Click Here to Download the Report

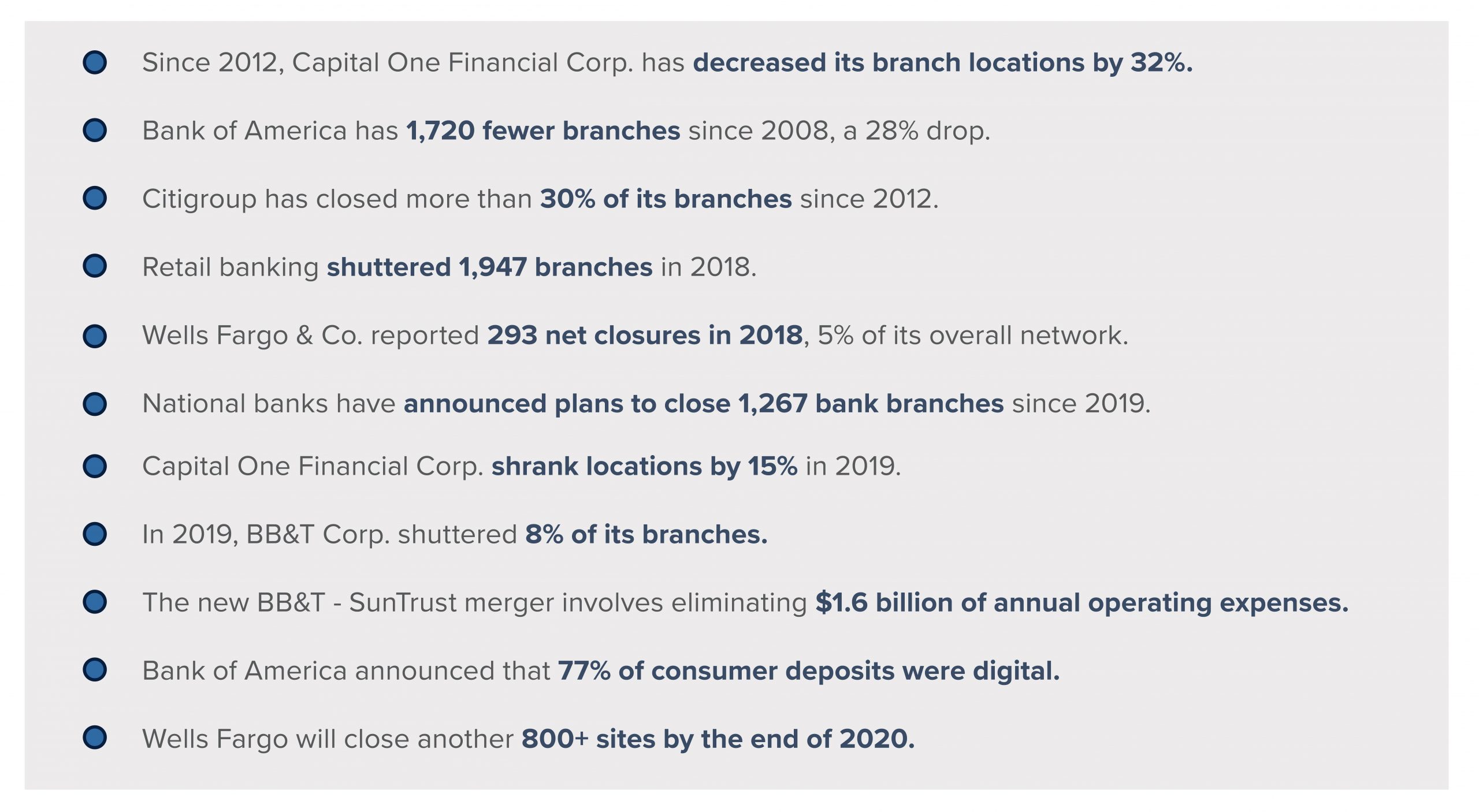

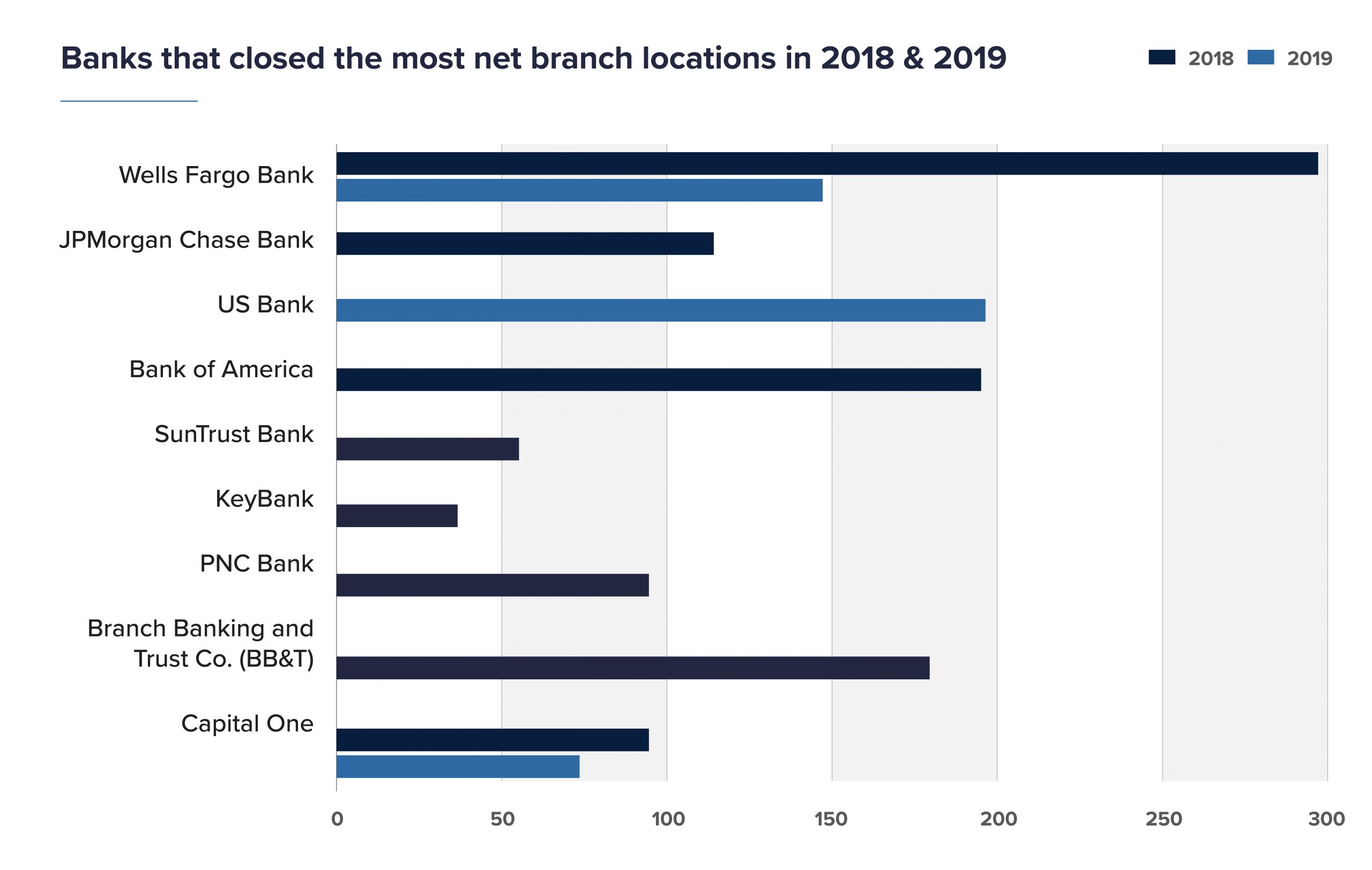

Gone are the days where customers must physically visit branches for all their banking needs. Historically, retail banks have been characterized as some of the safest single tenant investments due to their impeccable credit rating, brand name recognition, and premier retail locations. However, with the rise of technological advances, e-commerce, desirability of online consumer preferences, and the threat of COVID-19, the traditional brick-and-mortar retail model is changing as they learn to adapt to consumer changes.

The Blockbuster Effect

Currently, some of the nation’s largest retailers, such as JC Penney, Best Buy, and Sears, are trending towards the same fate as Blockbuster. In 2004, Blockbuster had 9,094 stores and revenue of $5.9 billion, and 15 years later, the company is defunct. Society hasn’t stopped watching movies, rather, they stream it via digital interfaces like Hulu, Amazon Prime, HBO Now, and Netflix. It’s not the service or product that is provided that no longer exists, it’s the delivery that has changed. Just as Blockbuster lost their battle to Netflix, brick-and-mortar bank locations are losing the battle to their own in-house mobile deposit model. It’s likely consumer habits will continue to change as people adapt to the events surrounding COVID-19.

Why Consolidate?

The goal of every business at the most basic level is to maximize revenue and minimize costs. According to JPMorgan Chase, it costs roughly $0.65 each time a deposit is made through a teller, whereas a deposit made through smartphones costs around $0.03, a 95 percent cost reduction. A study released in August by the Board of Governors of the Federal Reserve System reported 70 percent of U.S. households currently use online banking.

With increasing technology, ATMs are predicted to complete nearly 90 percent of the transactions performed by tellers in the coming future. In a world driven by convenience, the 24/7 operating hours of ATMs further add to the efficiency consumers seek in their banking experience. The market for ATMs totaled $12.7 billion in 2015 but would hit $26.1 billion in 2023, according to research firm Global Market Insights. JPMorgan Chase announced that 90 percent of withdrawals and 60 percent of deposits were executed via ATM. Banks are adapting to consumer preferences and continuing to increase the number of ATMs in its network.

A 4,000 square foot building with ten or more employees is no longer an efficient use of the corporation’s funds. Tim Sloan, CEO of Wells Fargo, announced in September 2018 the firm plans to cut the workforce by roughly 26,500 positions, a response to “changing customer preferences, including adoption of digital self-service capabilities and ongoing commitment to efficiency.” Chase also reported tellers handling 90 percent of bank deposits in 2007, dropping to an astonishing 42 percent of deposits through tellers in 2015. The larger corporations have been leaders in the consolidation trend, however smaller banks are beginning to follow. “There’s a little bit of pruning of the number of locations, but the greater element of that program is trying to take 4,200 square foot branches and turn them into 2,500 or 2,200 square foot branches,” said Bruce Van Saun, Chairman and CEO of Citizens Financial. “I’d say, by 2021, I think we’ll have gone through 50 percent of the branches as the target.” According to PWC, the COVID-19 impact on retail banking may easily lead to much-needed market consolidation, which can help improve banking systems by improving efficiency.

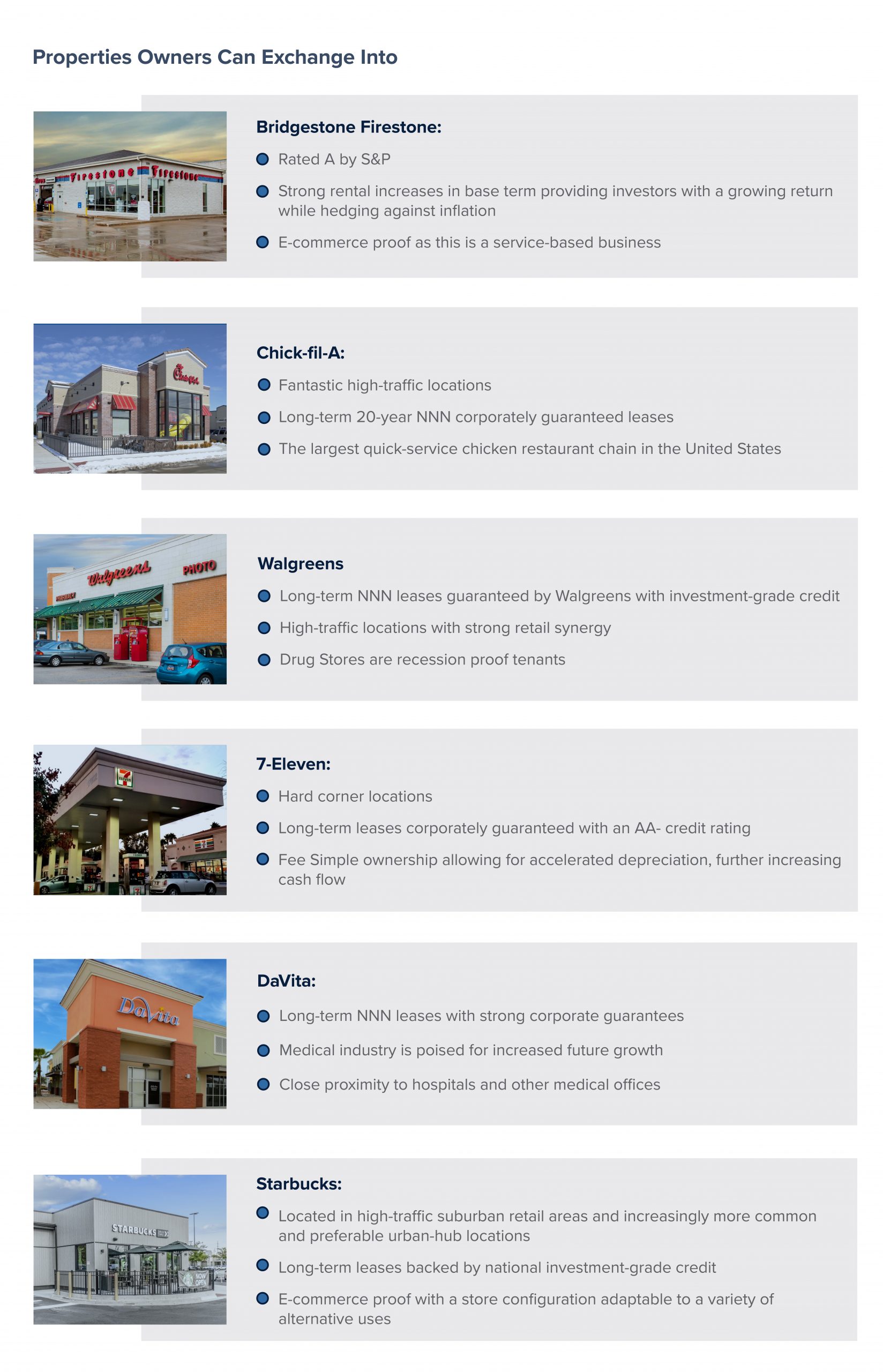

What are Investors Exchanging Into?

While we have witnessed a shift in cap rates with bank assets perceived as riskier investments, the cap rate environment has maintained an interesting balance. This allows current investors a unique opportunity to utilize a 1031 Exchange to move their capital into properties with greater returns, long-term security, and often better locations. And now, with the deadline extended for 1031 Exchanges due to the impact of coronavirus, owners have until July 15th to scope out their options. Many seasoned investors are exchanging out of these bank properties and into service-based tenant types that cannot be replicated by e-commerce or taken over by the “Amazon Effect,” while better representing their real estate goals. These tenant types include quick-service restaurants, casual dining, auto services, convenience stores, and medical tenants.

With events surrounding COVID-19 impacting businesses around the world, retail banks are reprioritizing and recalibrating for the future. Owners can take steps now to improve their investment position and continue to support their local communities and customers during the pandemic. These include managing branch distribution and internal issues in operations, finding ways to minimize spending, and reevaluating your revenue outlook.

The goal of any investment is to be ahead of the curve. At Matthews Real Estate Investment Services™, we assist our clients by providing them the resources to make an informed investment decision with the goal of preserving equity, security, and increasing cash flow. With these extraordinary credentials, we highly advise that you consider looking into your current market position and what is progressing with respect to your specific retail bank investment.