CLICK HERE TO DOWNLOAD THE ARTICLE

Businesses, schools, and society came to a sudden halt following the unprecedented arrival of COVID-19. To subdue the health crisis, corporations pushed their employees to work remotely, emptying offices across the country. With the obstacles of COVID-19 still apparent, many offices have yet to reopen, and some businesses are to remain a remote workforce permanently. In this article, Matthews™ reviews the impact of COVID-19 on office space and the future of the sector.

Office Development

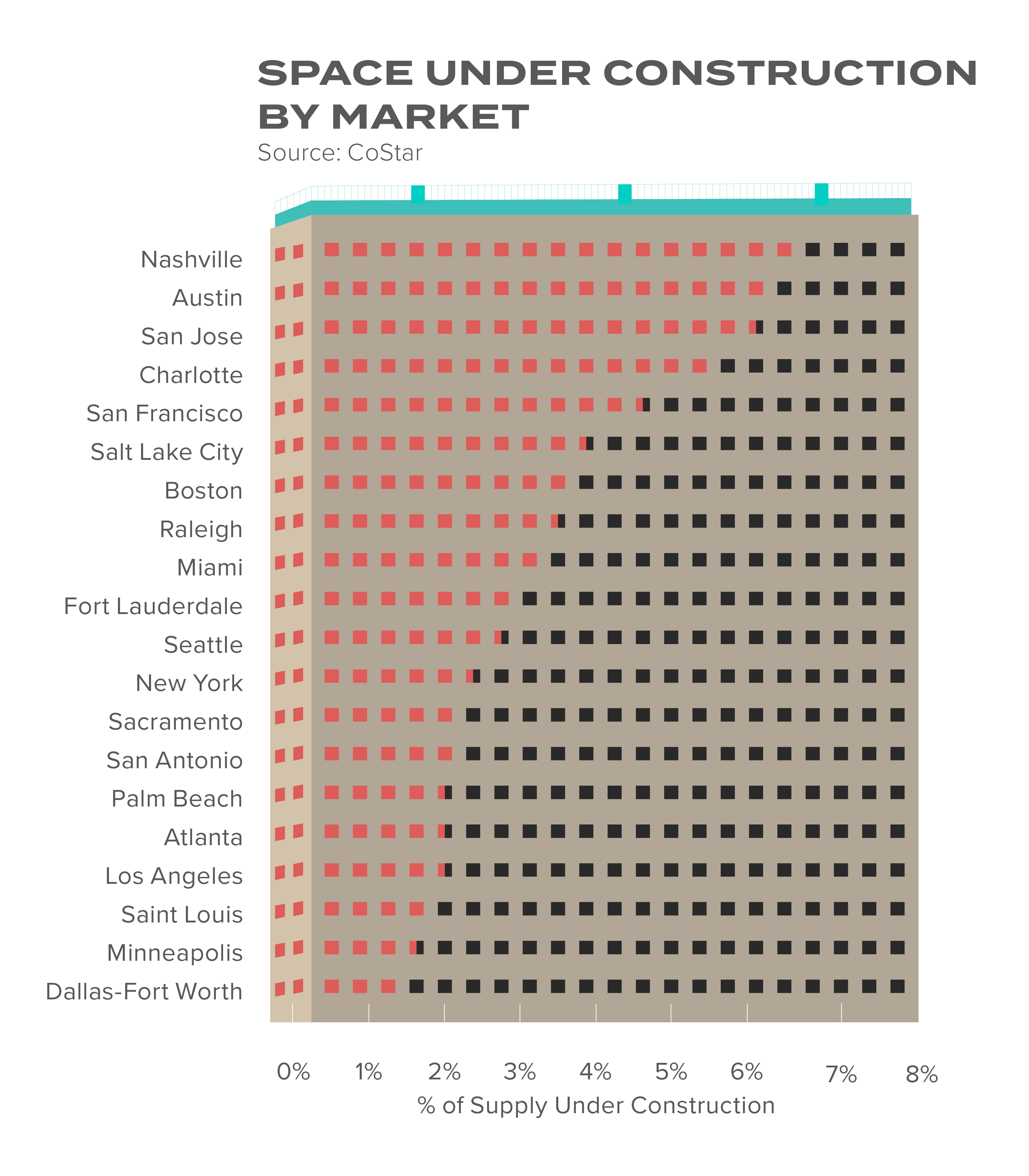

Currently, there is about 155 million square feet of office space under construction throughout the U.S., according to CoStar. That is roughly less than two percent of existing stock, and only 40 percent of the office space in the pipeline is available for lease. Almost 120 million square feet is expected to be delivered over the next few years, helping keep vacancies from rising any higher in the near-term. The markets seeing the bulk of office development are tech hubs in Austin, Nashville, San Francisco, and Seattle. Tech companies, like Twitter, Google, and Facebook, have embraced the work-from-home arrangements and have decided to keep their employees’ home, either until the end of 2021 or permanently. Offices located in the heart of a city have grown expensive and unattractive, as they require employees to rely on public transit systems and enclosed elevator spaces to reach their high-rise offices. In response, tech tenants, such as Pinterest, have scaled back growth plans.

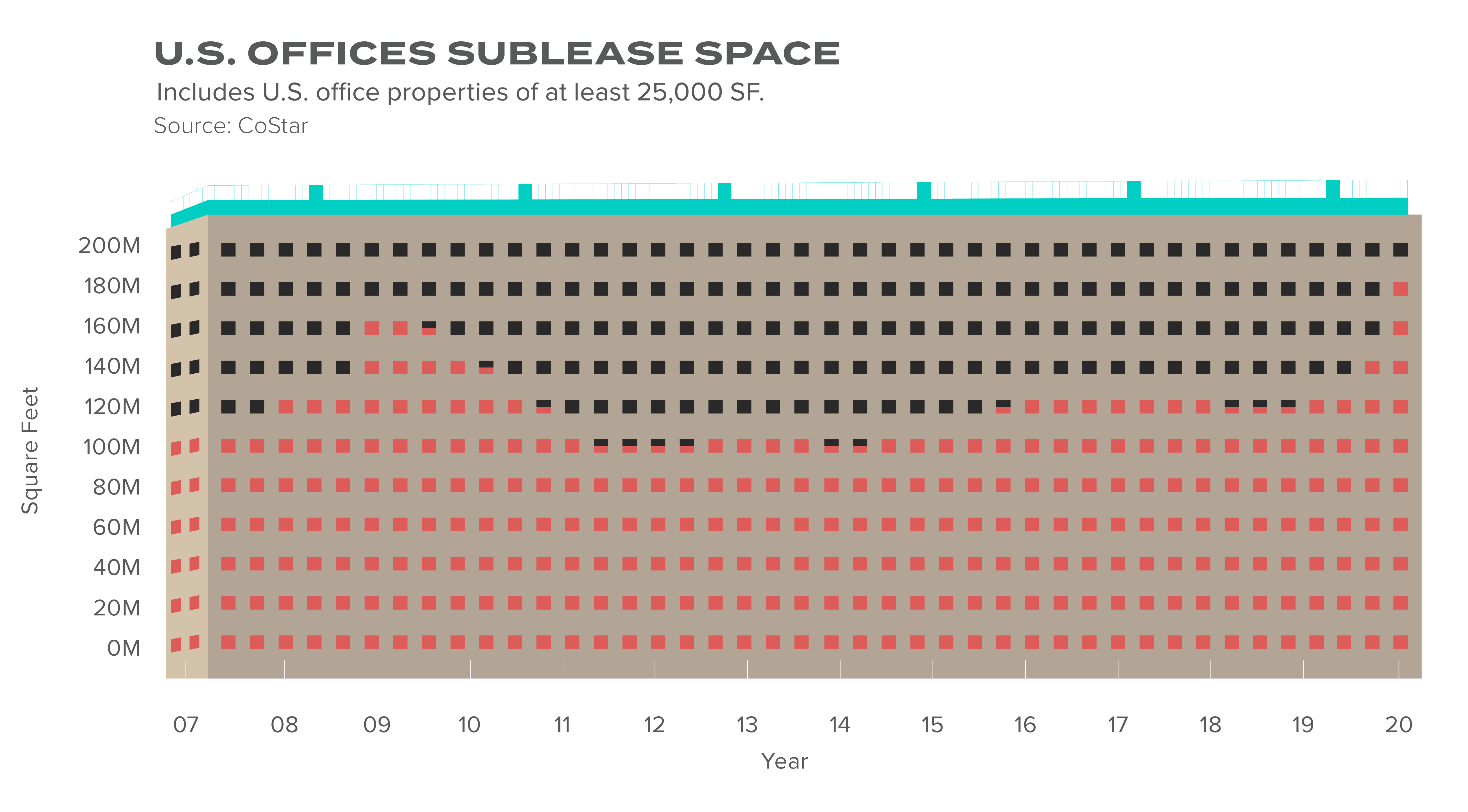

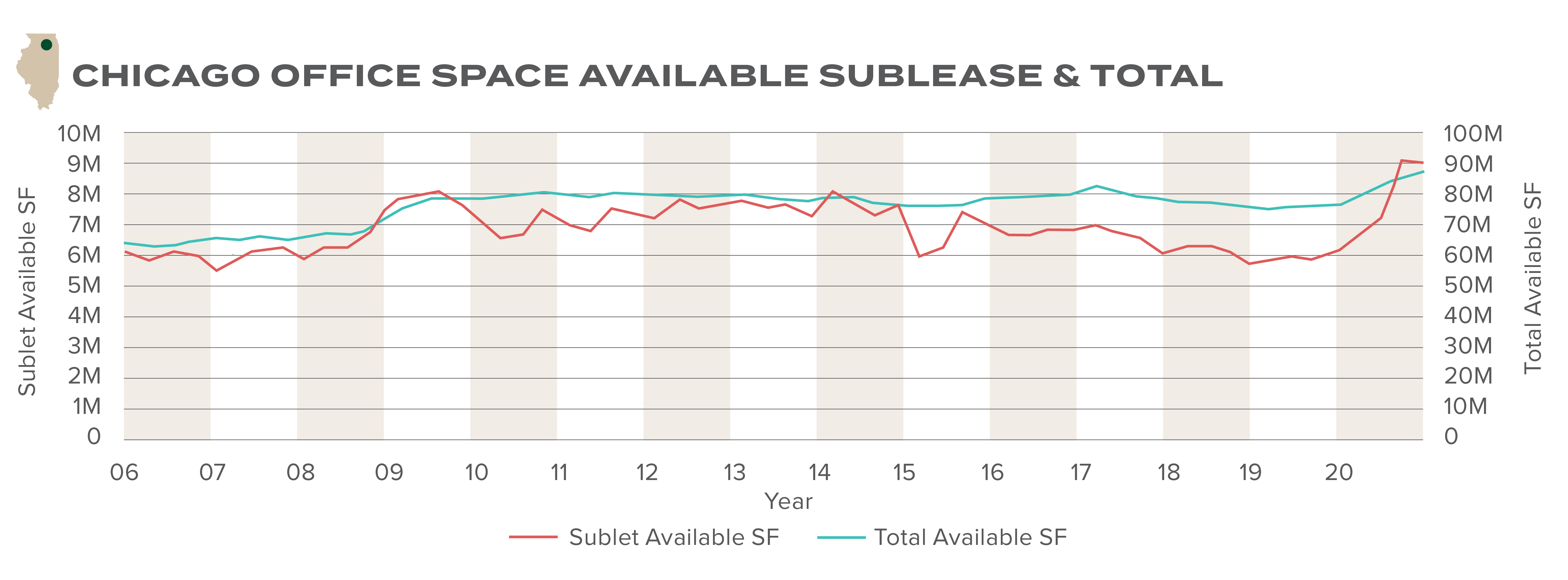

As tenants look to decrease their office footprints following the devastation by COVID-19, office sublease availability has increased. According to CoStar, the incredible amount of sublease space coming to the market since the beginning of the year, for a total of over three million square feet, is a reflection of the spikes in unemployment tied to COVID-19.

The Current Condition of the Office Sector

In April and May, 96 percent of office rents were collected, compared to the 61 percent collected for shopping centers during that same time, according to CoStar. With the average lease term for office around 6.5 years, the long-term effects of COVID-19 will unfold over the next several years. Yet experts remain optimistic. “I don’t see a situation where offices completely die off,” CoStar managing consultant Paul Leonard said. CoStar anticipates occupancies and rents to recover and grow in 2021. Growth companies, like Google, still see the importance of offices and have continued signing leases. Google spokesman, Michael Appel, shared that the tech giant views office space as a necessary element for collaboration and company culture as they bring the workforce together in a physical space. Despite San Francisco’s office vacancy rising to nine percent in Q3 2020, Google recently closed on new expansion plans in Silicon Valley, bringing the company’s footprint up to 208,480 square feet in Two Rincon Center, making it the largest tenant in the tower. After seeing the effects of COVID-19 on the economy and offices, Google plans to adopt more flexible work models.

While meetings are now held in a Zoom chat room, rather than in a traditional conference room, offices are still necessary for recruitment, building company culture, and collaborating with coworkers. As one of the nation’s largest office tenants, JP Morgan is experimenting with their hybrid work model, cycling between working remotely and in the office. The process will include teleworking and assigning temporary workspaces while in office. The company anticipates having 25 to 30 percent of the workforce working remotely at any given time.

Another popular office model is hub-and-spoke, where the headquarters is located in an urban area with smaller offices in the suburbs. This model provides employees with decreased commute times as offices are located near homes in suburban areas. Each corporation will approach and tailor their new work experience depending on their priorities and what works best for their employees. For example, the outdoor recreation retailer REI recently sold their new and unused 400,000 square foot headquarters in Bellevue (a suburb of Seattle) to social media giant Facebook. This places Facebook alongside Google in plans to buy office locations in the suburbs around major metros. Finding and creating the perfect office for clients, employees, and customers can get very costly, especially in markets, like New York City, where the location and architecture bolster the price tag. According to SquareFoot, an office locating firm, companies in New York spend an average of $17,020 annually per employee on office space. Historically, it takes about a year after an economic downturn for rents to reflect market conditions. With the amount of office supply being offloaded and subleased, landlords are forced to be flexible and drop rents to retain tenants.

Impact on the Market

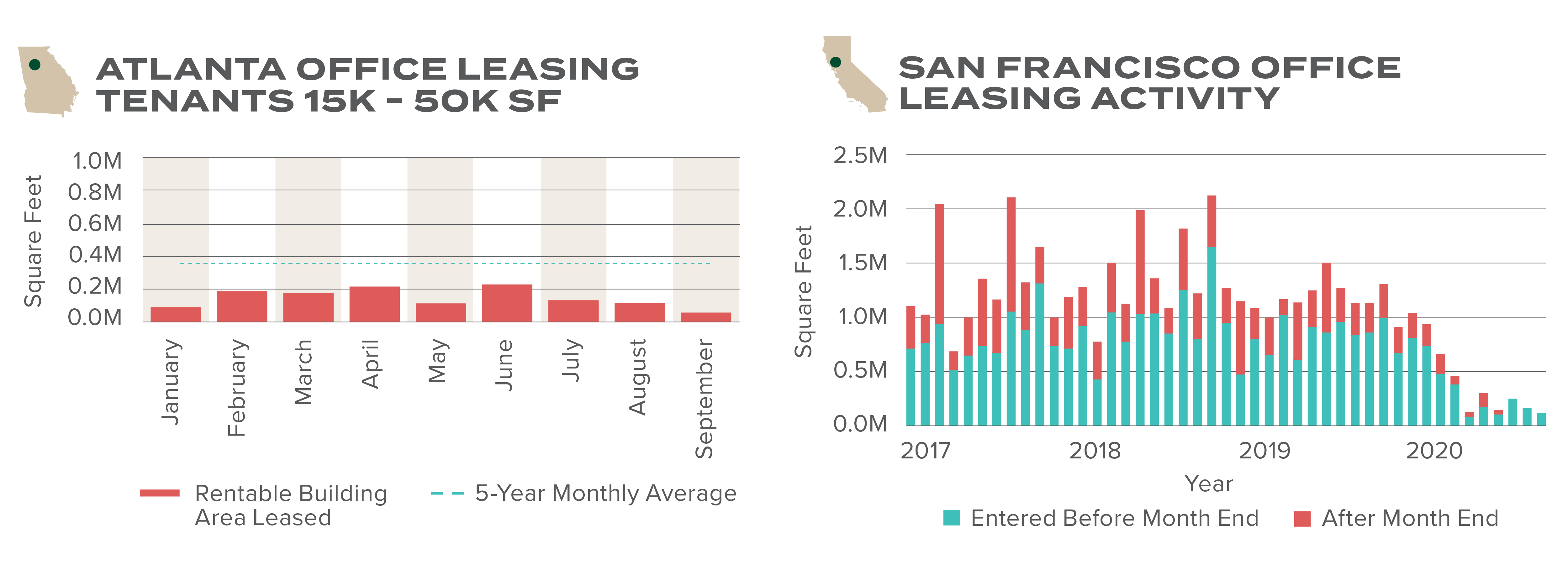

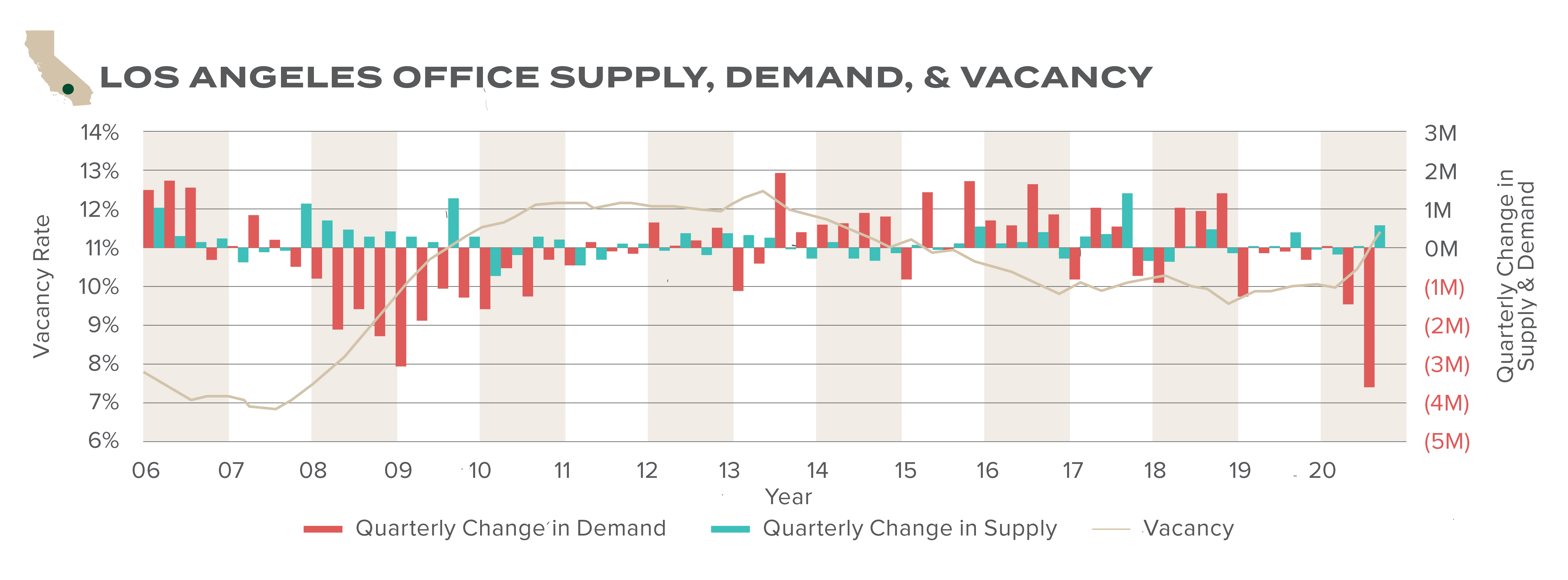

Just like renters are migrating from dense urban markets to roomy, affordable suburban neighborhoods, corporations are following suit. In some cases, local businesses have turned to downsizing their staff and physical space to save on expenses, while others are moving to cheaper markets, a trend that emerged well before the current economic downturn. Businesses are eyeing attractive suburban markets near central business districts (CBD) that share similar features to urban offices, like the clustering of businesses, service establishments, and cultural centers. Markets taking the biggest hit include Atlanta, Chicago, San Francisco, and Los Angeles. The San Francisco office market is seeing the country’s biggest occupancy decline and decreasing rents, closely mirroring what occurred during the Global Financial Crisis. Chicago, the third-biggest U.S. city, is seeing pressure from both office demand and supply, indicating a large decline in rents is to come. Atlanta leasing activity has slowed, despite tenants smaller than 15,000 square feet consuming most of the activity, hindering landlords’ ability to raise rents. Los Angeles has increased office square footage on the market by 70 percent, while tech companies look to offload their office footprints in the short-term temporarily.

Markets performing well during the pandemic have attractive market fundamentals that bring in corporations, like low-costs of doing business and healthy population growth. Experts predict that transit-dependent office markets will have a more challenging time recovering as commuters fear the higher probability of transmitting the virus, where office markets that don’t rely heavily on public transportation will return to a normal faster rate.

New Structures

Offices are likely to remain a primary workplace in the future, but they will look much different. In the short-term, businesses are looking to offload office space as a means to save costs. To continue attracting tenants, existing offices will need to shift focus to post-pandemic safety measures and prioritizing tenants’ health and wellness. This will include incorporating touchless access points, social distancing, improved air quality that filters out bacteria and viruses, rearranging the office layout to be more open, and connecting indoor and outdoor environments. These new additions, leasing structures, and financing could destabilize the once stable office asset class.

Medium, an online publishing platform, speculates the new working model could end the concept of skyscrapers, a 150-year-old trend that developers utilized to make the most money per square foot. The amenities arms race that offices have been involved in since the 20th century to recruit and retain tenants could transform, as fancy lunchrooms, golf simulators, and luxury bathrooms no longer appeal to health-conscious office employees.

As buildings enforce capacity limits in enclosed spaces, such as elevators, lower floor offices could command higher rents in the immediate-term. Leasing across the board has slowed as tenants put off renewing long-term commitments, shed office space, and explore teleworking. This gives landlords the prime opportunity to visit the standard lease provisions that are now outdated or inapplicable. The force majeure clause will be the focal point of most revisions; however, it’s also important to revisit operating expenses, base-year calculations, and rules and regulations to minimize any unforeseen damage from COVID-19.

Outlook for Office

The office market once saw intense competition among prime office spaces that emphasized collaboration. Now that the arrival of COVID-19 has the majority of employees working remotely, companies have started to reconstruct their office space’s purpose and function. In the near-term, landlords will be met with increased operational costs related to COVID-19, such as spacing protocols, sanitizing, cleaning, and decreased rents and tenant renewals. Experts believe the low point of economic activity has come and gone, and the office market could see growth as companies transition overseas operations back to the U.S. as a result of the pandemic.

According to NAIOP, landlords have adapted and become flexible in providing tenants what they need by offering rent deferment periods, lease concessions and revisions, and implementing standard health safety protocols. With both the incredible job loss and the workforce moving to remote work, the office market has seen the coronavirus’s short-term impact. However, the pandemic has allowed the office industry to reevaluate what is essential for tenants and sped up the flexible working trends. While the outlook is still undecided, offices will prevail, looking and functioning differently, putting the human experience at the forefront.