What is Build-to-Rent?

As demand drivers change, incomes shift, and renters’ priorities adjust, major homebuilders are pivoting their focus to purpose-built, single-family rental homes, otherwise known as build-to-rent properties. These homes are constructed from the ground up for the specific purpose of renting to tenants. Due to increased home prices, higher lending rates, preference for renter flexibility, and new housing standards, this product type has emerged in popularity. To put this into perspective, homeownership in the country is currently below 66 percent and is expected to decline over the next 20 years.

According to the Harvard Joint Center for Housing Studies’ Rental Housing 2020 report, all single-family rentals – both existing homes and new BTR units – Grew a whopping 18% from 2008 to 2018 to 15.5 million units, or about a third of all rental units nationally.

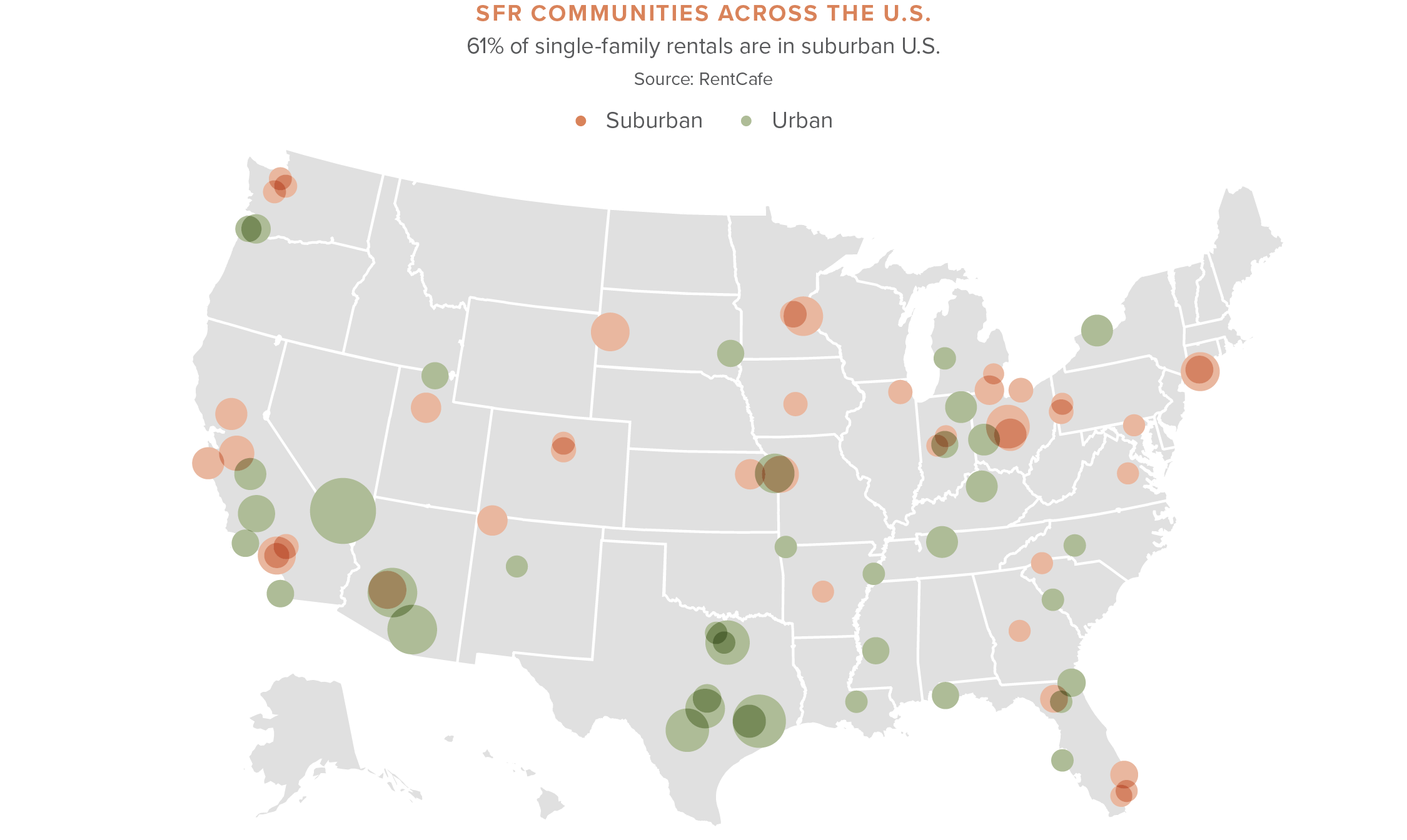

Build-to-rent (BTR) is an evolutionary development trend featuring professionally managed communities of single-family rentals (SFR). These communities aren’t just low-density multifamily properties or clusters of single-family tracks but instead are more akin to traditional, gated single-family neighborhoods with community amenities. These homes are typically larger (three or four bedrooms), located in prime areas with quality schools, and provide easy access to jobs, culture, and recreation.

Residents in the United States have fundamentally changed the way they think about the American Dream, what they value, and how they choose to live. For a growing number of people, this means they would rather choose to rent than own and want more than what the traditional housing market can offer. Renters are attracted to the product because

there are currently limited rental options available on the market, and residents have changed their housing preferences. BTR properties offer a sense of community with more space and ease of access to retail, employment, and major transportation corridors. They also provide the privacy, quality, convenience, and luxury typically found in downtown metros, without the hustle-and-bustle. The types of renters looking at BTR range from professional millennials to baby boomers and people in a transitional period such as a divorce.

Why are Investors Interested in BTR?

When it comes to alternative investments, build-to-rent or single-family rentals are tough to beat. This product delivers excellent returns through appreciation and rental income, presenting BTR as one of the most risk-averse investment opportunities. Niche players and large publicly held investors are attracted to the perfect trifecta of affordability, flexibility, and demand offered by BTR. There is also plentiful availability of financing for the product type.

Homeownership rates across the country are steadily declining, causing rental vacancy rates to go down and median asking rents to rise, all while being in the middle of an inflationary period. In conjunction, real estate investors and developers are seizing this opportunity created by housing shortages and demographic shifts to fill the growing void in housing by delivering BTR single-family homes.

Does BTR Compete with Multifamily?

The simple answer is no, BTR is not a competing asset class to multifamily, although they fall under the same roof. BTR is a logical stepping-stone out of multifamily for residents who have outgrown their apartments and are looking for the lifestyle provided by single-family homes. Residents in BTR communities want a different experience with low-density suburban living and specifically choose BTR instead of multifamily.

These communities are not replacing buying a home, living in an apartment, or living in a single-family rental – this is a unique option that blends both worlds of single-family home living and carefree maintenance without a mortgage.

What Does the Future of BTR Look Like?

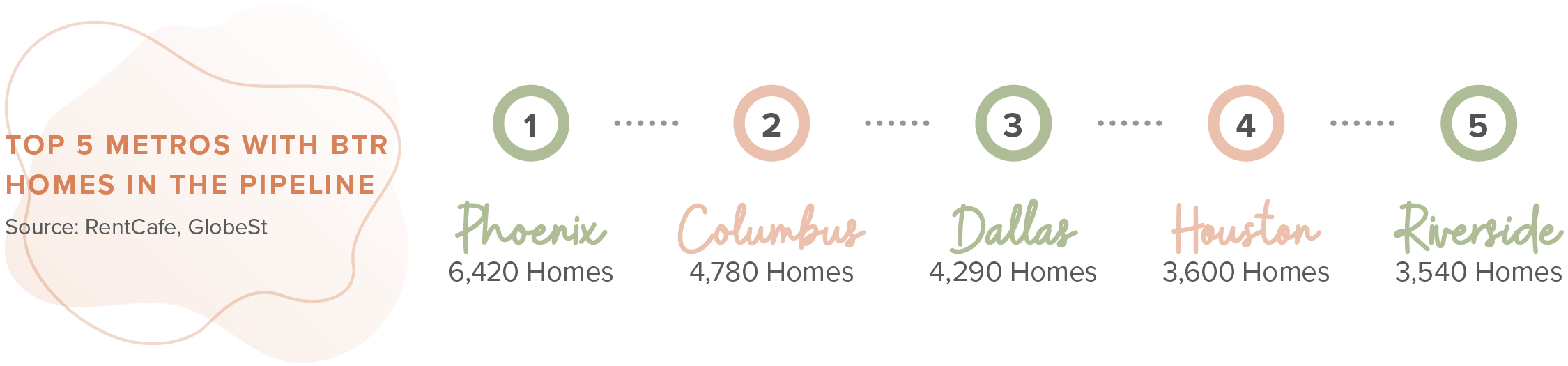

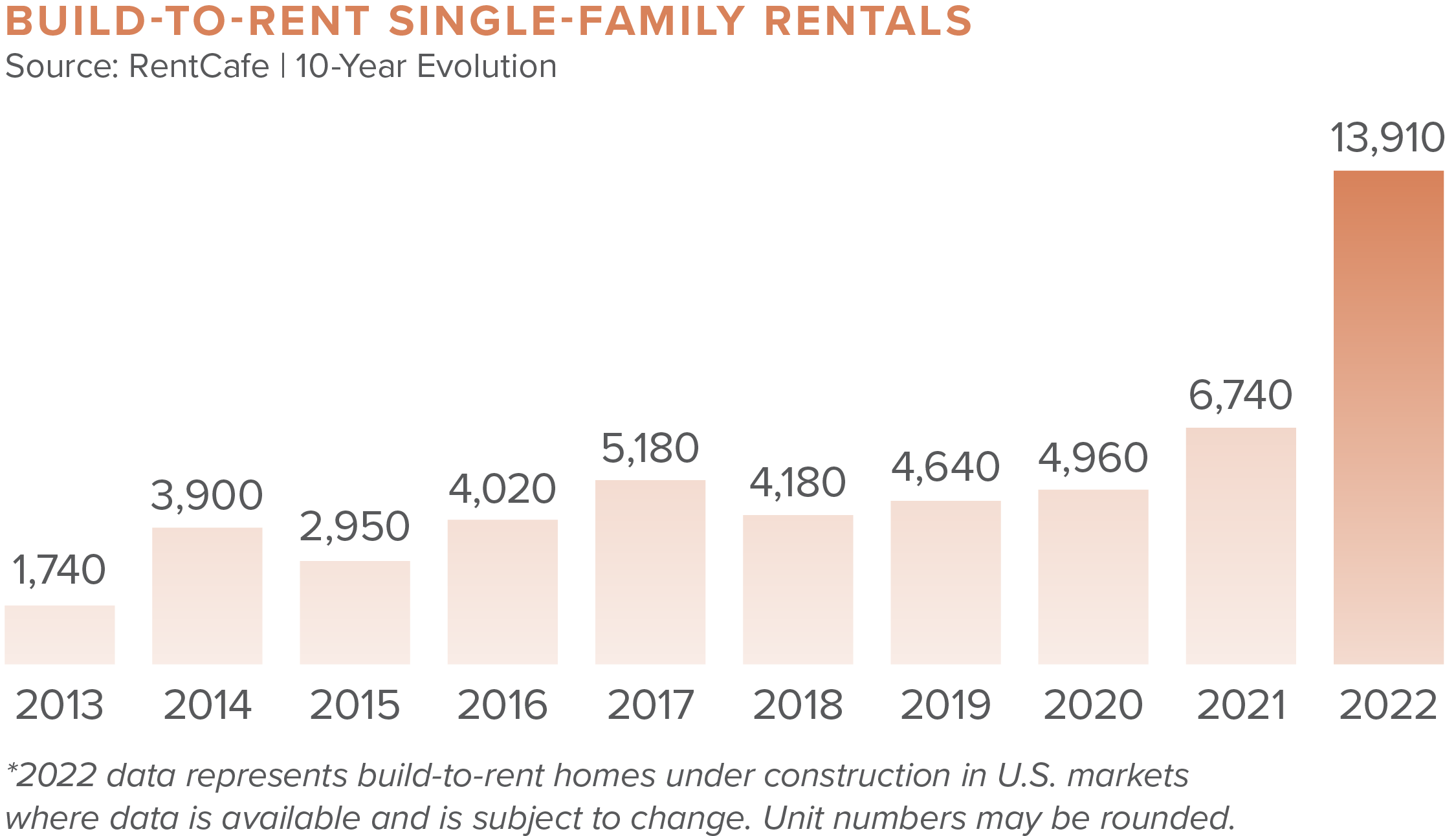

According to Yardi Matrix, single-family rental construction posted its strongest year in 2021, with 6,740 new BTR homes constructed. In 2022, BTR homes are expected to more than double that record, with almost 14,000 in the pipeline for this year.

The number of build-to-rent properties built annually is expected to double by 2024. The amount of development money that has already been pumped into the asset type assumes a steady pipeline of BTR deliveries on the horizon. As such, it is expected that the BTR trend is here to stay as the country’s residents reconsider how and where they want to live. This product type fills a logical niche within the U.S. rental market. Although single-family rentals have always existed, it is evolving into a more professional and institutional market as players take a more prominent ownership role than the typical mom-and-pop owner. These institutions can operate on a scale that brings more sophisticated management and capital to the BTR space.