Top Markets for Short Term Rentals

Short-term rentals (STR), also known as vacation rentals or rental housing, are generally furnished lodgings rented for brief periods. They are valued at $1.8 trillion and are one of the fastest-growing commercial real estate sectors. Because of the prices, furnishings, and space, these rentals may be more appealing than hotels. Several companies, including Airbnb and VRBO, act as intermediaries between the renter and the host. The market for short-term rentals has expanded to include all types of housing, from single-family homes to condominiums to apartments. Short-term rentals benefit local economies significantly, as cities gain additional tax revenue and local businesses and restaurants benefit from increased tourist spending. As a result, cities must take a balanced approach to address community concerns while also adapting to meet the changing accommodation needs of their visitors.

Geography is highly critical in determining whether short-term rentals will succeed. Fort Worth, TX, and Jacksonville, FL, are the most popular cities for short-term multifamily rentals. Westchester and the Hamptons in New York, Greenwich, CT, and warm-weather towns like Phoenix, AZ, Las Vegas, NV, Charlotte, NC, and states like Florida and Texas are also popular markets for short-term multifamily rentals. Popular alternative accommodations service providers, such as WhyHotels, have locations throughout the country. Still, some of the most popular markets for these providers include Nashville, TN, New York, NY, San Jose, CA, and Washington, DC.

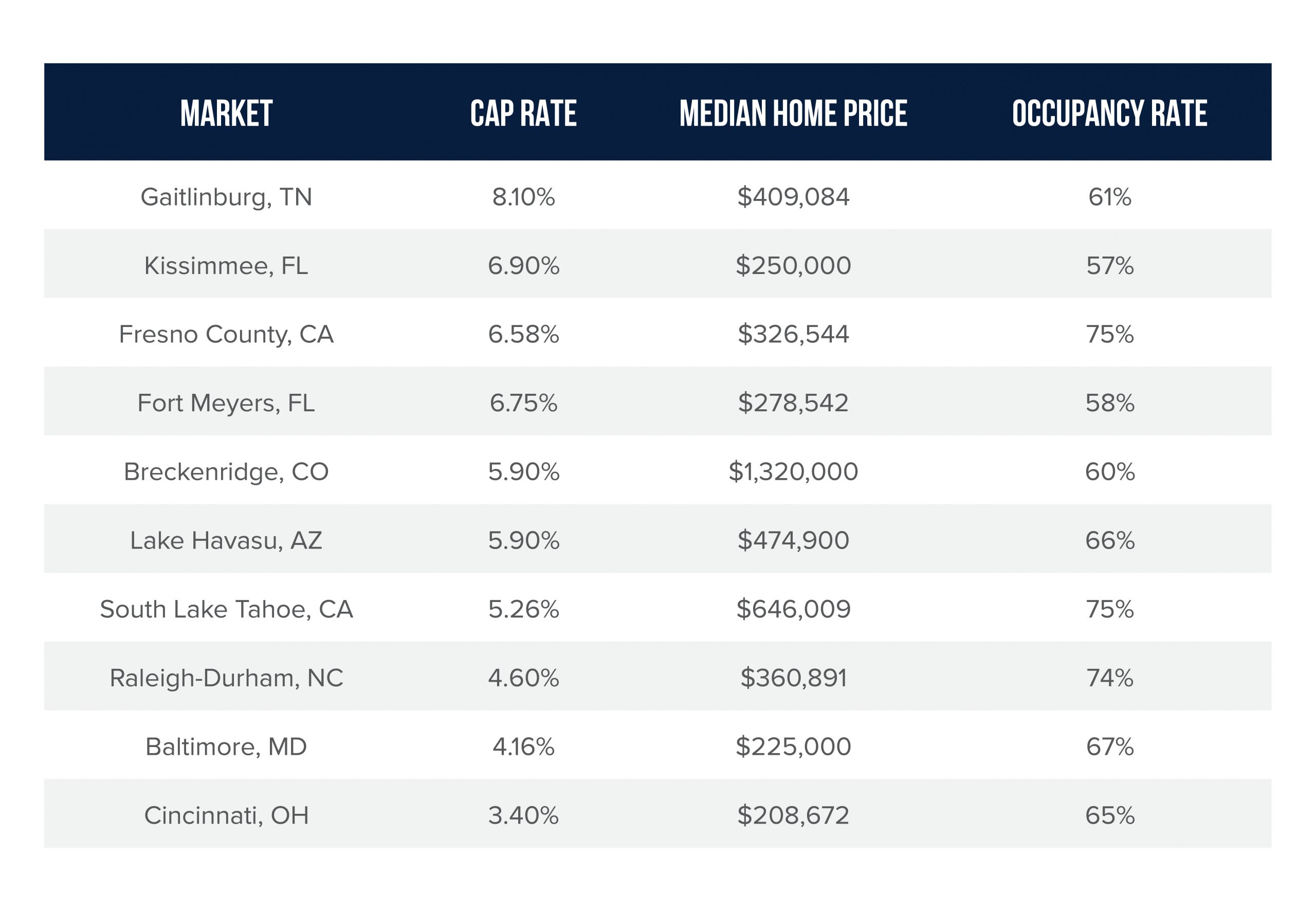

Markets Offering the Best Cap Rates for STRs According to Lodgify

Top 5 cities for Profitable Short-term rentals according to Mash visor include:

- Slidell, LA

- North Charleston, SC

- Gulfport, MS

- Crystal River, FL

- Joshua Tree, CA

With the economy improving and pandemic restrictions lifted, the outlook for short-term rentals for the remainder of 2022 appears promising. With more than 1.2 million listings, the number of full-time STRs is expected to increase by 15 percent this year. According to AirDNA and iPM research, 25 percent of second homes (over 2.2 million) are expected to be used part-time as vacation rentals.

Purchasing the right STR property in a desirable market can mean the difference between a profitable investment and one that barely makes a profit. Location, seasonality, cap rate, cash-on-cash return, occupancy rate, and local rules and regulations are all factors and metrics to consider when investing in an STR. The three main ways to find a reliable short-term rental property are through an online marketplace, traditional listing services, and word of mouth.

Closing Thoughts

Purchasing an STR property allows investors to participate in the rapidly growing vacation rental market in the United States. Some STR investments, however, are superior to others. To find a great STR property, spend time evaluating markets and crunching the numbers before investing.