When it comes to investing in commercial real estate, it is crucial to understand prospective tax advantages. Having an effective tax strategy can lower an investor’s overall tax burden and bring awareness to tactics like 1031 Exchanges and explore the maximum amount of deductions. One additional approach investors consider is investing in states with no income or capital gains tax. In this article, Matthews™ presents various avenues for tax benefits to apply to current or prospective properties and investment goals. Preserving capital and turning capital gains into more wealth should be top of mind for investors.

Taxation at the State Level

A premium location with a corporate, credit-worthy tenant, like Dollar General, Advance Auto Parts, or KFC, is a starting point to finding success in investments. Typically, these absolute net lease (NNN) tenants are strategically located in areas with solid demographics and high visibility, attracting targeted customers that need their services.

Why is this important? Absolute NNN leases require little involvement from the owner, which is why many investors consider purchasing net lease properties in states that don’t have a state income tax, no matter where the owner resides.

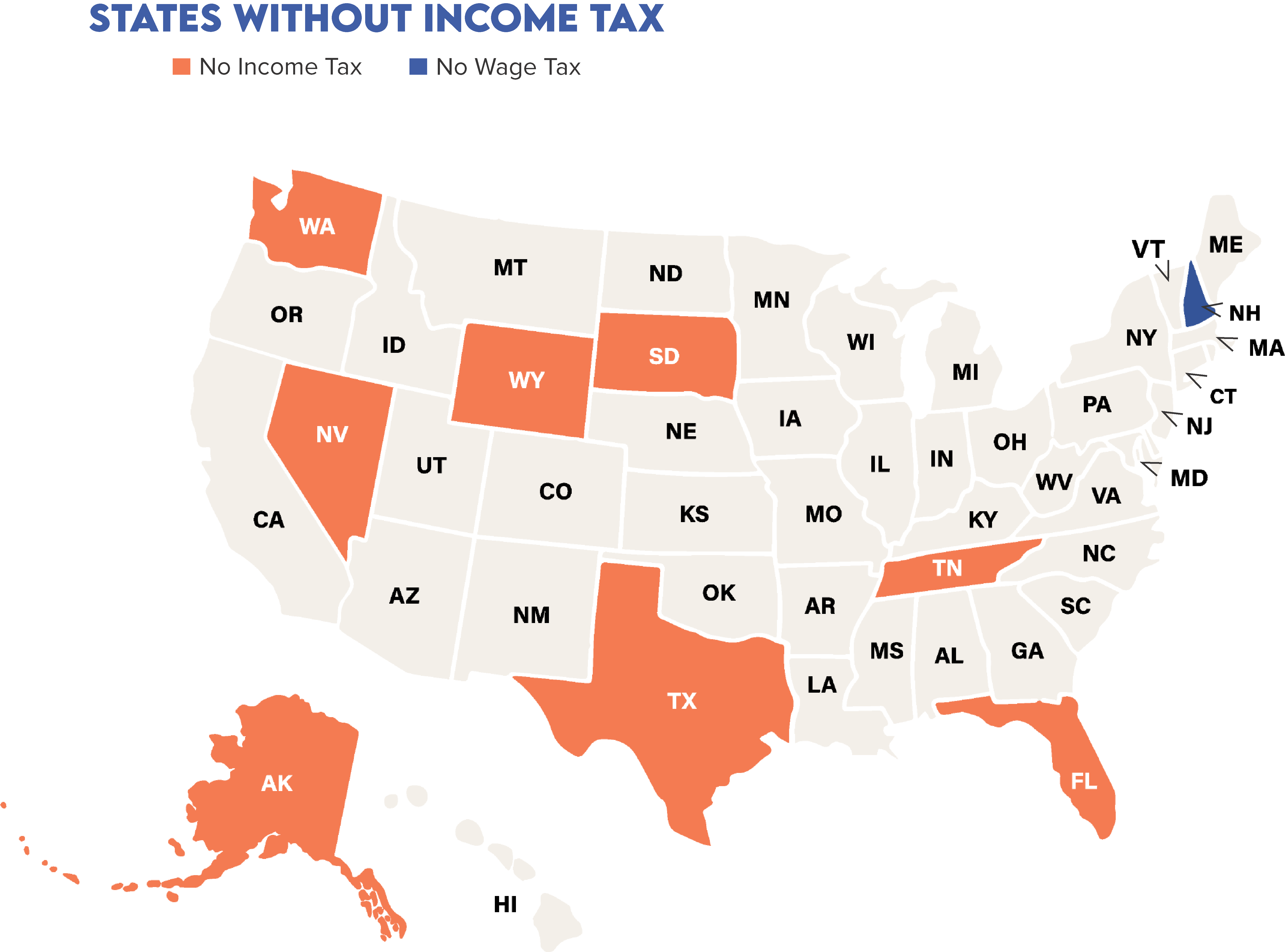

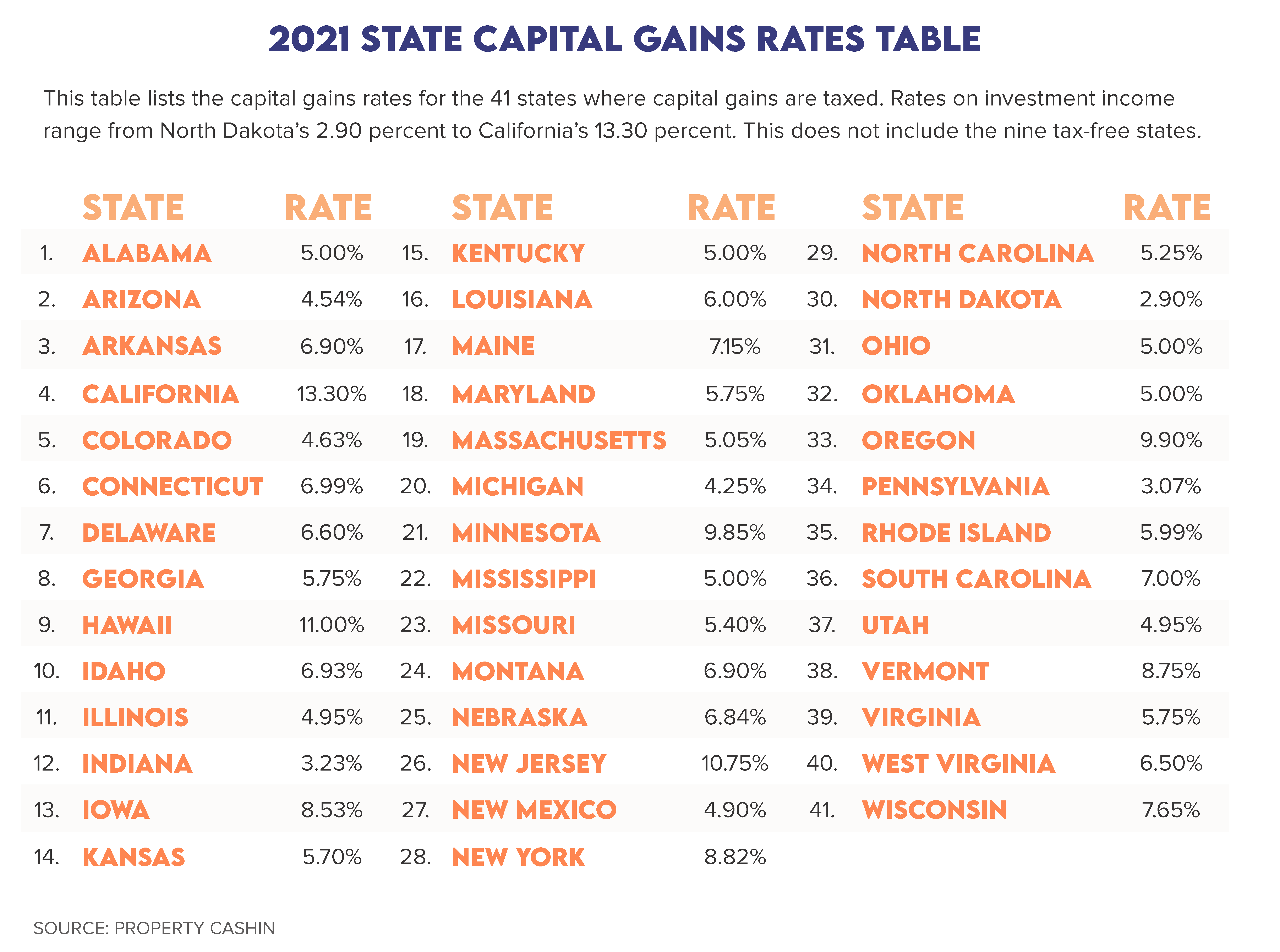

While investors are subject to federal income tax, each state handles income tax or capital gains individually. The majority of states have an income tax rate between two percent and 20 percent. However, nine states do not tax personal income – Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming. New Hampshire and Tennessee, do not tax earned income but instead tax interest income and dividend income. More recently, Tennessee eliminated its tax on investment income.

Over the past decade, the nine states without a personal income tax have consistently outperformed the states with the highest income taxes in GDP growth, employment growth, and in-state migration. (Source: American Legislative Exchange Council)

There is compelling evidence that states without income taxes outperform states that have them or even have relatively high rates. Therefore, investing in a state without income tax leads to the likeliness of a successful net lease investment and spares capital from income tax.

Many new investors are surprised to learn that they have to pay state income tax on their private placement income in their state of residence and the state(s) where their investment(s) are located. For example, a resident in California with an investment in New York will pay taxes in New York on the income earned, despite not residing there, and also pay taxes in California. This differs for the taxation of public securities, such as Real Estate Investment Trusts (REITs). Investment offerings typically structured as partnerships don’t pay taxes at the partnership level; instead, the taxable income or losses are passed on to partners who pay taxes on dividends and capital gains in the states they reside.

The Advantages and Disadvantages of Investing in a State with no Income Tax

Like any investment opportunity, there are pros and cons to investing in a state where the income tax burden is lower.

Advantages

Avoid Double Taxation: Double taxation occurs when an investor is taxed twice on the same amount of earned income. For example, an investor is forced to pay taxes on investment income in their home state and again in the state where the investment is located. It is important to note that most states provide a tax credit for the tax paid to another state. For example, a Pennsylvania resident owns property in Georgia. The investor will pay Georgia’s state income tax on the income earned, and Pennsylvania will give the investor a state tax credit for the taxes paid in Georgia from that investment. The credit is generally for the amount of the state tax paid to the non-resident state, or if the non-resident state’s income tax rate is higher, then it amounts to the tax that would have been paid in the resident state. Also, note that if an investment is made in a state with a higher income tax rate than the state of residence, the investor will pay tax at the higher rate.

Greater Investment Security: According to the American Legislative Exchange Council, states with a lower state income tax rate saw 109% greater population growth than those with a higher tax rate in the last ten years. They also argue that job growth in those states grew 130% faster than their more highly taxed counterparts. These two statistics are important indicators of a booming real estate market, as the states are better at creating jobs and keeping a core of young, educated workers from moving to other states.

Disadvantages

Other Taxes are Higher: In states where the earned income tax is non-existent or lower, other taxes compensate to generate revenue and pay for roads, schools, and infrastructure. These taxes include higher state and local taxes and property taxes. Tennessee ranks first on the list, with a combined state and local tax rate of 9.55%, the highest in the country. Washington came in fourth with a rate of 9.21%, and the state levies a tax of 49.4 cents per gallon of gasoline, one of the highest rates in the nation. Florida imposes a 6% sales tax, and the average locality tacks on 1.08%, for a combined total of 7.08%. Wyoming, too, collects significant revenue from severance taxes, levies imposed on the extraction of natural resources. New Hampshire has no sales tax but takes the third spot on the list with an average property tax rate of 2.03%. In fact, 64% of New Hampshire’s revenue was from property taxes – the highest rate of any state. Texas received 44% of its revenue from property taxes. (Source: Tax Foundation)

Higher Competition: NNN properties in these locations are accompanied by higher competition and a higher price point. Although it may seem like money is saved due to no income tax, a premium price is paid for the property.

Additional Tax Advantages for Commercial Real Estate Investors

1031 Exchange- Deferred Capital Gains: As it currently stands, Section 1031 of the Internal Revenue Code allows investors to defer capital gains tax when they sell any property held for productive use in trade, business, or investment and reinvest one-hundred percent of the proceeds from the sale within specified time limits into a property or properties of like-kind and equal or higher value. Typically, the replacement property must be identified within 45 days and close within 180 days. Within this timeframe, an investor would be able to exchange an apartment building for a triple-net commercial property in a tax-free state.

Note: Biden’s proposed American Families Plan adjusts or eliminates some of CRE’s key policies regarding tax breaks on 1031 Exchanges. President Joe Biden plans to “even the special real estate tax break” when completing a 1031 Exchange for gains larger than $500,000. This could result in significantly different strategies, create less turnover, and decrease supply and demand. Click here to read more.

Cost Segregation Depreciation

Commercial property will naturally age, require repairs, and inherently depreciate over time. Fortunately, an investor can take property depreciation deductions against income taxes to represent this loss in value. Commercial properties are typically depreciated over 39 years. A NNN lease investor may benefit from cost segregation, or a 179 Deduction, a strategic planning tool used to assess an entity’s real property and identify a portion of costs that can be treated as personal property. By identifying personal property to be segregated from the building, a cost segregation study (CSS) can reassign costs that would depreciate over 39 years to asset groups that depreciate more quickly. For instance, capital spent on non-structural improvements such as carpet, lighting, HVAC, and landscaping may be depreciated over five, seven, or 15 years rather than 39 years. This substantially shorter depreciable tax life frees up capital for other investment opportunities. If combined with an investment in a tax-free state, these additional savings help investors preserve capital, realize immediate cash flow, and achieve significant tax benefits on new and existing assets.

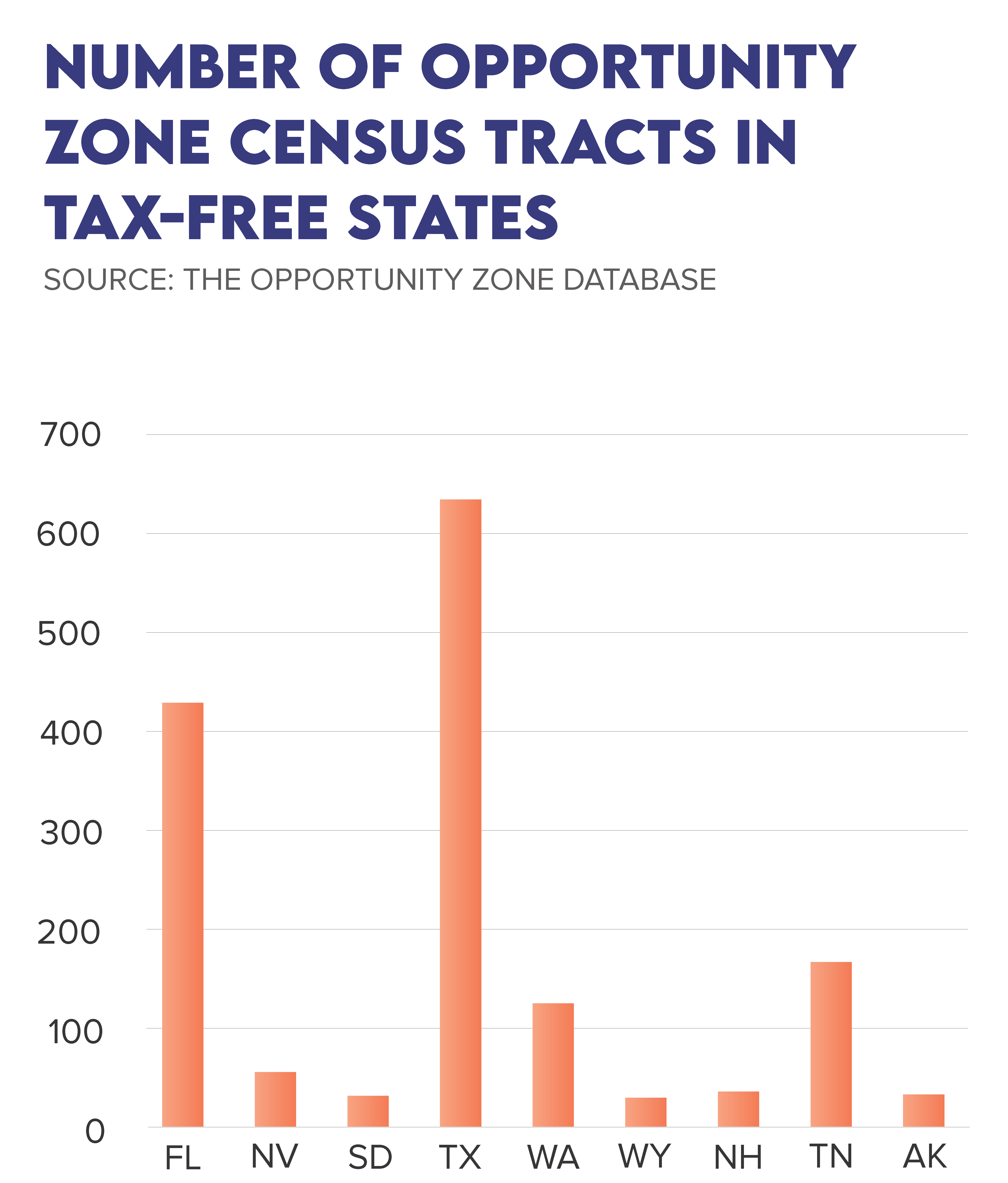

Opportunity Zone Investment

The Tax Cuts and Jobs Act introduced an incentive tax program, referred to as the Opportunity Zone program, allowing commercial investors to defer taxes on capital gains until December 31st, 2026, by reinvesting into a Qualified Opportunity Fund (QOF). The program is designed to encourage investment and economic growth in economically distressed communities, in turn offering federal tax incentives to the taxpayer who invests in a property located in one of these zones. The program also offers the partial exclusion of previously deferred gains when specific holding period requirements in a QOF are met, and the permanent exclusion of post-acquisition gains from a sale of an investment in a QOF is held longer than ten years. Investors who keep their money in a QOF for at least five years, before December 31st, 2026, are permitted to take a ten percent reduction in their capital gains tax basis, while those who keep their money in a QOF for at least seven years before December 31st, 2026, are permitted to take 15 percent reduction in their capital gains tax (meaning they would have needed to invest prior to December 31st, 2019).

Note: The Biden Administration is considering an overhaul of the opportunity zone program. Although administration officials have not settled on making adjustments, critics and supporters alike are pushing for measures that include more transparent reporting and favor working with the treasury department on funding impoverished areas.

Net Stop, Tax Savings

NNN investments offer many tax advantages and provide reliable monthly income and a steady, long-term return. The tax advantages previously mentioned provide an incentive to investors to preserve capital and reinvest in various commercial properties, which aids in portfolio diversification, and ultimately, wealth expansion. So, whether investing in a tax-free state is of interest or another strategy mentioned, remember, when it comes to real estate taxes, the more knowledgeable an investor is, the more money saved.

*This material is not intended to provide and should not be relied on for tax, legal, or accounting advice. It is recommended to consult with tax, legal, and accounting advisors before engaging in any transaction.