Why is it a Great Time to Buy in the Hospitality Industry?

The hospitality market has made a comeback following the pandemic. Leisure and business travel demands have increased exponentially since 2020, and as such, booking rates have multiplied. This growth pattern makes it a great time to invest in the hospitality industry. The real GDP growth forecast for the remainder of 2022 remains unchanged at 1.7 percent and this economic momentum is expected to remain resilient. ADR is also 14 percent higher than it was five years ago, which can be attributed to the rising room rates across the nation. Interstate hotel sales volume are expected to break records within the upcoming months. Overall, if employment trends continue to stay strong, we can expect both hoteliers market interest and travel rates to remain high. Of course, there are short-term challengers with seasonality and overall market environment, but hospitality has proven resilient through Covid, strengthening the sector for future success.

Strong Growth Rate

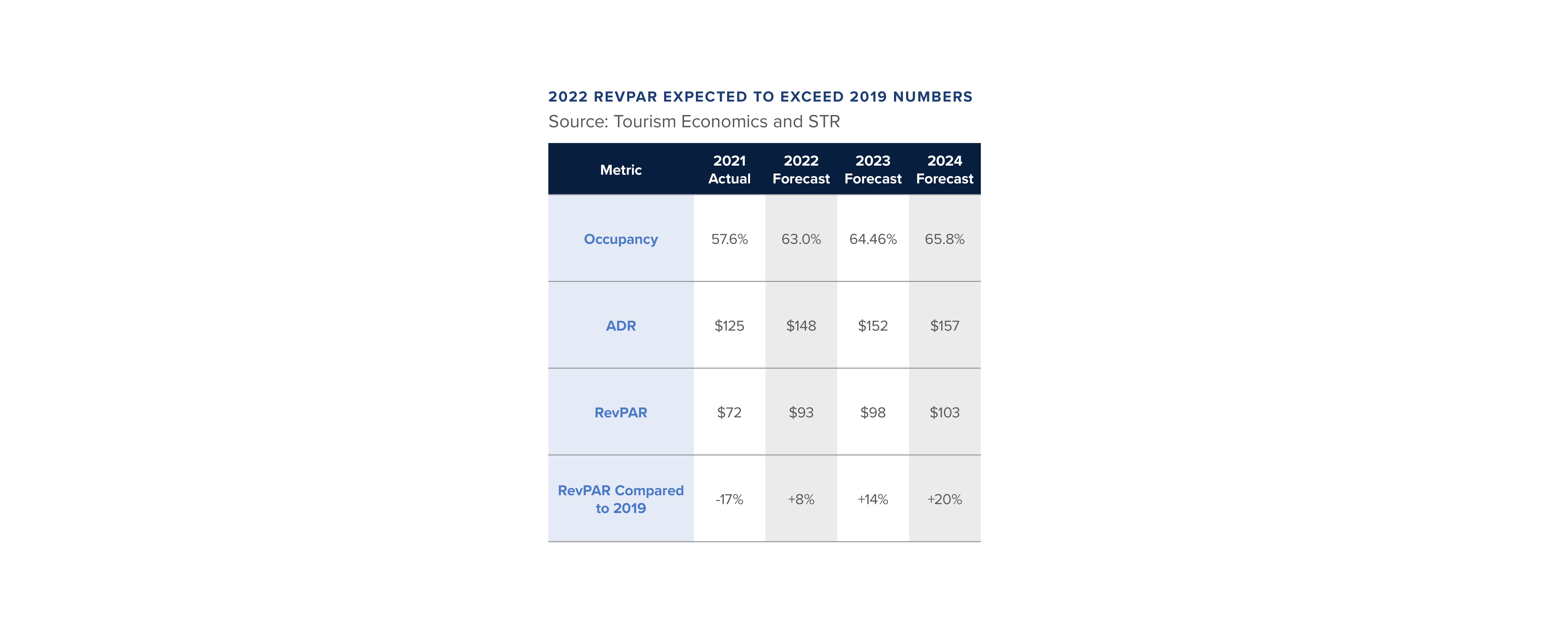

Product analysts have stated that inflation and demand mix are the main factors to today’s strong room rate growth, emphasizing the luxury segment. Experts have forecasted that the average daily rate for room revenue will remain high, while rate growth will regulate over the next few years. Tourism Economics recently published an updated U.S. hotel forecast. The forecast has predicted that occupancy expectations will decline while projections for the average daily rate will increase. This forecast is promising for potential investors and hotel staff members who are overwhelmed by the record numbers of demand they are currently facing. When the demand begins to stabilize, but the average daily rate continues to rise, hotels will have more capital as a result of a balanced customer flow reducing the concern of an overworked staff. The average daily rate (ADR) 12-month period in June was $140.59, a significant increase from the previous high set in February 2020.

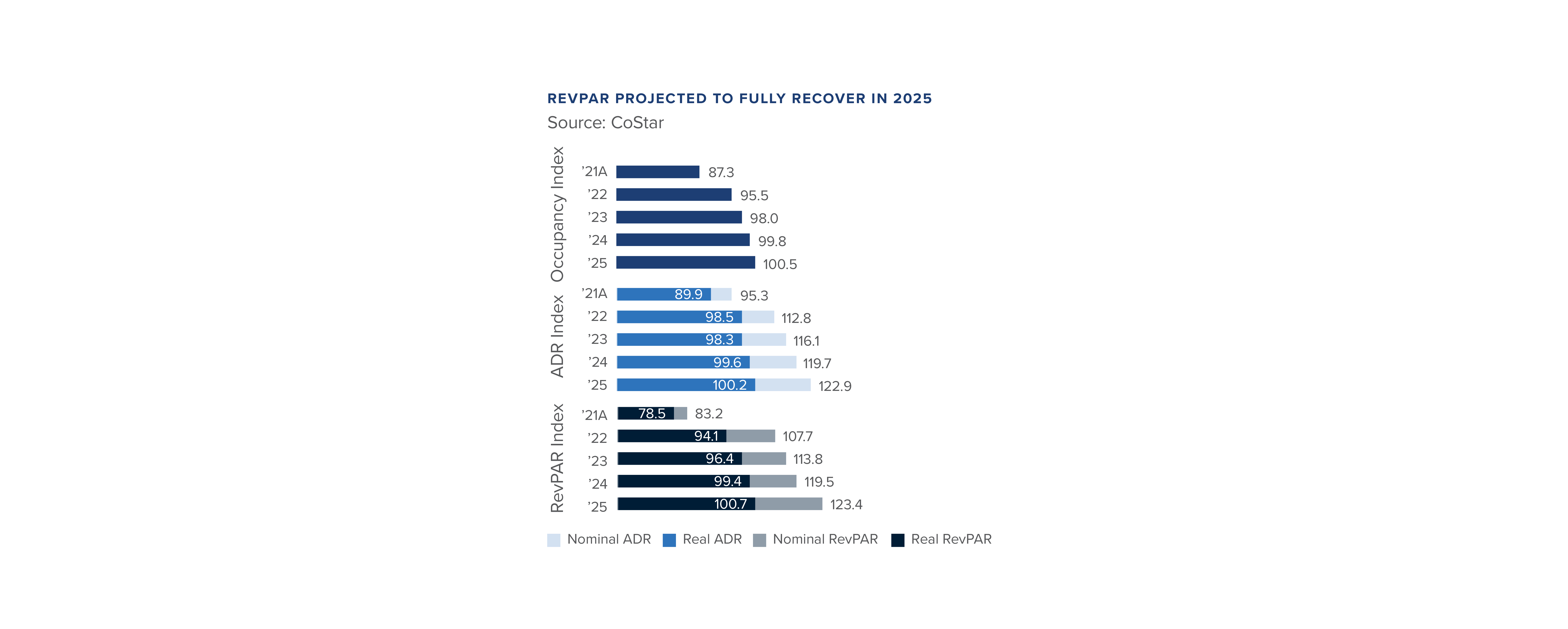

The graphs display the optimistic predictions that experts have made after comparing the current market trends to 2019. They highlight the gap between real revenue-per-available-room growth (RevPAR) and nominal RevPAR, which usually goes unnoticed. There has also been a continued improvement from the low point of the Pandemic in 2020. Several markets, especially leisure and drive-to-destinations, have seen a full RevPAR recovery, already surpassing 2019 levels. RevPAR is set to achieve full recovery nominally by the end of 2022, but if inflation continues this same trajectory, recovery will be pushed to 2025. This is extremely promising considering the economic burden that 2020 imposed on thousands of people and businesses for two years.

The urban city center market’s performance will accelerate over the next 12 months with international and bus travel re-emergence. It is currently unclear whether the rebound of travel will outpace inflation and result in REVPAR/ADR growth. Several factors will impact these rates, including a softening economy, increasing labor costs, or fears of recession.

The hospitality market has been recovering over the past two years. CoStar Group’s Director of Hospitality Analytics Daryl Cronk expects a full recovery by the end of the 2023 fiscal year. According to data experts, a recession also does not appear to be on the horizon, and a recent July report had unemployment rates at just under 3.7 percent. These positive perspectives should help calm those more hesitant to buy in the current hospitality market. Investors need to remember that the definition of business travel and the distinction between business and leisure travelers is changing. Experts are confident that business executives will continue to realize the value of in-person interactions with their partners and clients. This and more workers traveling as the economy continues to grow will only bolster the hospitality market. Top executives are constantly strategizing ways to lighten the labor load on hotel employees through automation, cross-training, gig work, and the leverage of data to make better decisions. The hotel industry has survived the most significant crises of the 21st century, including 9/11, the Great Recession, and, most recently, the COVID-19 Pandemic. Surviving these times of uncertainty has set the precedent that the hotel industry is sustainable, an excellent investment, and there will always be a demand for it.

In short, the top reasons to buy in the hospitality market include sustainability of the hotel industry, rising average daily rent, and increase of leisure and work travel. This is a great time to invest, don’t miss out on a great opportunity.