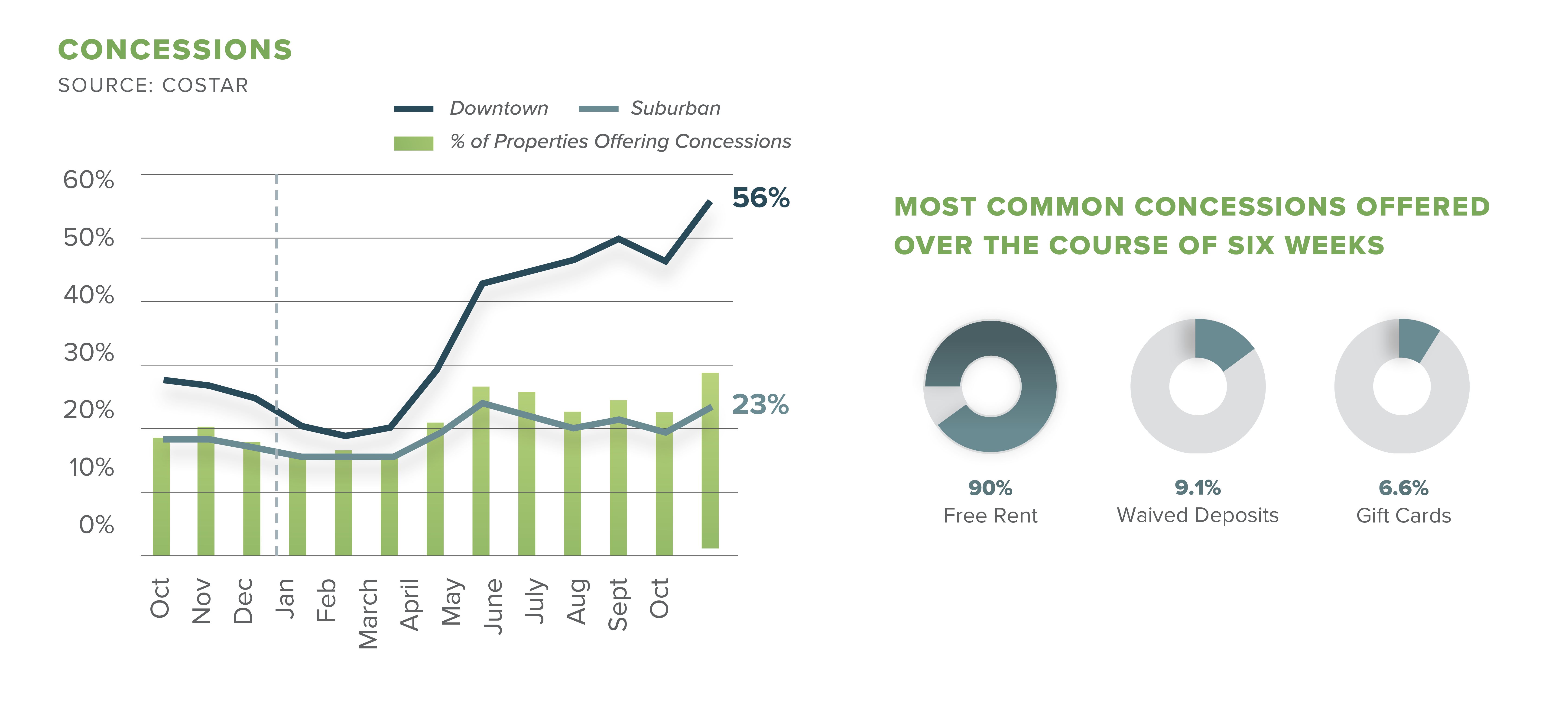

According to Freddie Mac, vacancy rates will increase 200 to 250 basis points at the end of 2020. Eviction moratoriums and government cash payouts will help preserve vacancy levels, not necessary property NOI. A report from RealPage showed an improvement in leasing during Q3 2020, up eight percent year-over-year, more than four times the second quarter’s activity. But while leasing activity has improved during the pandemic as renters decide to stay put, concessions increased. In September, there was a significant jump in concessions from August, the first rental month after the benefits from the CARES Act expired. Many landlords are offering incentives to prospective tenants, which has likely aided in driving the vigorous leasing activity. Concessions totaled nearly $6 million in October 2020 and are up 21 percent compared to last year. Since April, concession values have increased by 82 percent.

These concessions, however, haven’t helped stabilize rental rates. Pricing compared to the renewal term was down to the lowest since the start of the pandemic for longer lease terms, and the highest since the beginning of the pandemic for shorter lease terms. It’s important to note that since the pandemic, many tenants have shifted to shorter lease terms, but 12-month leases, which are an industry standard, have started to normalize again.

Future leasing activity trends remain uncertain. Many landlords have increased their adoption of leasing technologies during the pandemic to drive activity, which has worked well for many. When a vacancy pops up, it is essential to understand the surrounding target renter demographic and their current rent payment habits. Essentially, what can these renters afford? The good news for private capital owners of Class B and C apartments is that demand might be coming from Class A renters, who can no longer afford the luxury rent. During a period of vacancy, consider upgrading the unit and match the current market rent. There is more competition today to lease a unit. Some landlords are dropping rental asking price by $100 to $300 depending on location or offering concessions. The reason for this is to get the units leased up so they don’t sit on the market too long.

What Owners of Older Properties Can Do

A review of new and recently developed apartment complexes clarifies that property designs, unit features, and amenity packages that ruled the business ten years ago are now outdated. With millennials increasingly dominating the tenant demographic, upgrades might be necessary to attract the value-conscious target audience. Naturally, these properties command higher rental rates.

Short of a full-scale property overhaul, owners of older stock properties can take a page out of the master-planned community handbook: destination marketing. Destination marketing is based on the premise that people buy an idea and a value, not just a place to put their beds. Simply stated, it means being able to say, “ABC Apartments is the place to be for XYZ.” Most properties have some sense of destination marketing, using location-based monikers like “Hillcrest Heights” or “Valley Vistas.” But destination marketing is a branding concept that promises a lifestyle that resonates with a prospective tenant, not just a physical location.

Steps to Make Your Property More “Resort-like”

Step #1: Correctly Identify Target Audience – Look at the current tenant mix and create an ideal renter profile in terms of age, income, profession, and lifestyle.

Step #2: Choose a New Name for the Property – One that holds promise for the target audience.

Step #3: Enhance Curb Appeal – A property’s exterior appearance from the street is the physical manifestation of a promised lifestyle, including new signage, window treatments, paint, and landscaping.

Step #4: Create an Online Presence – During a COVID-19 environment, shopping online has become the new norm, even for apartments.

How to Prepare Your Asset for Sale

With millions of units on the market with outdated property features, some owners will choose to stand by, continue to collect current rents without the headache and upgrades. However, with looming occupancy levels and decreasing rents, it may become necessary for an owner to sell. According to California Rental Housing Association’s President Sid Lakireddy, many landlords want out, either out from being a landlord, or in some cases, just out of the California real estate market.

Although selling a multifamily building is substantially more complex than other assets, the goal tends to remain the same: maximizing value. While there are several ways to achieve maximum value throughout an asset’s lifetime, minimizing leverage during the sale process will play a considerable role in preventing renegotiation of the sale price. Prior to going on the market, an owner can take the following steps to set the stage and avoid renegotiation. This leads to a smoother experience and a higher success rate of achieving the best terms and maximum value for their asset.

#1: Increase curb appeal

#2: Research market rents

#3: Address deferred maintenance

#4: Ensure clear and marketable title

#5: Review books and records

#6: Create a plan for proceeds

—

Even with a pandemic and shifting fundamentals, multifamily remains one of the most attractive asset classes for investment. It is expected that multifamily will make a quick recovery in 2021, and according to the Matthews™ Investor Survey, investors will continue to seek multifamily as a safe investment opportunity. With many looking to move out of the multifamily space due to eviction orders, large investors with cash reserves are on the hunt.

For more information, please contact a Matthews™ specialist.