The Value in a Dollar Store

The net lease retail sector has continuously grown in popularity among investors due to passive income and minimal management responsibilities. One of the favored net lease segments is dollar stores, a popular discount retail sector that evolved during 2020 as consumers were shadowed with uncertainty. Dollar stores offer an advantage to investors as they target low-income shoppers and thus prove successful in all economic environments.

Two retailers dominate the dollar store world — Dollar General and Dollar Tree/Family Dollar — both of which opened a combined total of 1,300 new locations by the end of 2022, continuing the momentum seen from 2021. These discount stores have also released expansion plans and new concepts for 2023. In this article, Matthews™ reviews future dollar store initiatives and activity.

Dollar General and Dollar Tree Performance

Once largely overlooked by many investors, Dollar General and Dollar Tree both saw a substantial increase in sales for the second quarter of 2022. The reason for this increase in earnings can be attributed to consumers facing the pressure of rising prices for food, gas, rent, and other items. Dollar stores are also backed by long-term leases, investment-grade credit, high sales volumes, and comparatively low prices to other net lease properties. The heightened demand compressed cap rates to 6.112 percent in January 2023, according to CoStar data.

Transactions

As dollar stores’ revenue increased, so did investor interest. As shoppers from various demographics flocked to discount chains deemed essential during the pandemic, investors followed. As of January 2023, the dollar store sector achieved an average sale price of $3.7 million, recording an overall sales volume of $5.5 billion in the last 12 month period from January 2022.

DOLLAR TREE & FAMILY DOLLAR:

Dollar Tree Inc. saw $4.1 billion in transaction volume during 2022. Dollar Tree and Family Dollar offer 10-year NN leases, and only a few hundred Family Dollar properties offer 15-year NNN leases. The buyer profile for these assets includes investors seeking long-term corporately guaranteed leases by an investment-grade credit tenant at a higher rate of return. Dollar Tree Inc. noted that all future cash flow would be utilized for development, expansion, and paying down debt.

DOLLAR GENERAL:

Dollar General Corporation saw transactional volume of $1.5 billion in 2022, and an average sale price of $1.9 million. Generally speaking, Dollar General most commonly signs 15-year absolute NNN leases, although its older lease structure was a 10-year NN. There are two very active buyer profiles for Dollar General – those seeking a higher return in shorter-term NN leases and those looking for 100 percent passive income at a lower rate of return in absolute NNN deals.

Revenue

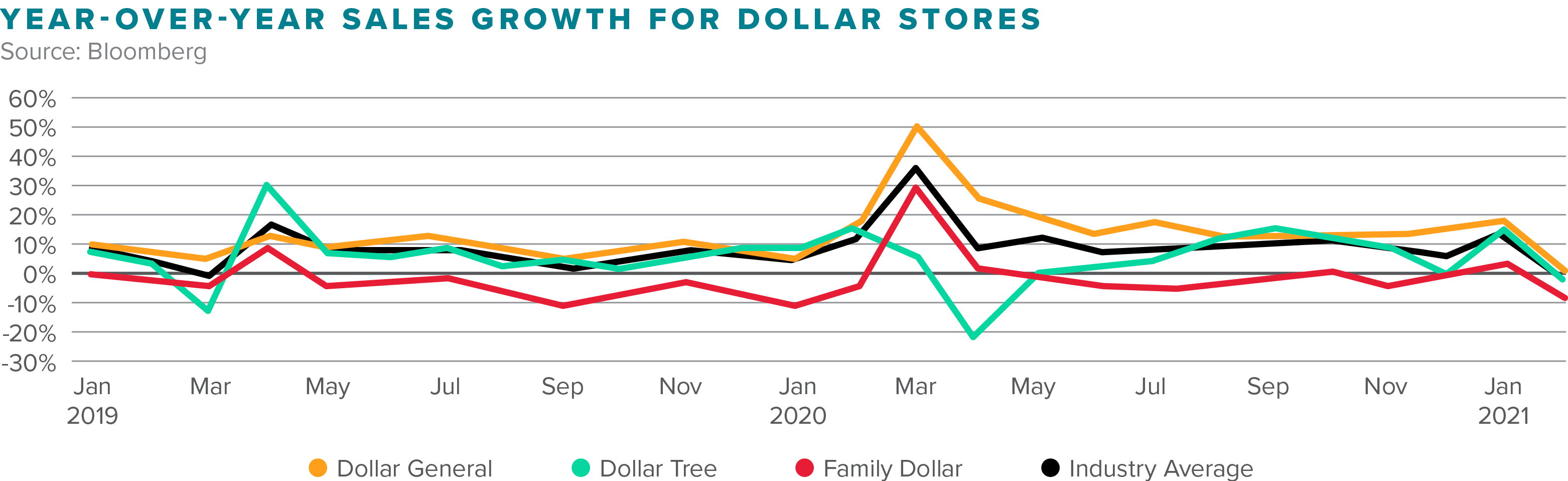

Since 2000, large discount stores have recorded tripled store sales, showcasing their rise in popularity among consumers. According to Bloomberg, the dollar store industry’s monthly store sales increased 12 percent year-over-year in 2020, more than the seven percent increase in 2019. The 2020 growth was bolstered by the incredible 35 percent growth rate seen in March 2020. While the majority of sales stemmed from repeat customers, new shoppers helped push overall consumer spending over the last 12 months.

DOLLAR TREE & FAMILY DOLLAR

Dollar Tree inc. released its 2022 third-quarter earnings results, reporting an 8.1 percent increase in net sales to $6.94 billion while operating income increased 22.8 percent to $381.3 million. Family Dollar increased comparable traffic for the first time in 12 quarters after implementing price adjustments in the second quarter, resulting in the greatest quarterly same-store sales growth since 2020. According to Dollar Tree Inc.’s earning report, the nine-month results from the months ended October 30, 2021, are as follows. Consolidated net sales increased 7.1 percent to $20.60 billion. Enterprise same-store sales increased by 5.4 percent. Dollar Tree’s same-store sales increased by 9.2 percent. The increase was driven by a double-digit increase in average tickets, partially offset by a decline in traffic. Gross profit increased 17 percent to $6.54 billion.

DOLLAR GENERAL

According to Dollar General’s third-quarter earnings report, net sales increased 11.1 percent to 9.5 billion compared to $8.5 billion in the third quarter of 2021. Same-store sales increased 6.8 percent, operating profit increased 10.5 percent to $735.5 million, and diluted earnings per share increased 12 percent to $2.33. The net sales increase can be attributed to positive sales contributions from new stores and growth in same-store sales, partially offset by the impact of store closures. Gross profit as a percentage of net sales was 30.5% in the third quarter of 2022 compared to 30.8% in the third quarter of 2021. The company reported a net income of $526.2 million for the third quarter of 2022, an increase of eight percent compared to $487 million in the third quarter of 2021.

Dollar General accomplished its 31st consecutive year of same-store sales growth in 2021. – Source: Eagle Point Capital

Logistics

The discount chains have started focusing on logistics by building distribution centers to better position themselves in the market. With solid operations and scalable distribution networks in place or in the works, the dollar store segment is committed to cutting costs by implementing new supply chain initiatives.

DOLLAR TREE & FAMILY DOLLAR

Dollar Tree Inc. is in a strong position, with 28 distribution centers already in place. Yet, the company continues to focus on supply chain logistics and efficiency efforts. Just last year, Dollar Tree Inc. opened two distribution centers around 1.2 million square feet each, one in Rosenburg, TX, and the other in Ocala, FL. In July 2022, the company announced plans to continue expanding through the addition of three one-million-square-foot distribution centers in an approximately $480 million combined investment.

DOLLAR GENERAL

Looking to cut costs on produce and drive sales, Dollar General started the DG Fresh initiative, a two-year-old program concentrating on shifting the company to self-distribute fresh and frozen food to its locations. So far, Dollar General’s distribution network delivers from eight dry distribution centers and ten DG Fresh (cold storage) facilities to 16,000 of its stores, surpassing its previous 14,000+ projection. It hasn’t stopped there, with DG Fresh warehouses currently underway in West Sacramento, CA, Ardmore, OK, and Bowling Green, KY. The company reported that the DG Fresh initiative is the most significant contributor to its realized gross margin benefit.

Dollar General Recent Activity

Dollar General’s incredible momentum in 2020 pushed the company to launch various initiatives, programs, and expansions that have kept the retailer relevant and investors interested. The bargain retailer reached 17,177 store locations and announced plans to build 1,050 new stores, remodel 1,750 stores, and relocate 100 stores in 2021. Put into perspective, one store is within five miles of 75 percent of the U.S. population. Dollar General is working towards doubling the store count in the long term.

Company Initiatives

BETTER FOR YOU

The Better For You program aims to fulfill the discounter’s mission of Serving Others by partnering with a registered dietitian to create recipes with in-store items that are low on added sugar, sodium, and saturated and trans fats. Better For You focuses on utilizing healthier food and beverage choices from the brand’s private label, Good & Smart, further boosting its value.

DOLLAR GENERAL PLUS

Going in hand with the DG Fresh program, Dollar General Plus is another store format the dollar store is experimenting with. Dollar General Plus stores are typically around 10,640 square feet and formatted after its traditional stores, but with more floor space to offer fresh produce and expanded cooler doors and freezer space.

The store’s fresh produce is carefully selected based on the most commonly sold items in grocery stores. Additionally, the new store concept includes home décor and an expanded party preparation selection. This format is being implemented into existing Dollar General stores through remodels, dubbed Dollar General Traditional Plus (DGTP). When built from the ground up, it is referred to as Dollar General Plus (DGP). The DGP prototypes have outperformed the chain’s comp-sales and have seen considerably higher sales volume than traditional and DGTP stores. These DGP formats will account for more than 550 store projects in 2021.

POPSHELF

As part of its Non-Consumables Initiative (NCI), Dollar General launched its latest new store concept, popshelf. Dollar General leveraged its robust customer insights from the NCI to create the specialty store, selling trendy home décor, beauty products, cleaning supplies, party goods, and more, all for $5 or less.

Popshelf targets suburban customers with a higher annual income between $50,000 and $125,000. The first store opened in Nashville, TN, in 2020, along with four other locations. So far, these 9,000 square feet specialty stores have outperformed the rest of the chain.

DOLLAR GENERAL EXPRESS

After Dollar General’s 2016 extensive research revealed that millennials were part of the company’s shopper segmentation, the discounter started experimenting with a convenience-oriented concept store, Dollar General Express (DGX). There are currently 22 DGX stores throughout the U.S., including Nashville, Memphis, Chattanooga, Huntsville, Philadelphia, Cleveland, and Columbus. DGX stores are smaller and more modern retail formats (7,300 square feet), primarily developed in downtown metropolitan areas, catering to city-dwellers. DGX offers grab-and-go products, ranging from lunch foods, household essentials, health and beauty supplies, and much more, at deeply discounted prices.

DG GO!

Launched in 2018, Dollar General was the first dollar store to announce mobile checkout through DG GO! The app boasts an item scanner, coupons, and alerts for promotions, allowing the customer to avoid the checkout line altogether. Dollar General has seen its pickup and delivery business grow and has ramped up efforts to transition its stores to operate as both fulfillment centers and retail spaces.

Dollar Tree & Family Dollar

COMBO STORES & H2 STORES

Dollar Tree Inc. is implementing several new initiatives to improve sales, including new items, products of various prices, store renovations, and expanded frozen goods selection. Already, results show that these strategies are yielding more sales.

The discounter wants to combine the Family Dollar and Dollar Tree banners in one store location, dubbed combo stores. Combo stores are designed to serve small towns with populations ranging from 3,000 to 4,000. Dollar Tree Inc. plans to expand this concept to as many as 3,000 rural areas. To feature improved merchandising and an expansive refrigerated and frozen food offering, Dollar Tree Inc. has started renovating Family Dollar stores, called the H2 format.

Combining the two chains into one location helped minimize the COVID-19 impact. Instead of building two properties, the company saves by housing both brands in the same size building as one store. Further, customers get more bang for their buck without leaving the store, as they no longer need to visit different locations to complete their shopping needs. These combo stores see increased customer visits, cart size, and profits by optimizing shopper convenience. Already, the combo store’s same-store sales exceed 20 percent, compared to traditional stores.

After seeing increased sales and customer satisfaction in its H2 store formats and combo stores, the company plans to incorporate these in its expanding strategies moving forward. H2 formats and combo stores are part of the 200 Family Dollar stores slated to open this year. Management reported that renovated stores saw ten percent higher sales, though COVID-19 may be a contributor.

DOLLAR TREE PLUS & INSTACART

About 500 Dollar Tree locations are currently testing a new Dollar Tree Plus initiative, selling a range of items above the traditional $1 price. This has allowed Dollar Tree to expand in-store offerings, including name brands, size and value of products sold, and new items. To stay within the ranks of major retailers like Walmart, Family Dollar partnered with Instacart last year and has plans to implement it in more than 6,000 of its 7,900 existing stores.

Outlook for Dollar Stores in 2023

Being an attractive investment alternative due to their strong performance throughout the pandemic, dollar stores continue to see heightened activity in the near term. The dollar store segment is working diligently to remain relevant through initiatives, expansion plans, and new store concepts. Dollar stores are expected to see positive performance for years to come. For more information on dollar store investments, contact a Matthews™ specialized agent today.