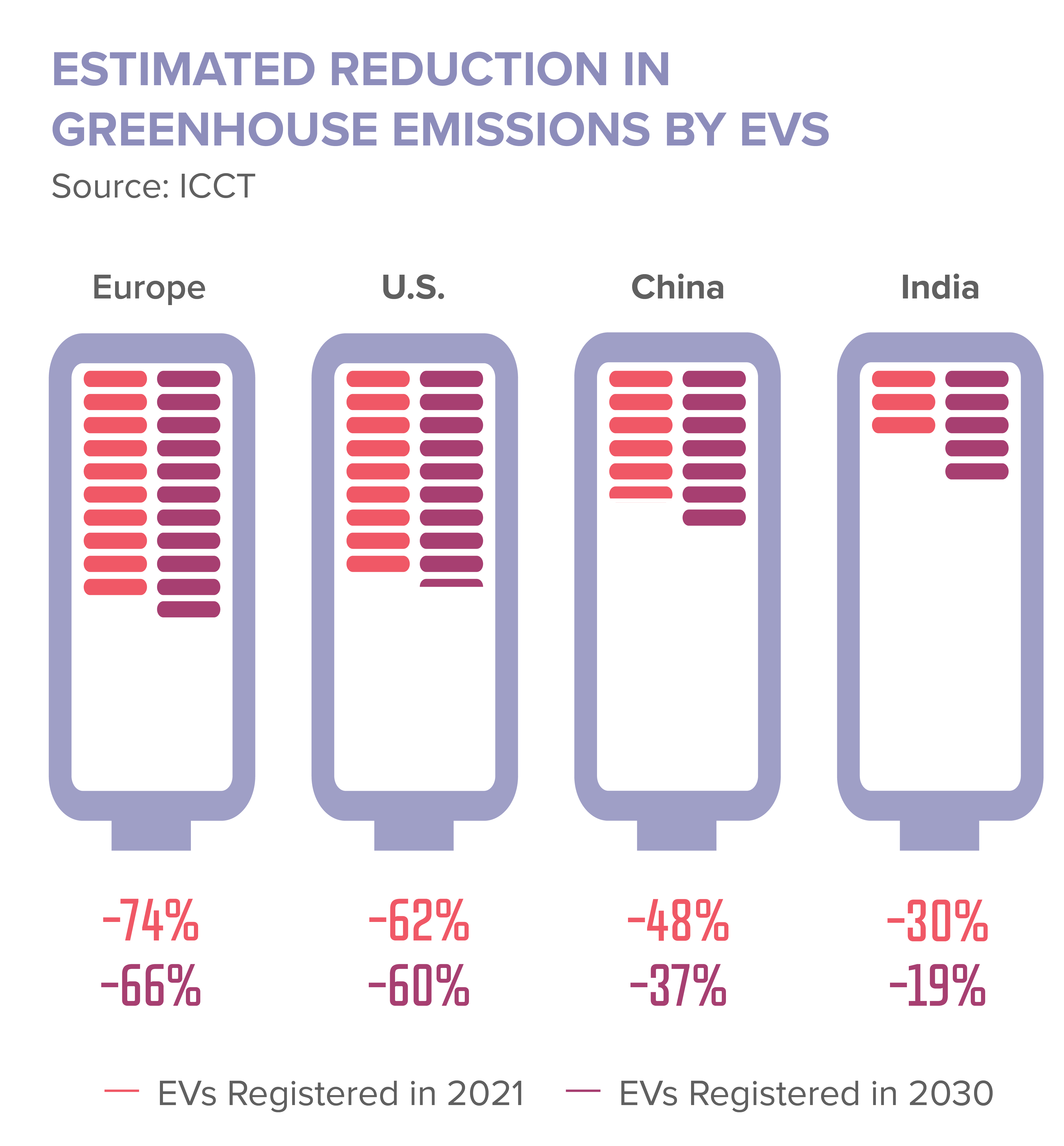

The threat of global warming is impending, and the transportation sector is the leader in greenhouse gas emissions, producing roughly a third of the country’s total emissions. The solution appears to be electric vehicles (EVs), as automotive manufacturers understand the long-term environmental impact. The number of emission-free vehicles being produced has reached record numbers, proving that car manufacturers envision a future with these products. With the manufacturers’ commitment to the EV revolution, state governments and consumers are following suit. Although there are concerns that these changes will forever alter the automotive industry moving forward, EVs present many new opportunities for real estate investors.

The Adoption of Electric Vehicles

Internal combustion engines are nearing their final days with the United States government, car manufacturers, and drivers. In a serious attempt to combat climate change, General Motors announced early in 2021 that it would phase out petroleum-powered cars and trucks and strictly sell 100 percent zero-emission cars by 2035. The pledge has pressured other manufacturers to make similar commitments, including Nissan, Ford, and Honda.

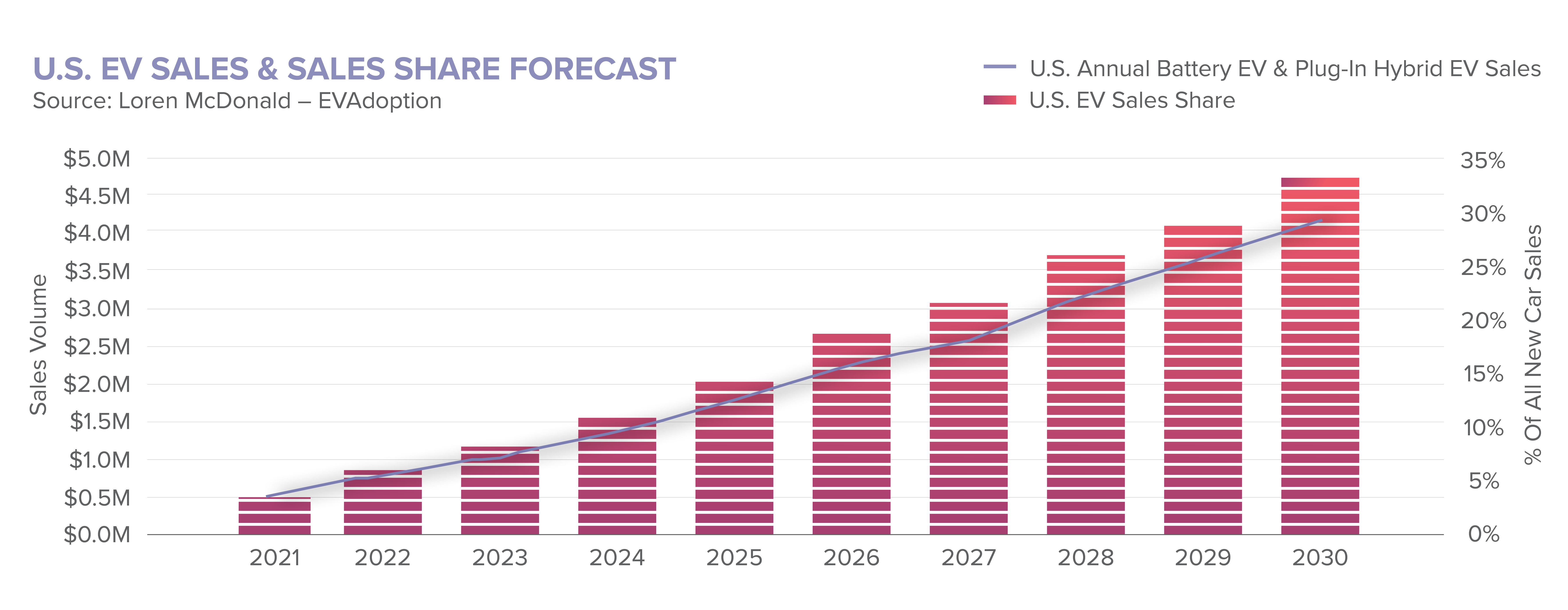

United Auto Workers pledged that 40% to 50% of their new car sales will be electric vehicles by 2030, up from just 2% this year. Source: New York Times

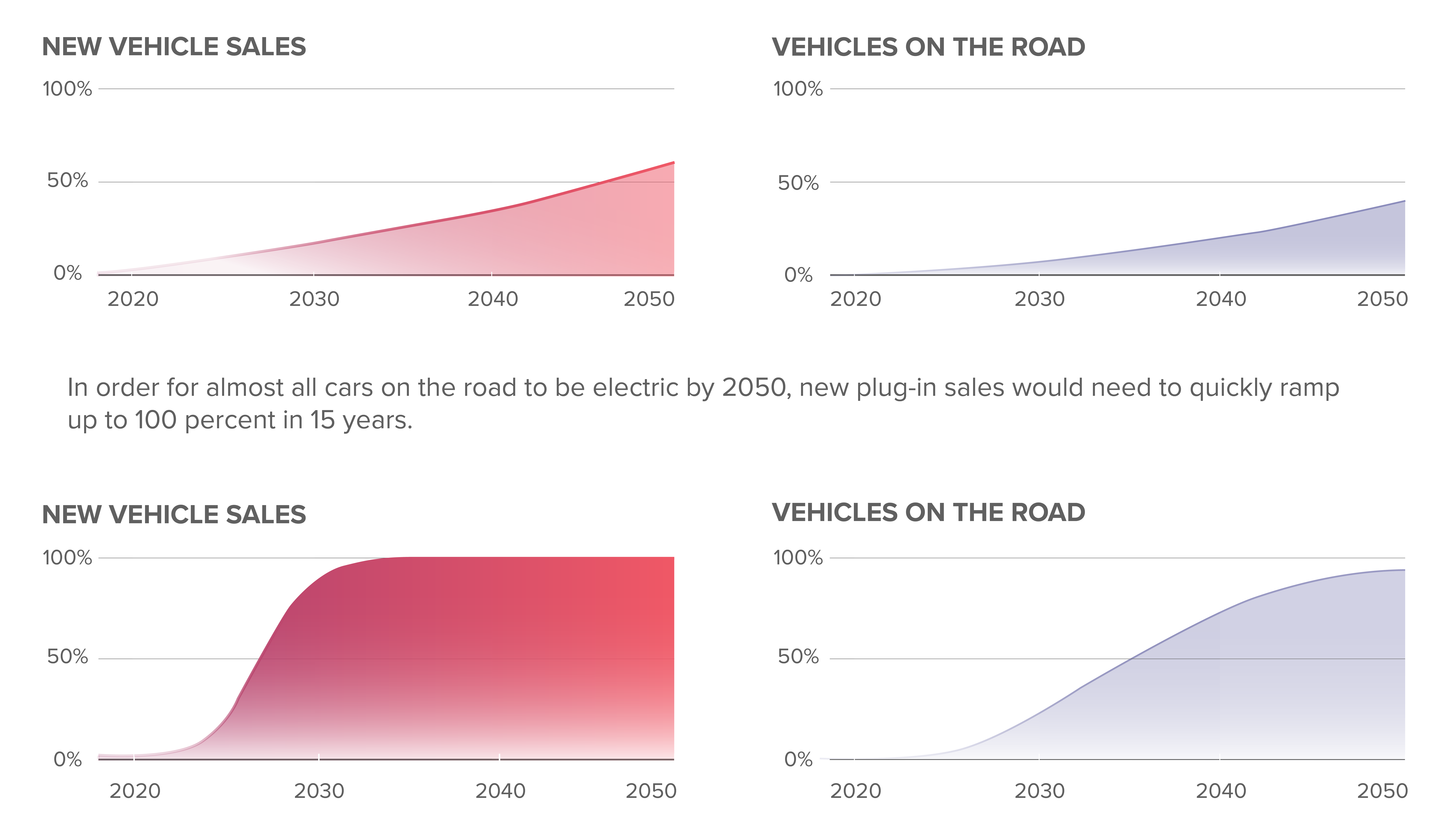

EV Sales Projections to Reach Zero Emission by 2050

If electric vehicle sales gradually ramped up to 60 percent over the next 30 years, as projected by analysts at IHS Markit, about 40 percent of cars on the road would be electric in 2050.

There are currently 40,000 EV charging stations registered by the U.S. Department of Energy, compared to 150,000 U.S. gas stations. Charging stations can be found at several property types ranging from gas stations to shopping centers to apartment buildings. Even Taco Bell is installing fast EV charging stations to its San Francisco locations as an initiative with Tritium and ChargeNet to bring chargers to fast food restaurants.

EVs’ rapid charging can take around 15 to 20 minutes, whereas gas fill-ups only take a few minutes. According to the Idaho National Laboratory, EV drivers are limited to a current range of 50 to 150 miles before needing to recharge, meaning they will need to visit charging stations more frequently than gas drivers needing to visit

fueling stations. Properties with charging stations have a competitive advantage, presenting a unique opportunity for commercial real estate owners to capitalize on EV customers.

Refuel Electric Vehicle Solutions (REVS) predicts that multifamily owners will see the most significant impact of electric vehicle adoption. With a dominant portion of EV owners charging at home, installing EV charging stations at apartment complexes offers commercial real estate owners a centurial opportunity to generate a new stream of income. Owners will profit from providing electricity to recharge car batteries and generate additional revenue by reselling carbon credits to certain parts of the country.

Currently, 80% of EV owners are refueling their vehicles at home, including many multifamily buildings. Source: Refuel EVs

Consumer Adoption

EV sales have exponentially grown over the last ten years, with the average demographic being 40 to 55 years old and an annual household income exceeding $100,000. Forbes forecasts that more than 18 million EVs will be on the road in the U.S. over the next decade. Consumers are attracted to the cost-saving benefits of driving an EV, including the comparatively lower cost of electricity to gasoline and lower maintenance costs. Several studies and market analysts also predict battery prices to significantly reduce in the coming years, lowering the price for most EVs and making them more accessible to a larger demographic.

In 2020, EVs made up less than 2% of the U.S. car and light-truck market. That figure is expected to surpass 3.5% nationally in 2021. Source: IHS Markit

Government Regulations & Incentives

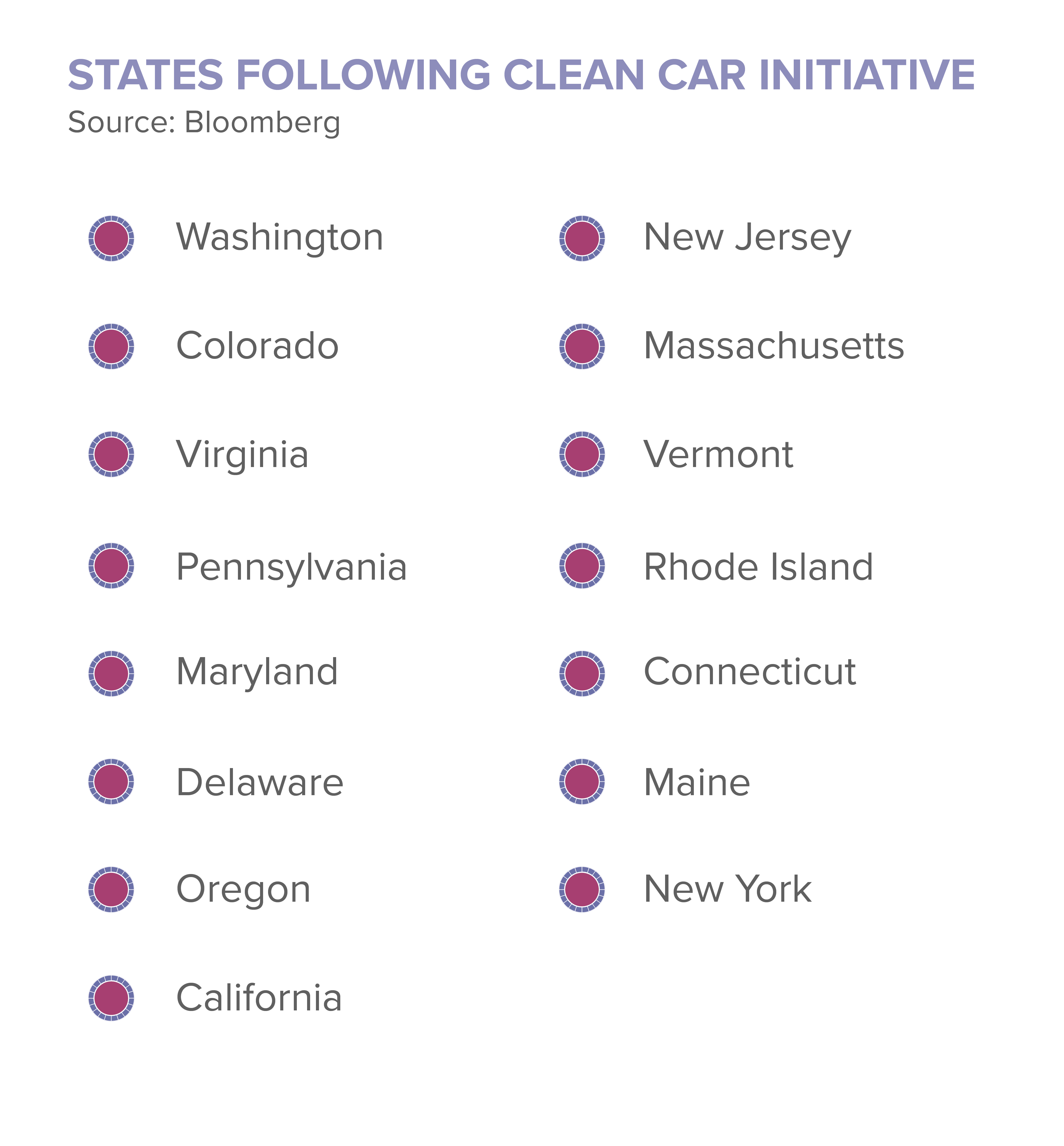

California is the first state to mandate zero-emission vehicles, as they currently lead the way in the EV revolution. Governor Newsom announced that the state will aggressively transition away from fossil fuel emission through an executive order requiring all new passenger vehicle sales to be zero-emission by 2035. Fourteen other states and the District of Columbia followed the emission-free initiative and adopted California’s clean car standards.

Despite manufacturer pledges and government incentives, cars used and sold today will continue to be present, with about 17 million gas-running vehicles purchased annually, each averaging a lifespan of ten to 20 years. Additionally, pre-owned vehicle sales will continue as used cars remain a source of affordable car options. According to Forbes, electric cars are projected to make up 60 percent of new sales in 2050, but the majority of vehicles on the road would still run on gasoline.

Impact on the Automotive Sector

Though EV sales are predicted to grow over the next decade, the one thing holding them back is the cost. As more affordable EVs eventually come to the market, a fundamental change will occur in the auto service and auto parts sector. EVs impact the need for six of the ten most common vehicle repairs, including oil changes, air filter replacements, antifreeze, and engine tune-ups, while concurrently reducing the need for battery replacements and brake work. EVs utilize regenerative braking, which slows vehicles down while simultaneously saving energy and reducing brake wear.

Electric vehicles come with their own set of repairs, though, as they use more glass and technology, such as cameras and sensors. Moreover, emission-free vehicles consume tires at a much higher rate, with Tesla cars replacing tires after 10,000 miles on average. According to Zohr, an on-demand replacement service, EV owners replace their tires 30 percent more frequently than traditional car owners. Auto services and parts shops are considering subscription services or offering a guaranteed uptime policy to keep EV customers returning.

Auto Parts

For the most part, those who visit auto parts stores are do-it-yourself (DIY) shoppers. About 80 percent of AutoZone’s revenue is from DIY shoppers. In comparison, 60 percent of O’Reilly’s and 40 percent of Advance Auto Parts sales are DIY shoppers, and professional mechanics make up the rest. Electric vehicle maintenance is far more complicated when compared to gasoline-powered vehicles, so the learning curve for consumers to make their own repairs will be a lot steeper. Shops with a large demographic of DIY shoppers will need to develop solutions to retain customers who self-repair their cars or solidify partnerships with professional shops to supply parts.

Electric vehicles have a third fewer moving parts than a conventional vehicle, and fewer parts means less labor.

Auto Services

There is no denying that electric vehicles are part of the future; therefore, repair shops will need to adapt their services and upgrade employee skillsets. Training programs for skilled technicians are being developed and implemented to enhance the conventional auto technician with the necessary skills to maintain an electric vehicle. It will take years of training and investment for a service chain to be fully functional at maintaining EVs. Auto service shops Take 5, Jiffy Lube, Valvoline, and others will need to evolve their services that include IT, auto tech, and sophisticated diagnostics for analysis and updates to accommodate the growing amount of EV customers. Valvoline has already implemented a service that offers various additional services, including maintenance for hybrid cars, dubbed “Valvoline Express Care.” A significant change in the auto service industry presents an immense opportunity for real estate investors to capitalize on.

While the services and parts needed today for traditional vehicles will eventually become obsolete, real estate investors have an equal opportunity to take advantage of what is to come. With the automotive landscape drastically changing, automotive-related tenants will have to retool their products and services to match consumer demand. EVs create new opportunities as they will spark battery manufacturing, battery mining, and charging station production. In the end, commercial real estate investors must be able to identify which sectors possess the ability to adjust the quickest and most efficiently to the new revolution of electric vehicles.