How the Shopping Center Sector Found its Footing

After the rollercoaster of a ride over the past three years, investors are taking a fresh look at shopping centers. Retail’s attractive yields, impressive fundamentals, and relatively smooth rebound from the early days of the pandemic have shifted the shopping center landscape dramatically. The pandemic ultimately forced shoppers and retailers to change how they operate, with customers favoring open-air neighborhoods and community centers. As such, there was a sharp increase in investor interest, and due to limited new construction, net absorption and rent price gains were substantial in 2022. In 2023, investors are met with a different investment landscape as the economic backdrop has heightened uncertainty, challenged by high-interest rates. Despite this, the shopping center sector is expected to remain strong, with retail fundamentals barely flinching; inflation is moving down, and interest rates are expected to stabilize towards the end of the year.

State of the Market: A Look at the Fundamentals

Occupancy & Rent

The sector’s current strength is reflected in occupancy and rental growth, which reached record levels in 2022. Bolstered by a resilient consumer, retail shrugged off the concerns surrounding inflation, rising rates, and recessionary fears, remaining in expansion mode throughout the year.

CoStar Group reports that the U.S. average vacancy rate for neighborhood, power, and strip centers averaged 5.16 percent during the first quarter of 2023. It was 6.4 percent at the start of the pandemic in 2020 and surpassed seven percent at the end of 2020 and early 2021. The lowest vacancy rate was in the fourth quarter of 2022 at 4.2 percent, the lowest since 2007.

In 2022, store openings outpaced closures by nearly 2,500 – the largest net expansion in a decade.

The retailers responsible for several large move-ins to centers include sporting goods brands, off-price retailers, and home improvement retailers. However, it’s important to note that the average size of signed leases for community and neighborhood centers fell around five percent and 3.5 percent, respectively. While the average strip center lease size increased by 3.4 percent in 2022.

Most developments coming to market are build-to-suit, meaning the rent will be double that of existing developments.

In 2022, year-over-year rent growth for neighborhood, power, and strip centers rose around 4.8 percent, one of the highest annual rent increases on record, averaging $22.99 per square foot. In Q1 2023, rent growth averaged 4.2 percent and appears strongest along the Sunbelt, where population growth fueled absorption. According to Moody’s Analytics, asking and effective rents grew by 19 and 21 basis points, respectively, in Q4 2022. This is the most growth recorded on an annual basis.

Sales & Construction

A mere 48.8 million square feet of new retail space was delivered in 2022, the lowest annual total on record. At the same time, 23.3 million square feet of obsolete retail was demolished, so net delivery was just shy of 29.8 million. This is a dramatic change from the number of record deliveries seen for retail in the third quarter of 2008, with 228 million square feet delivered to the market.

More retail construction is needed to allow tenants to expand to their full potential. However, with a challenging debt market, developers face headwinds to secure capital for new projects. Therefore, availability is increasingly limited in high-quality centers.

In February 2023, the retail property sector was the only one to post growth in deal activity, according to Real Capital Analytics. The level of deal activity was also higher than any other sector for the month. However, if it were not for the take-private transaction involving the STORE Capital REIT, deal volume for the retail sector would have stood at $2 billion in February, on par with the hotel sector. In the last 12 months to February 2023, transaction volume for centers was recorded at $56.3 billion, a nine percent increase year-over-year, and $1.3 billion for the month of February 2023, a 71 percent decline year-over-year, according to Real Capital Analytics. While some element of decline this year is a function of an unusually strong period of growth in retail property sales in late 2021 and early 2022, the economic market has also been a factor.

In the last two years, consumers were spending, and that pent-up shopping demand lured investors to pursue properties. In fact, REITs increased acquisitions during this period, and grocery-anchored centers attracted $5 billion in investment activity in Q3 2021 alone. Further, data showed that when looking at the sale of individual shopping centers, that figure reached $10.4 billion in the first half of 2022, a 19 percent increase from the same period in 2021. Overall, this renewed positive outlook on the sector is showcased by increased investment sale numbers.

The Markets Outperforming

The most attractive centers are in growth markets, particularly along the Sunbelt, that have strong demographic drivers and development that can support demand. At a local level, demand is strong in primary markets such as Atlanta, Boston, Chicago, Dallas, Houston, Miami, and Phoenix. And in secondary markets such as Milwaukee, Jacksonville, Orlando, and Raleigh-Durham.

The Anatomy of a Shopping Center: Creative & Strategic Leasing

The Relationship Between Landlord & Tenant

The pandemic exacerbated friction between owners and retailers; it created a disconnect in expectations and responsibilities. Retailers often regarded owners as their landlords instead of partners and collaborators. So, how can owners and retailers create new environments that meet the standards of today’s shoppers with intent and purpose?

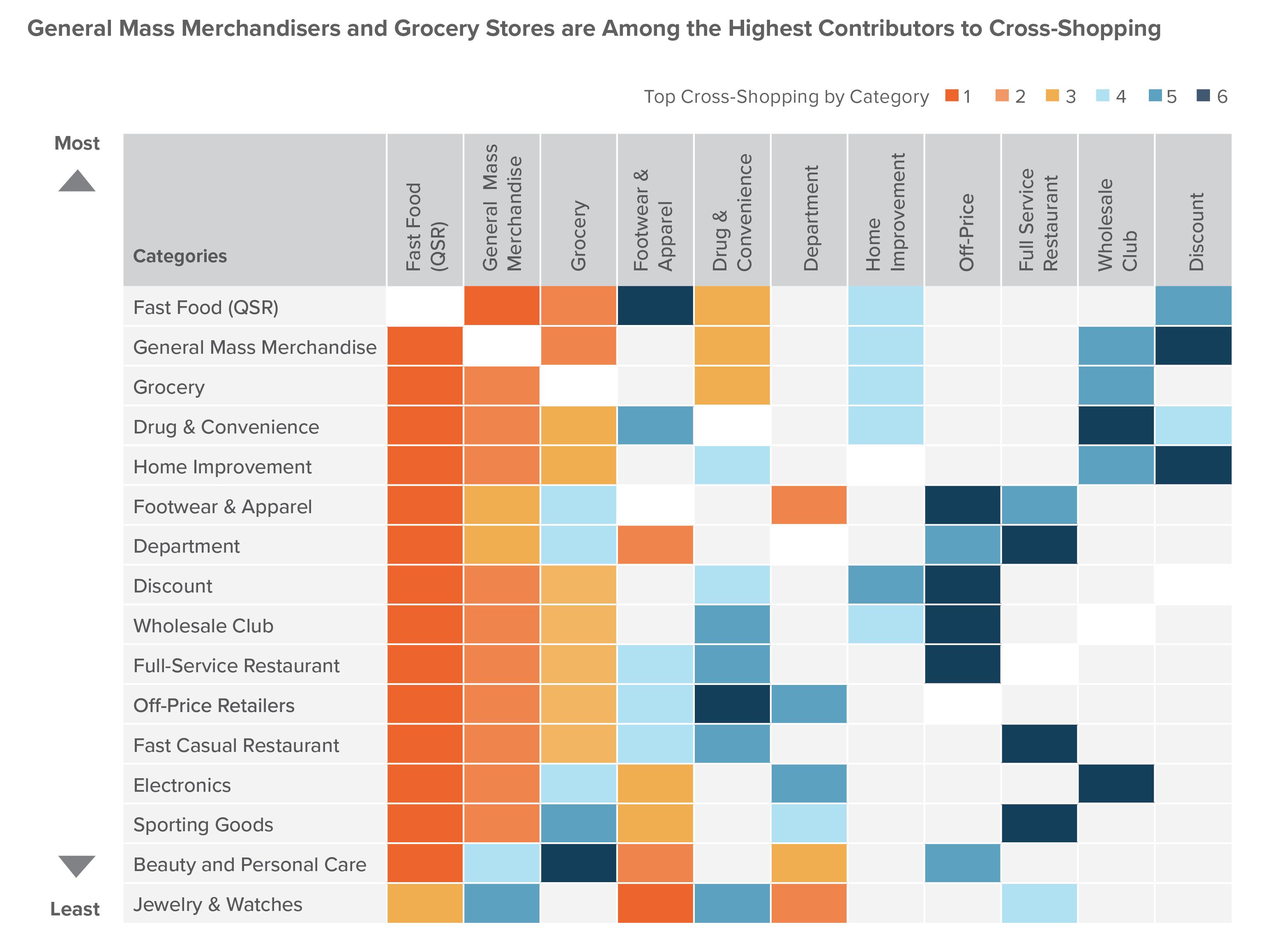

Ultimately, shopping center owners should evolve their tenant mix, and tenants should adjust their service offerings, helping the center become more of a multi-purpose lifestyle center that boosts community experiences. Both parties must work together to target and serve consumers. Further, as more data becomes available, retailers and owners can determine the appropriate tenant mix for each location that complements each other and maximizes foot traffic and sales.

Reworking the Tenant Mix

Retailers are using space a lot differently than they were before the pandemic. The space is becoming more efficient and convenient for consumers. This is especially true for centers with a grocery anchor. Increasingly, national credit tenants are looking for Class A space and are holding out until that space becomes available or moving to markets where that space is available. Other tenant types bolstering retail real estate demand, more than they have in the past, include medical, entertainment, and dining tenants. The aforementioned concept types are helping owners generate traffic in different ways outside of the usual retail generators of 30 years ago.

Top Tenants

Grocery-Anchors

They were resilient during the pandemic as they are necessity-based. The sector has also heavily adapted to online innovations by implementing curbside pick-up and utilizing third-party delivery services. Grocery-based e-commerce is expected to double by 2025, however, many landlords are holding their breath regarding whether Amazon Fresh will open and/or be successful after completing 44 new lease locations in the U.S. Top grocers expanding include Aldi, Trader Joe’s, Meijer, Costco, and Publix.

General Merchandise Retailers

Walmart, Target, Costco, and more

Pad-Sites

The car wash category is a top contender to lease pad sites. The industry is expected to reach $17.34 billion by 2027 as they continue its aggressive expansion across the country.

Quick-Service Restaurants With Drive-Thrus

Convenience is the name of the game in 2023, and these restaurant formats are a driving factor in centers. Not only that, but the newly designed drive-thru formats, with multiple purpose-built lanes, will maximize efficiency and shrink indoor dining areas. In Southern California, a drive-thru war has emerged where the following tenants are competing for the top spot, Starbucks, Dutch Bros, Raising Canes, Chick-fil-A, In-N-Out, Ono Hawaiian BBQ, Wendy’s, Pollo Campero, Taco Bell, and Habit Burger.

Key Big-Box Tenants

Largely located in neighborhood centers, tenants range from discounters to fitness centers, specialty stores like Total Wine & More, home improvement stores like Home Depot and Floor & Décor, craft stores like Michaels and Hobby Lobby, and more. Further, Ross Dress for Less and Burlington Coat Factory are having great success expanding.

Smaller, Single Tenant Freestanding Retail Site

Casual dining, urgent cares, vet clinics, and more

Smaller, F&B Tenants

Crumbl Cookies, Jersey Mike’s, Boba Tea groups, ice cream, cosmetic and beauty retailers, and other local tenants compete for smaller in-line spaces.

Deep Dive into Trends

- Retail real estate has become increasingly valuable to companies as brick-and-mortar locations create flexibility for in-person, pick-up, or delivery sales. These types of omni-channel store said in offering last-mile delivery to customers.

- ESG (environmental, social, and governance) is becoming more prominent, and investors are applying these non-financial factors to identify risks and growth opportunities.

- Redefined store formats grow as retail continues to evolve. Stores want to stay relevant and make the most of their retail store space by embracing a smaller footprint.

- Redeveloping former big-box stores to build out multiple retailers at affordable rent rates. Implementing a mix of retail, experiential, and food and beverage under what was once one roof opens the potential for a more comprehensive tenant pool.

- Experiential retail includes adding tenants known for their activities, such as pickleball, golf-themed spaces, bowling alleys, and more to the roster.

How Shopping Centers Can Mitigate Market Headwinds

Key Takeaways

- Recast the role of the shopping center to serve multiple purposes

- Drive greater customization into the tenant mix

- Develop a new leasing model that captures value from new business models

The shopping center space is becoming more efficient, which, combined with limited development, higher consumer spending, and economic growth on the horizon, the retail space will be invigorated in 2023. As a result, institutional investors entered back into the retail sector with an appetite to chase value-add, discounted centers, and mixed-use development opportunities. Pricing is expected to moderate mid-year, and investors remain bullish on neighborhood and community centers. Investors have realized these assets are incredibly durable and cash flows are reliable. On the tenant side, retailers continue to seek out high-quality store locations amid limited supply.