Bonus Depreciation Set to Expire

Real estate investment has a significant advantage in minimizing tax liabilities compared to other assets. This is partly because property owners can claim the depreciation of a building as an expense over time. Since 2017 owners have benefited from a law that allows them to accelerate that depreciation and thus write off more of their tax bill. Now that the “bonus depreciation” deduction is set to expire, many property owners are thinking about what it will mean for their tax bill going forward.

Real Estate Investing

While it offers many benefits, one of the most significant advantages is it helps investors keep their tax liabilities lower than other assets due to the ability to write off a building’s depreciation over time.

Depreciation pertains to the decline in a property’s worth due to regular usage, decay, or technological advancement. Property owners can claim depreciation expenses on their property for taxation purposes over a specified period.

Understanding Bonus Depreciation

In 2017, the Tax Cuts and Jobs Act brought about significant changes to the regulations regarding bonus depreciation. One of the most notable changes was doubling the deduction for qualified property from 50 percent to 100 percent, as defined by the IRS. Additionally, the bonus depreciation was expanded to include used property in certain situations.

Bonus depreciation is a tax break that enables a company to immediately deduct a large portion of the cost of eligible assets, such as machinery, rather than writing them off over the asset’s “useful life.” Its purpose was to promote economic growth by spurring investment among small businesses. It is restricted to specific business assets that fulfill eligibility criteria. To qualify, the property should have a useful life of no more than 20 years, and it can be used for either personal or business purposes.

The bonus depreciation deduction has been a major boon for real estate investors, as it allows them to save even more money on their tax bills. However, this deduction is set to expire, which has many property owners wondering what it will mean for their tax bills going forward.

Set to Phase Out

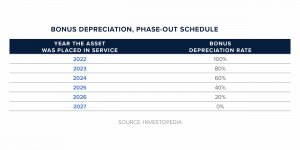

The 100 percent depreciation was phased out at the end of 2022. Now, only qualifying properties will get an 80 percent bonus depreciation in 2023 and less as time goes on.

Planning Ahead

While it is uncertain whether the bonus depreciation deduction will be extended, there are some steps property owners can take to plan ahead and prepare. One option is to invest in qualifying properties before the end of the year to take advantage of the current bonus depreciation rules. Property owners can also consider other tax-saving strategies, such as cost segregation, which can help them maximize their depreciation deductions.

Takeaways

The bonus depreciation deduction has been a valuable tax benefit for real estate investors since its inception in 2017. While it is set to expire, there are steps property owners can take to prepare for the potential loss of this deduction and minimize their tax liabilities. By working with a tax professional and staying informed about changes in the tax law, real estate investors can continue to enjoy the many tax benefits that come with owning property.

Please consult with a tax professional who can help property owners understand their options and develop a tax strategy that considers the potential expiration of the bonus depreciation deduction. This can help property owners stay ahead of any changes in the tax law and minimize their tax liabilities going forward.