Consumers are being met with inflation at various points of sale. From the gas pump to the grocery store, and now, restaurants, inflation is resulting in all-time high price surges. Food manufacturers have reported price increases due to higher commodity prices, transportation and labor shortages, and supply chain disruptions. These hiked prices have significantly affected the food industry, especially food service. With restaurants trying to stay afloat after the repercussions of COVID-19 shutdowns, some operators are turning to offloading the cost to consumers by increasing prices, decreasing real estate footprints, or investing in self-ordering technology and loyalty programs.

The Current State of Inflation

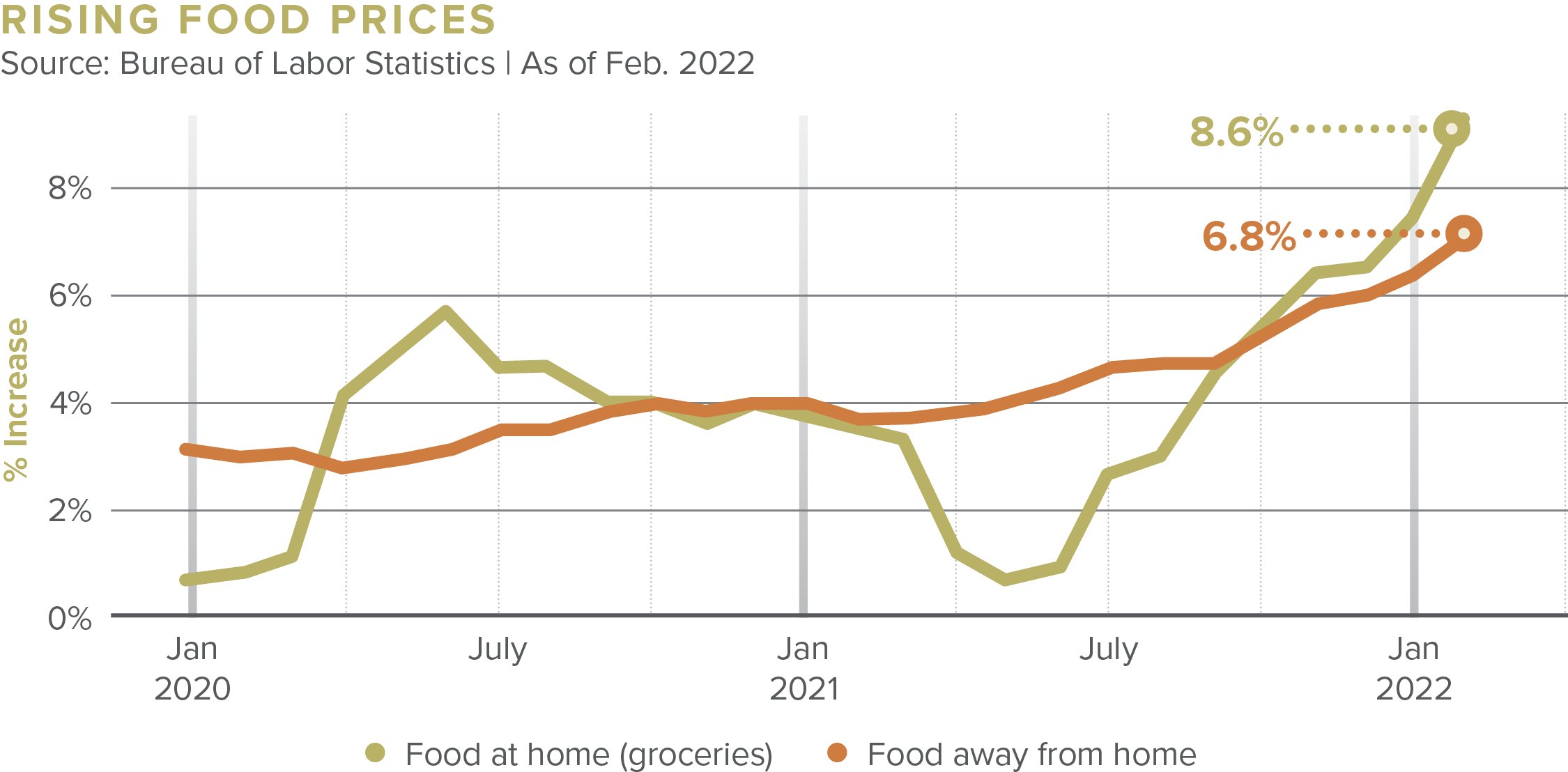

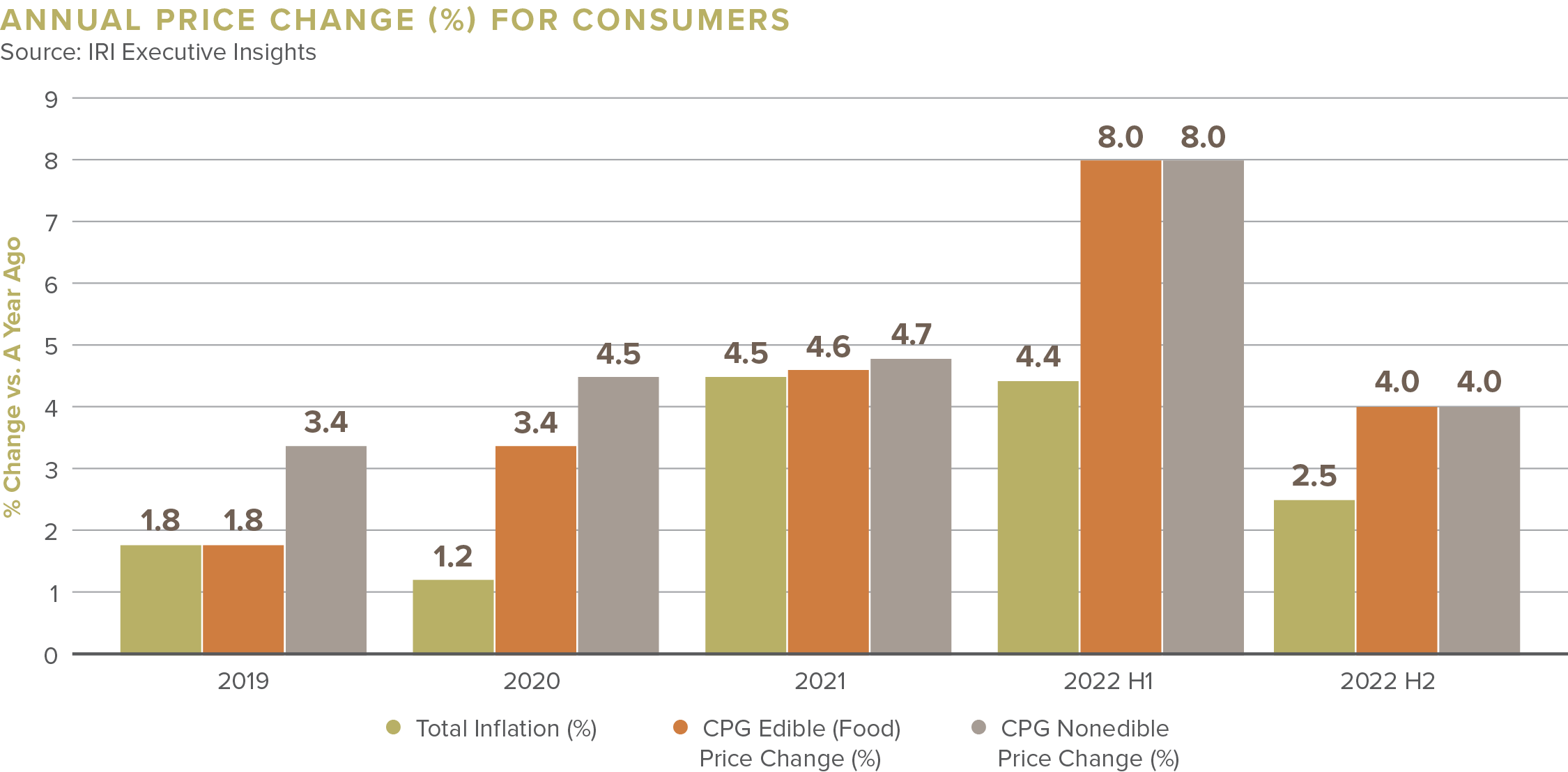

According to the U.S. Bureau of Labor Statistics, inflation has officially reached a 40-year high, with prices up 7.9 percent. The consumer price index climbed 6.4 percent in the last 12 months as of February 2022, marking the largest increase since August 1982. Food producer prices are up 13 percent compared to last year, and wage rates are up ten percent as operators attempt to attract workers by increasing pay amid the labor shortage. Inflation has hit restaurants hard, with prices at restaurants, bars, and cafeterias rising 6.8 percent in February, and prices for food at home, such as groceries, rising 8.6 percent year-over-year. Meats, poultry, fish, and eggs saw the highest price increases. As a result, restaurant menu prices have increased to their highest in four decades, with quick-service restaurants (QSR) raising prices eight percent in the last year and full-service restaurants by 7.1 percent. Drive-thru chains increased their prices by six percent in the summer of 2021 and another six percent at the start of 2022.

Restaurants Fight Back

With restaurants recognized as discretionary spending, operators nationwide share concerns about the impact these rising prices will have on their business. As a result of the pandemic, restaurants have an advantage, with pent-up demand from customers after eating at home in the last two years. In fact, the restaurant space recovered quickly in 2021, reporting ten percent more in new restaurants and food business openings than the previous year, according to Yelp data. As such, small business owners remain optimistic about their future.

Despite price increases, Starbucks’ same-store sales increased 18% in the U.S. in the first three months of 2021. Two-thirds of that came from increases in traffic to its locations. Source: Restaurant Business

Creative Solutions

To offset these new costs, restaurant owners are making creative changes of their own. According to Technomic, some restaurants prioritize higher-margin promotions or lower-cost ingredients. At QSRs, value menus have replaced dollar menus and sit-down restaurants are reducing portions. For example, Domino’s is reducing the number of chicken wings from ten to eight in its $7.99 carryout deal, while Little Caesars is increasing its pizza prices by $0.55 but adding additional pepperoni toppings.

Domino’s Pizza predicts its food basket costs will soar 8-10% in 2022, three to four times the pace for a typical year. Source: Domino’s Pizza

Labor Shortage

Employees nationwide are fighting to increase the minimum wage as inflation rises everyday costs. At the same time, packing and fulfillment positions serve as the current alternative, offering minimum wages starting between $18 to $22, better benefits, and sign-on bonuses. Employment in fulfillment centers grew 50 percent in 2020. Job searches for “Amazon” from restaurant servers increased over 600 percent, according to Glassdoor. Food brands, such as McDonald’s, Chipotle, Shake Shack, and many others, already have, or plan to, spend millions on wage increases in 2022.

Investing in Culture

The restaurant industry has long seen high staff turnover. According to the U.S. Bureau of Labor Statistics, the hospitality industry had a 78.9 percent turnover rate in 2019. That number jumped to 130.7 percent in 2020, with fast-food restaurants experiencing 144 percent in 2021. Chick-fil-A is among the food brands to thrive amid the pandemic, especially through the hiring crisis. The company intends to invest $19 million in employees’ continuing education, awarding scholarships to nearly 8,000 team members. Unlike other fast-food chains, the chicken chain giant remains closed on Sundays, giving all its workers a break. Additionally, Chick-fil-A funded $10.8 million for food donations or items for first responders, healthcare workers, Chick-fil-A employees, and their families. By prioritizing their staff and customers, Chick-fil-A has successfully recruited and retained employees amid the pandemic and the current inflationary environment.

How Restaurants Will Emerge

Despite inflation affecting food resources and corresponding increase in menu items, people will still eat at restaurants. Data from OpenTable indicates that traffic hasn’t slowed down, although not a tremendous uptick, there was a one percent increase in walk-ins and reservations in March 2022, compared to pre-pandemic level.

Yelp reviews were up 29 percent year-over-year in Q4 2021, indicating positive dining out trends. Source: Yelp

Investing in Technology

Restaurants will continue to transform to meet employee and customer demand. Already, operators are increasing hourly wages, offering signing bonuses, implementing benefits, and investing in company culture. Further, restauranters will rethink capital allocations towards essential tools in the industry, like QR codes, self-ordering technology, and touchscreen ordering kiosks, to mitigate the labor shortage. Self-ordering tech addresses the effects of inflation by giving value back into the hands of the restaurant operators. For example, the Samsung Kiosk uses innovative upsell technology to increase the average ticket size by up to 40 percent, according to GRUBBRR, the software utilized in these kiosks. The one-time purchase of a kiosk is a fraction of the price of training and retaining an employee.

Self-ordering technology saves on labor costs. Research from Deloitte shows that 70% of consumers prefer to order using self-ordering technology rather than ordering from a cashier.

Rethinking Real Estate

Restaurant brands are reconsidering their real estate footprint as another result of COVID-19 and the state of inflation. One trend blazing the industry is ghost kitchens – space solely dedicated to online ordering and delivery capabilities, with no dine-in seating. Virtual kitchens are low cost and require only a kitchen staff, benefitting both large brands with kitchen space to spare and smaller brands looking for ways to reduce overhead costs.

Another trend is prioritizing the to-go experience. The best example is Freddy’s Frozen Custard’s newest location with a drive-thru, curbside pick-up lanes, walk-up windows, and an outdoor patio. Another example is Burger King’s latest store prototype featuring similar concepts plus pick-up lockers for mobile orders or delivery and a suspended dining room and kitchen. These concepts are featured in Burger King properties that are 60 percent smaller in footprint than most of its locations.

Beyond the Loyalty Program

Customer retention is difficult during inflationary periods as people are more conscious of their spending. Customer loyalty software is proven to attract repeat customers to a restaurant with enticing rewards and relationship-building benefits. Businesses can use point of sale (POS) systems with customer loyalty software that encourages customers to spend more and collects data to help restaurant owners make smarter business decisions based on customer behavior and preferences. Square is a free POS with an in-house loyalty program where customers can enter their phone numbers to receive automated texts about reward activity per purchase. According to Square, customers who enroll in Square Loyalty spend 37 percent more.

While inflation has hit the restaurant sector, the resilient industry has proven to be adaptable during hard times, the most recent case being during the COVID-19 pandemic. The Yelp Economic Index showed in January that customer reviews mentioning price increases rose 29 percent in Q4 2021 compared to Q4 2020, however, this indicates that customers are still eating out despite the record-high menu prices. Restaurant owners must continue prioritizing customer preferences and adapting their business model accordingly to keep customers returning.