CLICK HERE TO DOWNLOAD THE ARTICLE

In many ways, COVID-19 has served as a hyper-accelerator on forces that have been reshaping retail for years, such as advances in technology, changes in spending habits, and shifting preferences of younger generations. As a result, the pandemic pushed retailers with antiquated business models out of the market, leaving numerous big-box spaces and traditional shopping malls empty. Repurposing and adapting CRE buildings to suit consumer’s changing demands will be the cornerstone for investors, owners, and operators in the coming months. As such, adaptive reuse will likely become more popular as retailers reconfigure spaces by taking vacant sites and reusing them for purposes different from which they were originally intended. In this article, Matthews™ discusses adaptive reuse opportunities and the economic realities for commercial real estate buildings.

Retail Performance

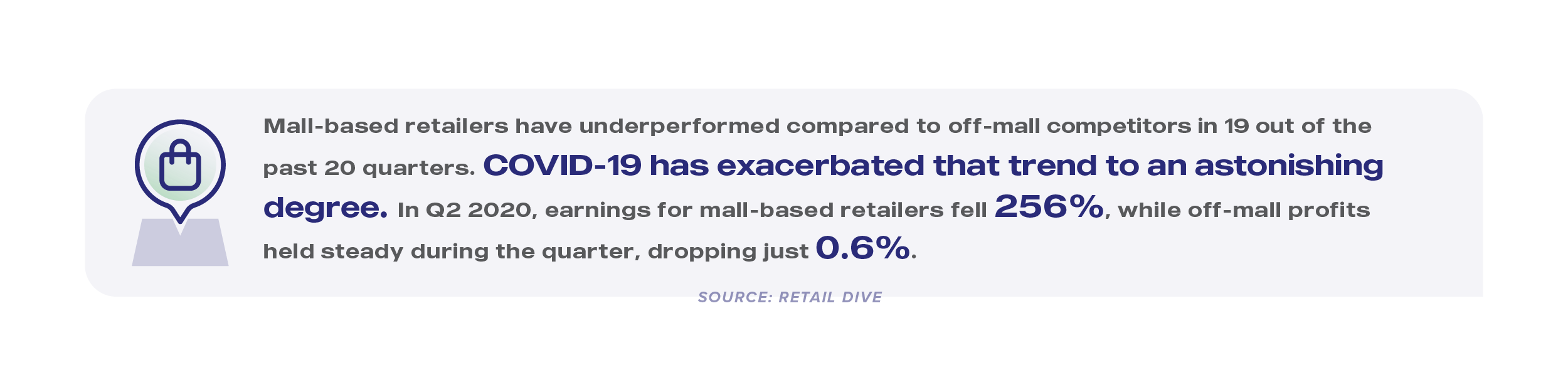

The pandemic brought a host of unforeseen changes to the retail industry. Among them included a lengthy and unprecedented closure period for nonessential retailers, which cost stores billions in lost revenue. Department stores and apparel retailers were hit the hardest in the industry. Despite investing in e-commerce operations, department stores have suffered market share losses in recent years. A downturn in the economy, which typically propels shoppers to off-price stores, could further increase department and traditional apparel store market share loss. It won’t come as a surprise if, in the upcoming months, department stores vacate space and leave malls with one less anchor and a large amount of square footage.

Retailers’ recovery from the closure period and entering into a new consumer market have been uneven nationwide. Most retailers have been forced to scramble and adapt to a new environment, putting further strain on revenue. Along with numerous other pressures, such as price competition, traffic declines, inventory overages, retailers are activating transition strategies that were years away from being rolled out.

Distress regarding in-store traffic was heightened by the pandemic and accelerated store closures and retail bankruptcies.

Although not all bankruptcies result in outright liquidation, some retailers are using bankruptcy as an opportunity to turn around financials. As of mid-November, 37 retailers had filed for Chapter 11 bankruptcy, including Modell’s Sporting Goods, Neiman Marcus, JCPenney, Tuesday Morning, CEC Entertainment (the parent company of Chuck E. Cheese), Brooks Brothers, Sur La Table, California Pizza Kitchen, Ruby Tuesday, Gold’s Gym, and Pier 1 Imports. Noah’s Event Venue, a chain offering spaces for various gatherings, also filed for Chapter 11 bankruptcy in 2019 but was officially ordered to close all locations in 2020. Bankruptcies are on pace to reach the highest number in a decade.

Chains like Macy’s, Gap, and Nordstrom, among many others, are collectively closing thousands of stores as they adapt to changing demands and consumer behavior. These closures will impact malls, which will turn many to permanently close or to adaptive reuse. For savvy investors looking for opportunities in the market, there will be plenty of square footage readily available for acquisition and adaptive reuse projects. According to experts, hundreds of troubled shopping malls may be seized by lenders over the next year. Research from Green Street Advisors indicated that a vast majority of Class B and C malls have lost at least one anchor tenant. Developers have proposed to redevelop hundreds of malls into mixed-use properties with apartments, 56 of which have been completed and another 75 are in the works, according to a count by Ellen Dunham-Jones, a professor of architecture at Georgia Tech.

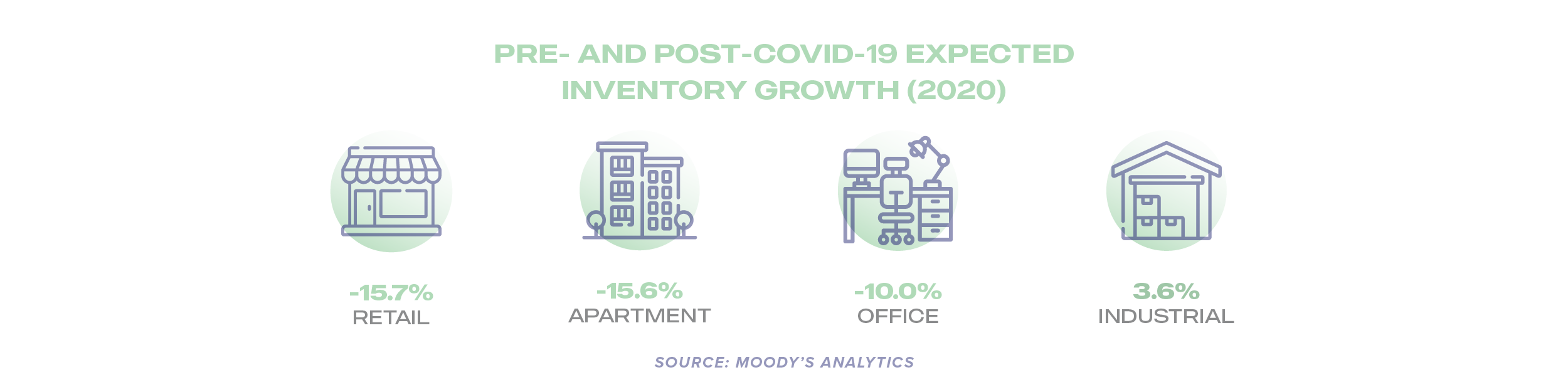

For retailers, it helps to be big, well-capitalized, and a generalist. Retailers that have performed well in the COVID-19 era include Amazon, Walmart, Target, and Costco, among other giants. Mass merchants have been able to adjust to rapid changes in the market faster than category specialists. Moody’s Analytics states that smaller, highly leveraged, and private-equity owned retailers will succumb to performance problems and defaults. Meanwhile, those with proprietary products and technology can pivot, invest, and serve to meet changing demand, which will prevail.

How Retail is Evolving

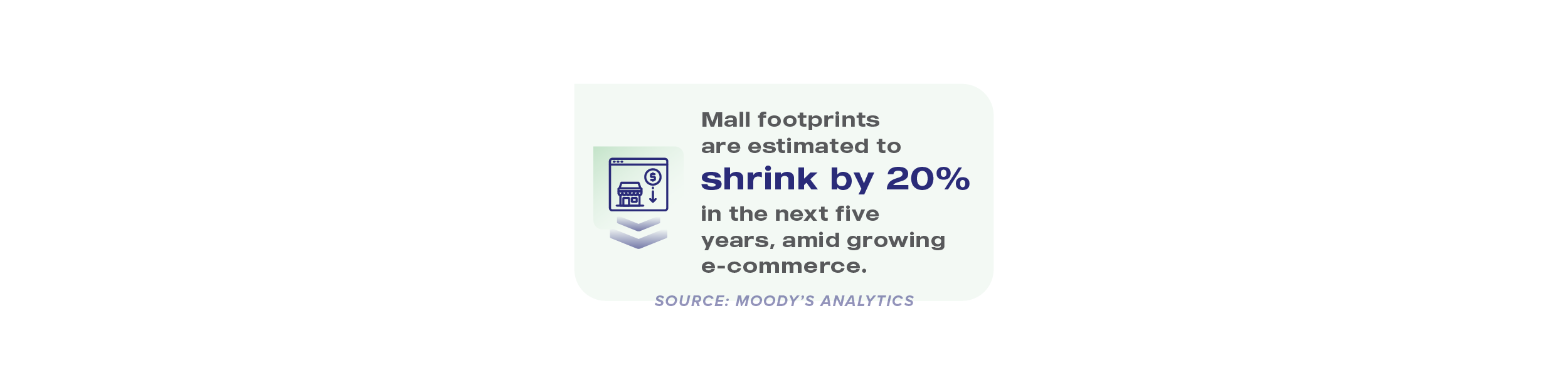

Similar to a wildfire, the pandemic has prompted change through the retail industry. It has accelerated transitions already occurring in the retail space and has forever changed the way consumers shop. The retailers who are unable to adapt to the evolving retail landscape will fall victim to COVID-19. With retail margins already under pressure due to heavy competition across sectors, it is predicted that there will be fewer stores nationwide. This vacant space will present opportunities of all kinds for adaptive reuse.

New Trends in Retail

Space– Consumers today no longer want to be packed inside a restaurant, retail store, or mall. The social distancing ease of outdoor shopping has amplified the appeal of open-air shopping environments, including lifestyle centers, outlet malls, and strip centers. Open-air shopping environments draw in steadier traffic than traditional enclosed malls, in part because big-box stores, grocery stores, salons, and gyms serve as anchors. Outdoor plazas also offer up more dining and entertainment options. Already, restaurants are converting some of their parking square footage into outdoor dining, and gyms are introducing outdoor workouts. This indicates that people value their space from strangers more so than the quality of experience. Patios will become more common in new restaurant development, and gyms will likely keep outdoor workouts around, weather-permitting.

Convenience– Atmosphere will become a lot less important post-COVID-19, with convenience at the forefront. One-stop-shops like Walmart, Target, and CVS have become increasingly popular due to convenience as consumers can get in and out quickly with everything they need. Convenience will become a new norm and essential for retailers to invest in click-and-collect strategies. Consumer experience is changing and people will no longer want to meander through an enclosed space. We see retailers, restaurants, and healthcare brands incorporate drive-up appointments and curbside pickup.

E-Commerce– The trend toward increasing online sales is years-long, but the pandemic has exacerbated it. Gone are the days of sub-par digital shopping experiences. Today, consumers that may have resisted e-commerce in the past have come to appreciate the ease and safety of ordering from their device, convenience of delivery, and competitive pricing. Moody’s analysts see the shift to online shopping as permanent, as the U.S. consumer becomes more tech-savvy. They note that domestic online sales growth outpaced retail store sales by 15 percent last year. Retailers need to offer a seamless and straightforward online shopping experience that includes browsing, selecting, purchasing and returning/exchanging. Given the cost of e-commerce, retailers will have to find savings elsewhere in their business, and inventory management will be pivotal in protecting margins.

Repositioning Buildings

Adaptive reuse is well on its way to becoming a stand-along asset class post-COVID-19. Most commercial real estate industry participants are convinced that the U.S. retail footprint needs to shrink, and in conjunction with COVID-19, adaptive reuse of excess space will be part of the solution. Retail repositioning isn’t new; instead, it has transformed with changing consumer needs. Many unused buildings can transform to include a mix of trending businesses, such as restaurants, cafés, retail, and fitness, in addition to multifamily. Most retail, especially big-box, is located in highly desirable locations. They provide ease of access and are often located near neighborhoods. A strong location can make even a complicated redevelopment work, as the land is justified for the cost of demolition and new construction. For other asset classes, like industrial, it becomes more tricky as these buildings are located away from cities and typically associated with high-crime areas. The current market conditions require creativity and flexibility – especially regarding retail space.

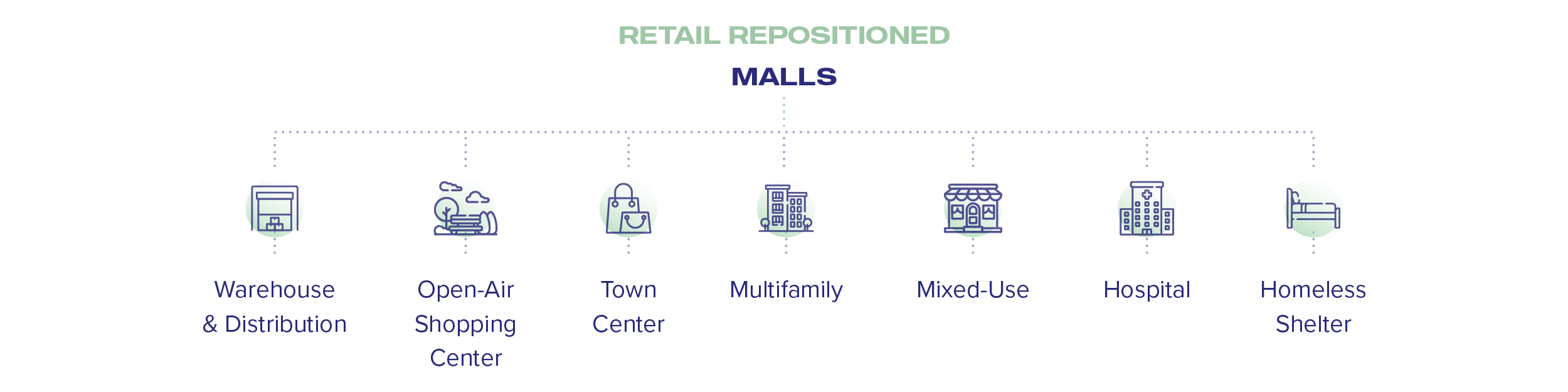

RETAIL REPOSITIONED

In the current environment, it’s hard to find another big-box tenant willing to move into a previous tenant’s space. Knowing that big-boxes are increasingly tough to fill, many consider redevelopment into another asset and replacement tenants. As an example, Urban Edge Properties recently made some strategic improvements on a previous big-box space for a grocery distributor, Triple-A Warehouse. This tenant services smaller grocery stores but uses 20,000 dedicated square feet for the public to shop products at wholesale prices. Redevelopment efforts for the property brought value to the retailer, landlord, and residents in the surrounding community. This makes the last-mile distribution warehouse a perfect adaptive reuse project. With more space allocated to fulfillment, the size of sales floors could shrink in the future. For example, drug stores need less square footage if a high percentage of revenue is from the pharmacy, the amount of retail space is unnecessary, and they can operate with less square footage.

During the pandemic’s early days, the American healthcare system utilized empty retail space as makeshift hospitals. These vacant big-box spaces could serve as temporary locations for clinics, or serve as urgent cares and other health-related assets. One of the growing retail trends seen in shopping centers, are more tenants focused on health and wellness. As such, this has further introduced the one-stop-shop mentality where a consumer can shop for groceries, pickup their dry cleaning, grab a coffee, and get a COVID-19 test.

Another retailer that continues to boom, even during the pandemic, are off-price retailers. Some experts say that spaces that previously housed department stores or apparel retailers may prove more lucrative for their cheaper counterparts.

With a large amount of square feet, vacated malls present a lot of opportunities for repurposing. The industry has even seen last-mile distribution on the bottom level and multifamily on the top level. As e-commerce continues to triumph through the COVID-19 pandemic, retailers have started transforming vacant retail storefronts into fulfillment and distribution centers. Experts believe this will likely continue with empty malls. In August, Simon Property Group, the largest owner and operator of malls in the U.S., was in talks with Amazon to repurpose some of the space formerly occupied by beleaguered retail tenants into distribution and fulfillment centers. Prior to this discussion, Amazon had already been repurposing failed mall sites in Northeastern Ohio into fulfillment centers.

Malls may also serve as prime locations to install apartment complexes or communities with a hybrid outdoor and indoor layout. There is a project underway in Lynwood, Seattle, which will serve as an ideal test for long-term, large-scale suburban mall-to-housing conversion success.

In cities like Washington, D.C., shuttered department stores have been converted into homeless shelters. Landmark Mall in Washington, D.C, transformed a defunct Macy’s into a homeless shelter in 2018. With homelessness on the rise in the U.S., Washington Post reporter Terrence McCoy wrote that “transformation represents a new way of thinking that is bringing together three economic phenomena: the collapse of the brick-and-mortar retail industry, the disappearance of affordable housing in America’s booming cities, and the struggle to reduce homelessness.”

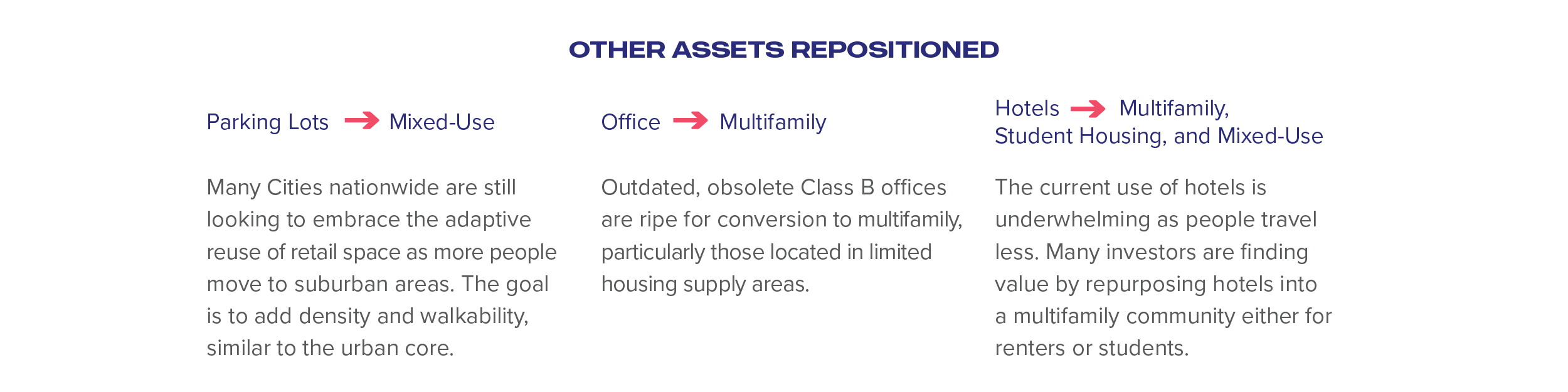

OTHER ASSETS REPOSITIONED

Re-Zoning Regulations & Cost

Adaptive reuse does come with its challenges, though. Re-zoning is typically a long and tedious process with a low probability of success. According to Moody’s Analytics, the evolution of zoning and safety laws have put institutional boundaries on where commercial properties can be located and how they can be used. Single-use of Euclidean zoning limits the type of properties that can be built in certain places around towns and municipalities. Further, municipal taxation issues stemming from single-use zoning will constrain projects with even the most ambitious repurposing attempts. This originates from complaints about pollution from industrial buildings and concerns about urban sprawl.

Prologis found that conversion opportunities to transform malls and other properties into distribution centers are fewer than expected, and decisions must be made wisely. Restricting zoning and truly appropriate spaces are challenging for retail-to-logistics conversions. Retail conversion to logistics could amount to 5 – 10 MSF per year to 50 – 100 MSF over the next decade.

Further, demolitions are prohibitive because complete tear-downs will add anywhere from $4 to $8 per square foot in project costs, not including extra time for permitting and execution. Once the land is cleared, developers will need to incur building costs, which vary widely by location. Therefore, it’s necessary to have a professional team for adaptive reuse purposes in order to find the most lucrative solution.

To revitalize property, owners need to be flexible and willing to adapt. In today’s environment, adaptive reuse is an intriguing strategy. The benefits include lower costs to acquire investments in high barrier-to-entry markets, significant cost savings on redevelopment projects, lower interest rates on leverage, and potential future tax incentives offered by federal and municipal governments. The current use of a property may not be maximizing the potential of the underlying real estate. As investment strategies shift to accommodate today’s needs and predict tomorrow’s demand, commercial real estate may never look the same.

For more information on adaptive reuse, please contact a Matthews™ specialist.