Consumer Spending

Consumer spending contributes to the creation of jobs, profits, and taxes in the local, state, and national economies. Even the slightest decrease can be detrimental because consumer spending drives two-thirds of the economy. With high inflation rates and a volatile market, experts were wary of how consumers’ shopping habits would respond at the end of 2022. However, retail therapy prevailed and served as a saving grace for the country’s economy. These consumer spending trends are expected to continue in 2023.

Retail Updates

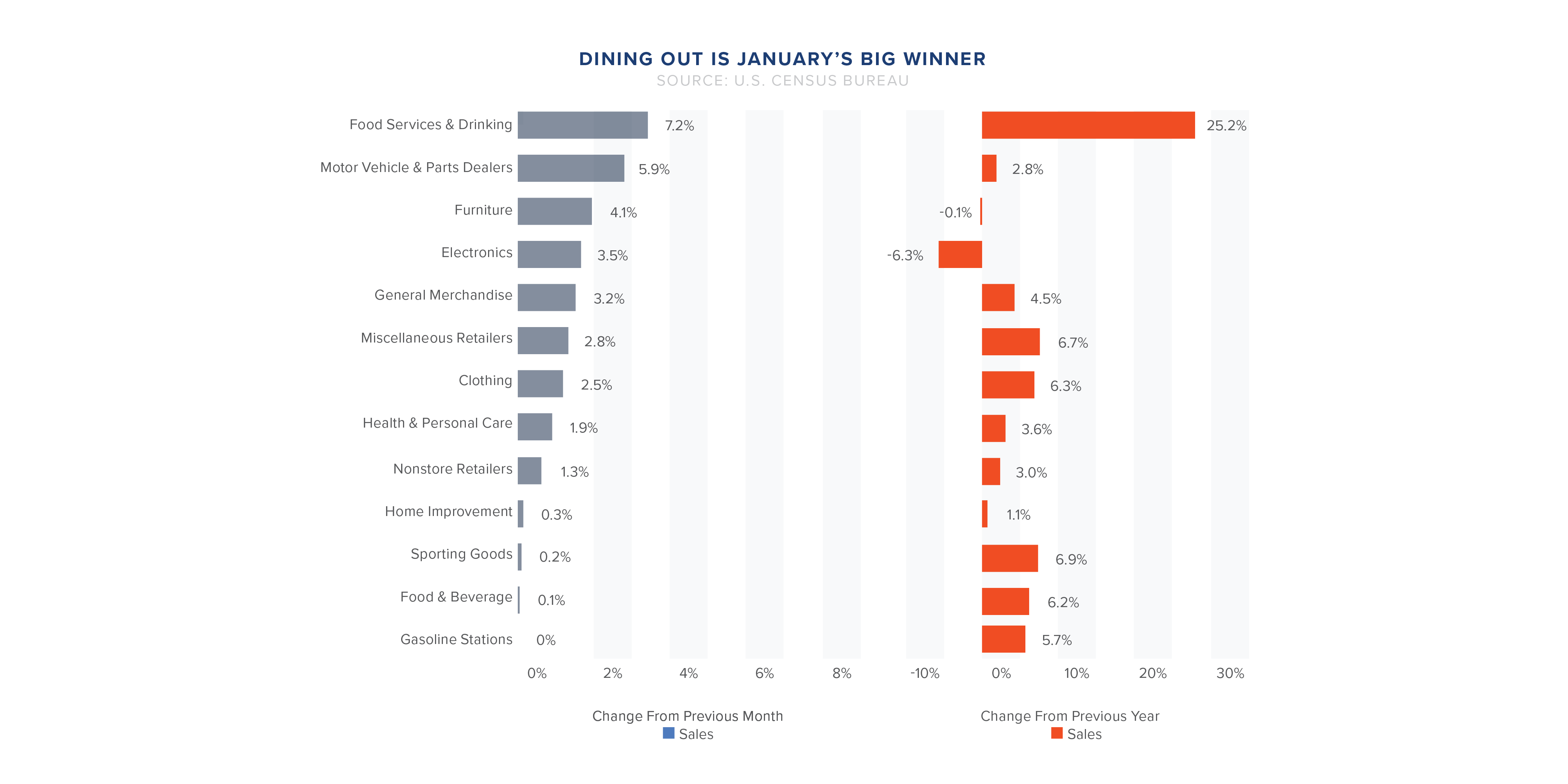

According to the United States Census Bureau, retail and food services sales for January 2023 were $690 billion, up three percent from December and 6.4 percent from January 2022. Additionally, all retail categories grew during January after being adjusted to account for December’s holiday spending.

Outperforming Retail Sectors

Of all retail sectors, dining-out services saw the most notable percent change from the previous month and year, quickly followed by automotive dealers.

Rise in Automotive Market

- Motor vehicle and parts dealers comprised the most significant proportion of any retail sector, making up about 20 percent of total retail sales.

- The market grew by 5.9 percent within the month.

- Supply chain issues within the industry from the pandemic are finally easing, and experts predict a decent increase in automotive sales for 2023.

Underperforming Retail Sectors

On the other hand, grocery stores and gas stations saw a much slower sales growth in January. The demand for sporting items and home renovation projects have also declined; both increased by less than 0.4 percent this past month. These slow growth trends are heavily attributed to the sectors’ high sensitivity to inflationary trends.

The consumer price index increased by 0.5 percent in January 2023, the largest increase in the last three months, indicating that the Federal Reserve may still have to raise interest rates during 2023 to get inflation back under control. However, despite the high inflation reading for January, retail sales adjusted for price increases remained very solid.

As of February 2023, inflation is 6.4 percent.

Consumer Spending and Inflation

In the fourth quarter of 2022, consumer spending in the United States climbed to $14,226.80 billion. At the same time, underlying inflation pressures remained significant, and the Federal Reserve raised interest rates to 3.4 percent. Although Americans are anxious about inflation, they continue to shop, allowing the economy to thrive for another quarter. Despite growing living costs, Q4 2022 numbers showed that 2022 was a strong year for consumer expenditure.

Although the economy may be volatile, consumers are predictable, and the economy can thank retail therapy for continuously keeping it afloat.

Significant Rise in Household Debt

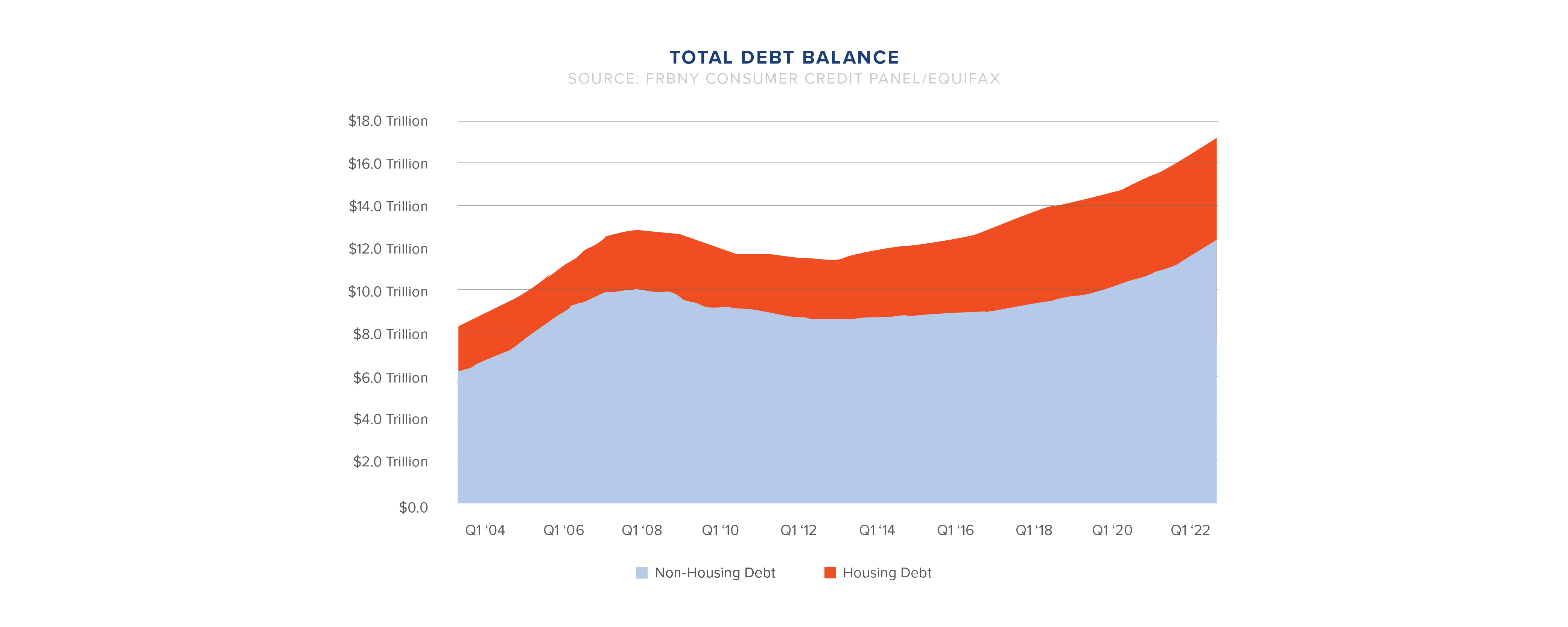

Total household debt increased by 8.5 percent year-over-year to $16.9 trillion, according to the Federal Reserve Bank of New York’s recent report.

The increase in sales for motor vehicles and parts dealers also means an increase in debt since auto sales are usually financed and paid over several years resulting in an increase in overall household debt. The Federal Reserve’s report stated that auto loan balances grew by $28 billion in the last quarter, extending an upward trend that began in 2011.

Mortgages and credit cards are also significant contributors to the rise in debt nationwide. The report stated that mortgage balances reported on consumer credit reports climbed by $254 billion in the fourth quarter of 2022, reaching $11.92 trillion at the end of December, representing a nearly $1 trillion increase in mortgage balances over the year. There was also a $61 billion surge in credit card balances, pushing them over the pre-pandemic peak of $927 billion. Now, there are $986 billion in credit card balances, up from $770 billion in the first quarte of 2021.

Outlook for Consumer Spending in 2023

Consumers are a driving factor keeping the economy afloat, but there is a limit. With rising household debt, high inflation rates, and the FED raising interest rates, consumer spending cannot fix all the economy’s issues. Fortunately, even when adjusted for inflation, wages continue to rise, which is reassuring as the country prepares for the remaining quarters of 2023.