CLICK HERE TO DOWNLOAD

Nearly every industry across the board took a hit during the COVID-19 pandemic, even healthcare. Medical office buildings were faced with staffing outages, scarcity in personal protective equipment (PPE), and specialty clinic closures, like dentists or specialized surgeons, as appointments were canceled or postponed. According to the American Hospital Association, over a four-month period, the healthcare industry was projected to lose $202.6 billion resulting from revenue loss in hospitals and health systems across the nation. These losses stretched across the entire industry as millions lost their jobs. Dentist offices were hit the hardest during the peak of the pandemic, with a -56% change in overall employment from February 2020 to April 2020. Ambulatory services and diagnostic laboratories also had net negative job growth of -9% and -11%, respectively, according to Peterson-KFF. Due to the revenue and job loss across the industry, one could assume that the same would occur across all healthcare companies. However, DaVita Dialysis Inc. continues to surpass investor expectations and continues to grow its revenue and reduce patient care costs. Continued success and revenue growth, despite the pandemic, highlights why investors are so confident in DaVita properties and why its demand has never been higher.

Where does DaVita Dialysis real estate go from here?

Perhaps the most noticeable change we have seen from 2020 is the market rent for most DaVita properties. Landlords facing renewals should expect rent reductions on renewals in the coming year despite DaVita’s success in 2020. Market rents per square foot have been on the rise for the past five years. As a result of COVID-19, market rents are expected to dip slightly in Q1 and Q2 2021 before rebounding and growing again. DaVita’s strength as both a company and tenant has influenced landlords across the county to reduce rents on extensions and renewals to keep DaVita at their locations for added investment security. The question now becomes, should landlords accept rent decreases from DaVita with an upcoming renewal or early extension? The answer is complicated and typically ranges per property. A simple solution would be to contact a Matthews™ healthcare specialist to discuss the many advantages and risks involved when investing in DaVita properties.

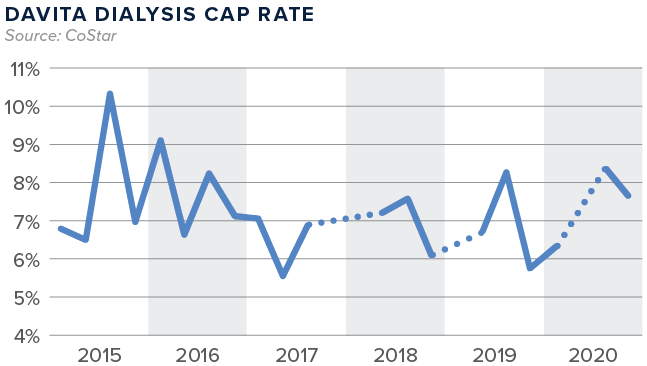

Cap Rate Compression

In 2020, DaVita Dialysis cap rates jumped as investors were interested in getting out of the market. Consequently, there were few players in the market during the pandemic, resulting in higher cap rates. As discussed earlier, DaVita proved its strength during COVID-19, and investors took notice. Savvy investors want essential, corporately backed dialysis clinics. Large institutional investors demand DaVita properties for their core investments and individual investors hold them as their “golden goose.” DaVita properties are in high demand, and sellers are taking advantage of the aggressive cap rates. If DaVita Dialysis continues to perform well at the corporate/business model level, their demand as a tenant in properties will increase