Matthews™ Market Update

Macroeconomic Overview

A year of volatility has taken its toll on commercial real estate as unrelenting Fed hikes, persistent inflation, and mismatched expectations between buyers and sellers swarmed the market. In this report, Matthews™ evaluates the current macroeconomic market and its effect on the commercial real estate industry.

Highlights

Source: Matthews™ Research and Real Capital Analytics

- Inflation is declining, currently averaging 4% as of June 2023.

- Property pricing is down approximately 9% year-over-year.

- The Fed indicated another .5 percentage point increase through year-end.

- Year-over-year sales volume is down 61%.

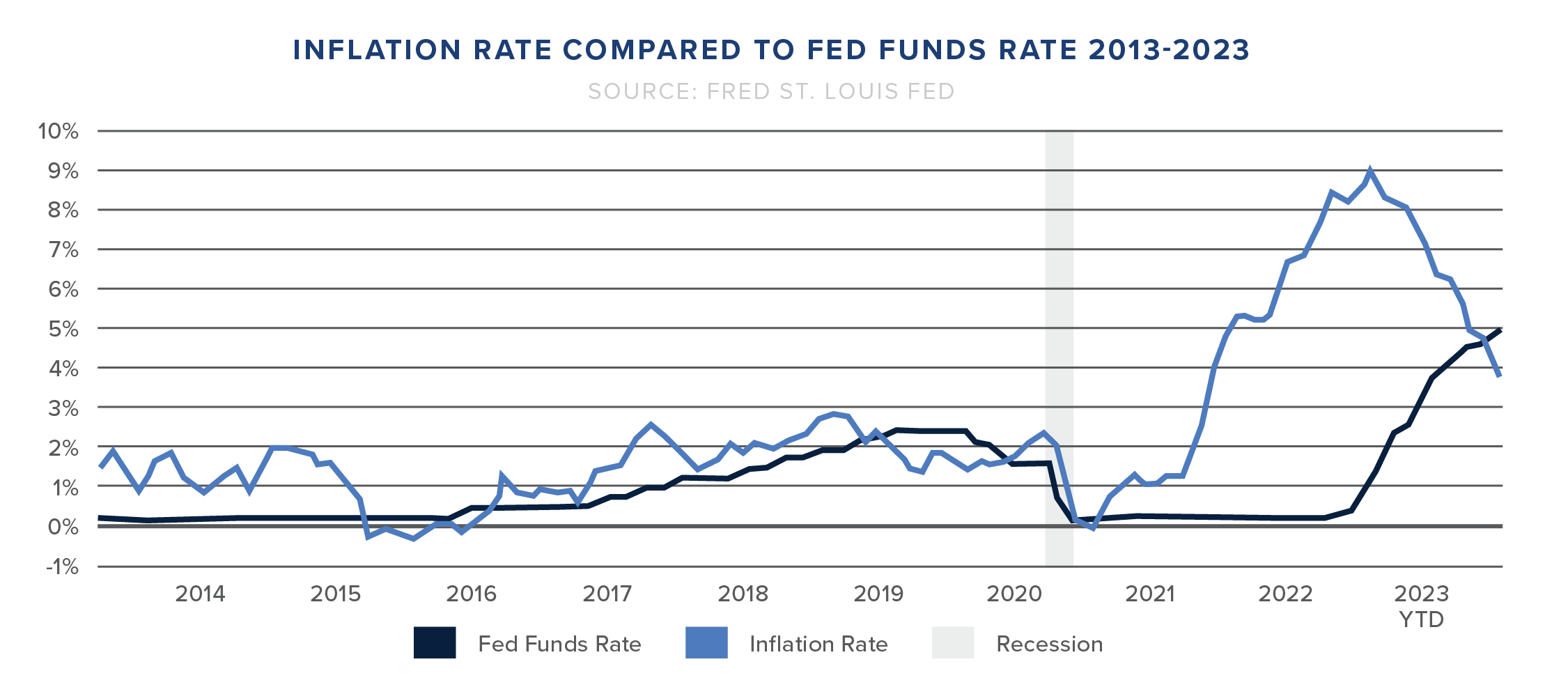

Inflation & Fed Funds Rate

Recurring interest rate hikes have lowered inflation from its peak of 9.1 percent in late 2022 to an average rate of 4.0 percent as of June 2023. The Federal Reserve is insistent on lowering inflation to its target rate of 2.0 percent and stated most likely, there will be another .5 percentage point increase by the end of 2023. The strong labor market is the biggest driver of continued inflation but is expected to cool moderately by year-end.

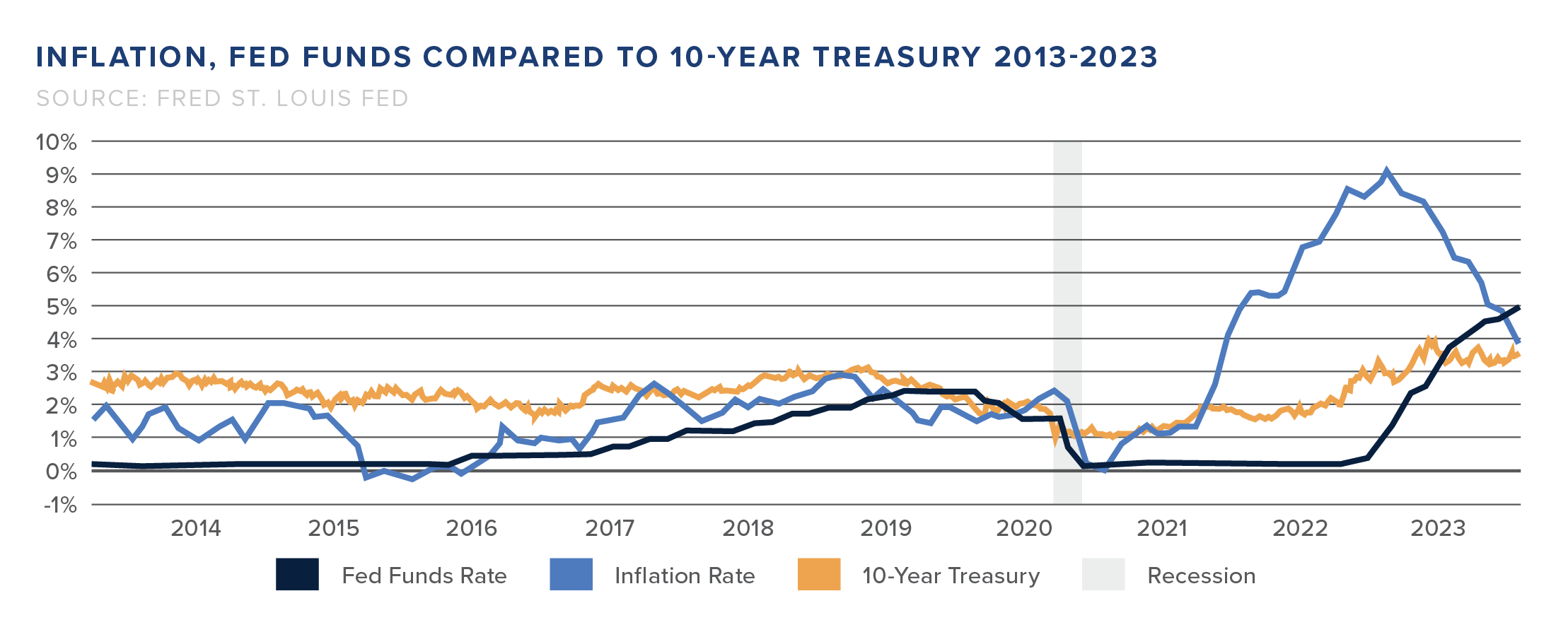

10-Year Treasury

The 10-Year Treasury rate reached 3.72 percent at the end of June after GDP growth outperformed prior expectations. The bond rate peaked at 4.01 percent in March 2023, with another uptick to 3.83 toward the end of May. Investor sentiment is relatively positive, but investors are still weary due to constant yield movement.

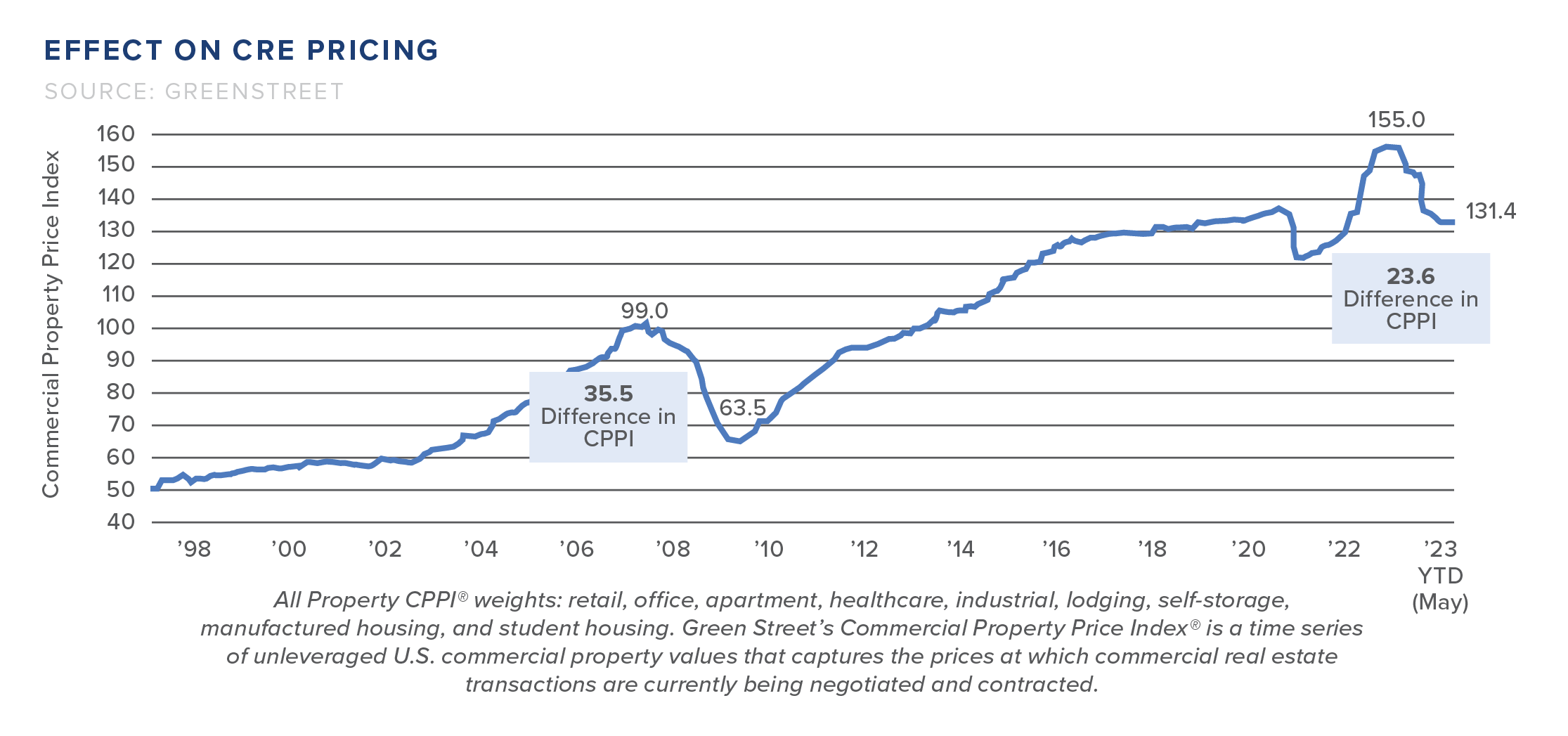

CRE Pricing

According to GreenStreet data, the commercial property price index is at 131.4 toward the end of Q2 2023. The index peaked in mid-2022 at 155.0 and has since declined 23.6 percentage points. Year-over-year CPPI is down 11.2 percent, with apartments taking the hardest hit at a -12.5 percent year-over-year change in pricing. Hotels reported the only positive increase in pricing at 1.8 percent year-over-year.

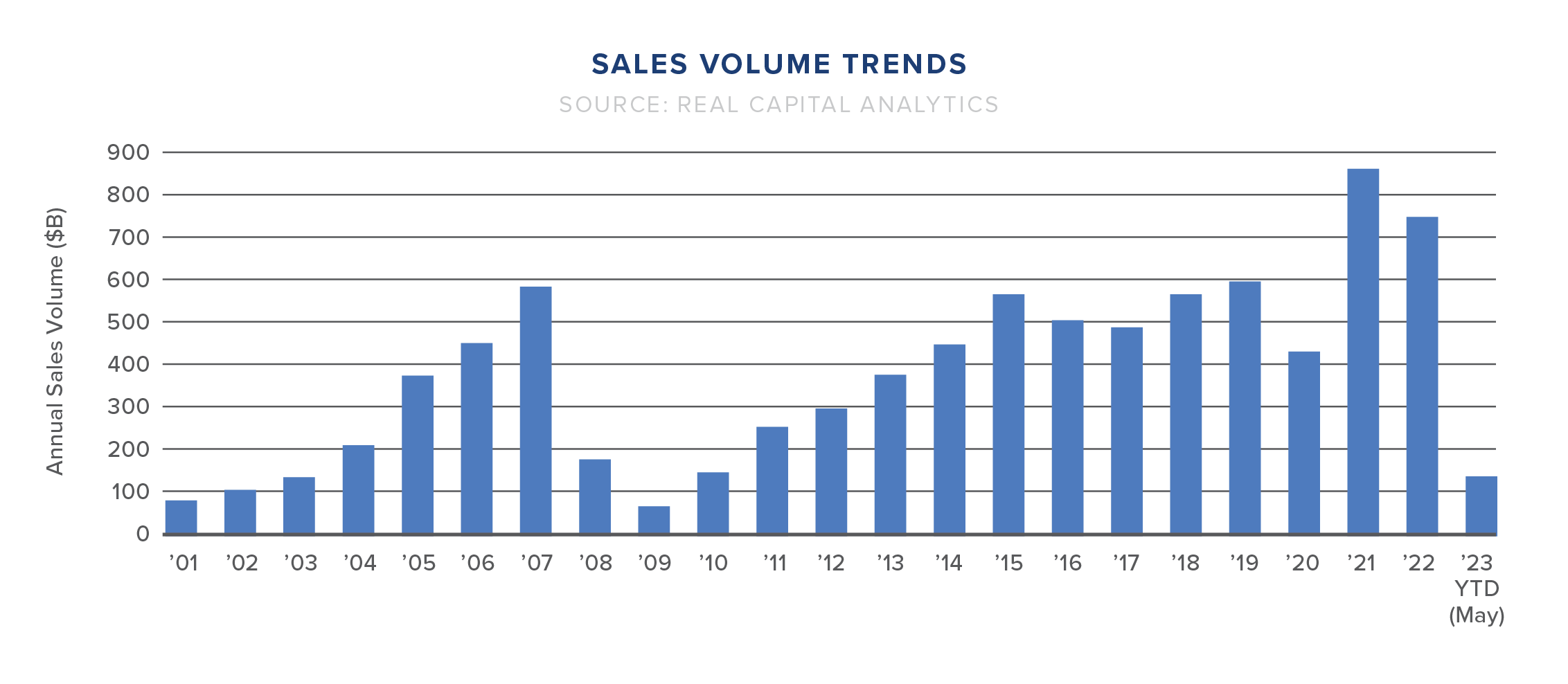

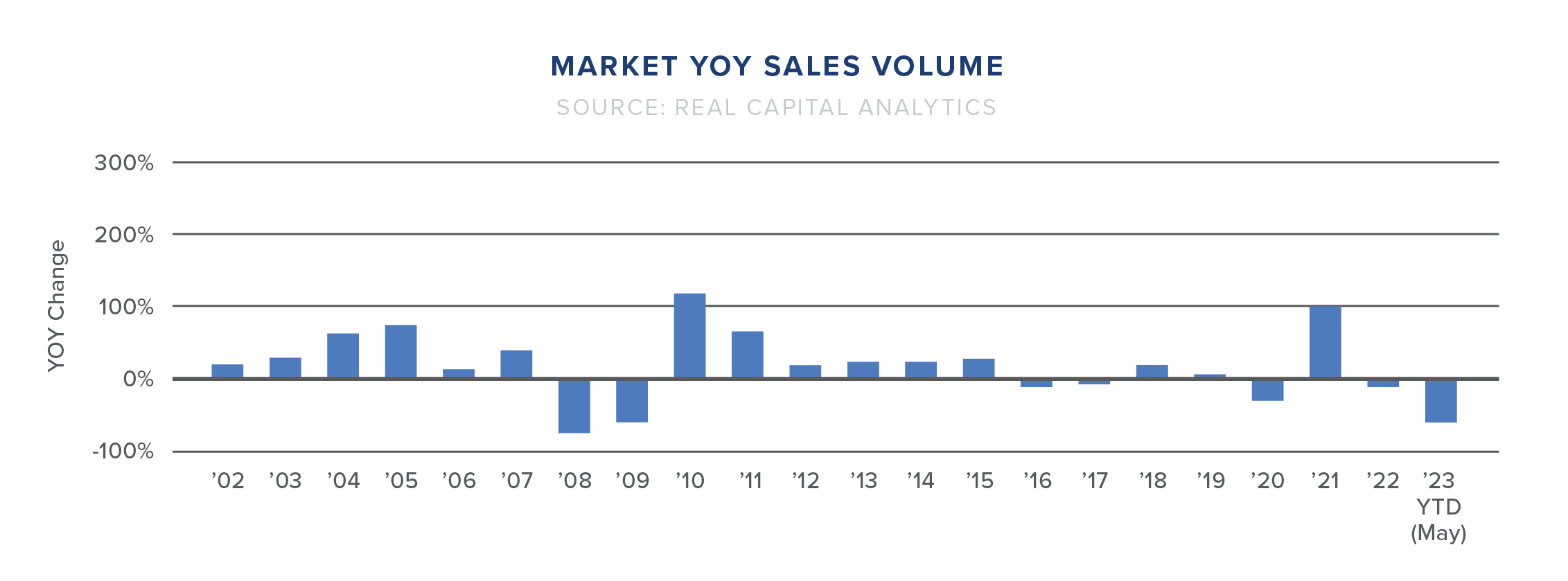

CRE Sales Volume

Real Capital Analytics reported transaction activity has been falling at a pace of 40 percent or more for the past seven months. May 2023 stated a -61 percent drop in year-over-year sales volume, with a projected $307 billion in total U.S. sales volume of retail, office, hospitality, and industrial assets for the entire year. 2022 was slightly down, approximately -12 percent, but the influx of sales in Q1 and Q2 2022 helped the year avoid a heavy decrease. Buyers and sellers’ pricing expectations will widen as investors struggle to secure profitable financing.

Overall, the commercial real estate industry is down as the U.S. economy fights to find its footing halfway through 2023. Economists predict a slight recession if the Fed continues its restrictions on lending, which translates to less lending activity and continued pricing movement. Owners should consider leveraging alternative investment strategies such as auction services and 1031 exchanges. It’s critical to remember real estate is cyclic in nature. Investments will regain value, and pricing and cap rates will stabilize.