What Is a Bear Market?

During a bear market phase, investing can be risky even for the most seasoned of investors. In most cases, a bear market symbolizes a deep selloff in the market, an economic downturn that has been caused by a decrease in the value of securities, or by an increase in interest rates. Typically, you will see stock prices decrease by 20% or more from their recent highs during this time.

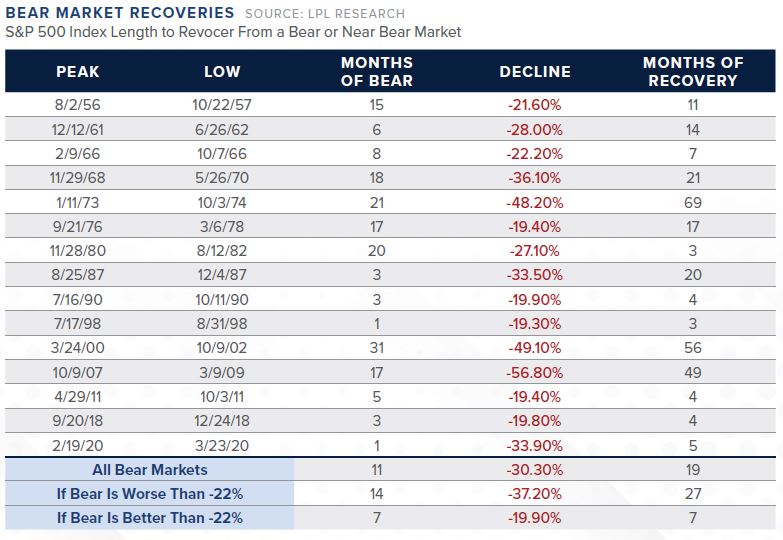

On average, bear markets will last 363 days versus 1,742 days for bull markets. They tend to be less statistically severe, with average losses of 33% compared with bull market average gains of 159%, according to data compiled by Invesco.

What Causes a Bear Market?

There are key economic signals investors should watch out for when a bear market occurs. Most often, it will happen just before or after the economy moves into a recession, but this is not always the case. To judge when the economy is shrinking you may want to look at the following factors:

-Hiring

-Wage growth

-Unemployment

-Inflation

-Interest rates

-Wars

-Pandemics

What Bear Markets Could Mean for CRE Investors?

Real estate is one of the few asset classes that continue to produce profits even during an economic turndown. U.S. commercial property indexes do not reach back as many years as stock market averages. In the last near quarter-century, there have been two real estate downturns for U.S. commercial real estate.

The first was the Global Financial Crisis from 2007 to 2009, which bottomed out in two years and then took until 2014 for full recovery.

The second U.S. commercial real estate downtown was in response to the COVID-19 pandemic, and was brief, and lasted under a year, and then bounced back to historical highs.

Should I Invest During a Bear Market?

Since bear markets make it difficult to get returns on investments, it will likely discourage people from investing their money. Over the past decade, however, commercial real estate has experienced a pronounced upward trend. Demand for apartments, distribution space, grocery-anchored retail, and self-storage has been robust.

Property types including offices, shopping malls, and hotels, struggled at the beginning of the COVID-19 pandemic, but even those sectors have avoided the dramatic downturn that affected the broader commercial real estate market during the Great Recession. What does this mean for investors? While there are no guarantees in any investment, if you look at the half century track record of general U.S. commercial real estate downturns, it has remained rare and lasts at most only a couple of years.