Feeling the Heat: Phoenix CRE Report

Known as the Valley of the Sun, Phoenix, AZ, is one of commercial real estate’s hottest markets. With a current population of over 4.7 million, a 1.4 percent increase from 2022, the Phoenix metro is packed with abundant job growth, consumer spending, and investment opportunities. Phoenix is the largest city in Arizona and the 5th largest in the U.S. Throughout the U.S., Phoenix has the largest absolute increase in population growth between 2010 and 2020 and reported the fastest growth rate among America’s biggest cities, according to the New York Times. Beyond impressive population stats, Phoenix also boasts a business-friendly environment with limited government interference and lower taxes. Lastly, the Valley offers sprawling submarkets at reasonable prices. Suburbs like Buckeye grew 80 percent in ten years and provide development opportunities not seen in dense coastal markets. In all, Phoenix has become a treasure for commercial real estate investors, but with great success comes great challenges. As the aftereffects of COVID-19 become clear and sectors begin to shift, investors will need to evaluate where in the Valley to plant capital, what type of products best suit their needs, and what economic and consumer trends Phoenix is experiencing.

The state’s Tax Cuts and Jobs Act established 42 designated opportunity zones for investors and developers in growing submarkets across Phoenix, offering deferred capital gains tax and reduced tax percentages based on the amount of time a property is held.

The Multifamily Market

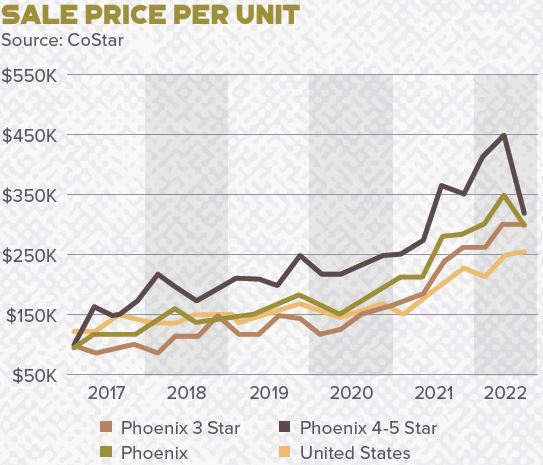

2020 spurred historical growth for Phoenix’s y multifamily market that continued into 2021 and early 2022. The influx of movers into Phoenix caused a massive shift in demand for multi-housing properties, forcing developers to ramp up new supply quickly. But in late 2022, the absorption rate began moderating, and supply accelerated, causing the metro’s vacancy rate to reach 7.9 percent, a two percent increase from Q1 2022. Now, the Phoenix multifamily market has experienced a noticeable shift in demand in 2023. The surge in multifamily demand that drove unprecedented performance during the pandemic has been descending due to high inflation and economic uncertainty at the end of 2022, just as new supply was ramping up, resulting in negative rent growth and soaring vacancy rates. The market is expected to see further dislocation in the near term as new supply is digested. However, there are some signs of optimism, including strong net absorption in Q1 2023 and the long-term drivers that supported the outstanding multifamily performance during the post-pandemic boom. Elevated interest rates and softening property performance have had a noticeable impact on sales volume, with the current investment climate in a holding pattern. Apartment values have begun to decline, and cap rates have risen.

Investment Opportunities for Multifamily

With high vacancy rates, slowing rent growth, and overwhelming supply, Phoenix multifamily investors may be looking at a game of “hot potato.” Certain assets could hold dangerous consequences and cause trouble for owners as demand stalls and renter expectations change.

Investors are striving to find first-generation value-add deals, which are few and far between, as over 1,300 properties have traded over the last five years, representing about 36 percent of the market. The biggest opportunity for investors will be re-strategizing and adding value to operations rather than adding extensive interior and exterior renovations. Investors should focus on improving the bottom-line net operating income, whether that be turning the rent roll or re-capturing market rents. Other ways to increase the bottom line include adding other income-producing initiatives such as parking, pet rent, or laundry while simultaneously focusing on cutting down ownership expenses. Overall, improving within during an uncertain interest rate market will ultimately create the most value for multifamily investors.

The Industrial Market

The Phoenix industrial market is on the verge of a significant change as it prepares to receive one of the most ambitious construction pipelines in the country in the upcoming year. Currently, there is a record-breaking 50.7 million square feet of industrial space under development, with about 75 percent being built without a tenant secured. Despite this, strong demand from various industries has absorbed most of the new supply, resulting in a vacancy rate only slightly above the lowest ever recorded. However, it is expected that in 2023, vacancy rates will increase as significant development activity surpasses new demand. As of May 2023, the asset class’s annual rent growth rate was 15.2 percent. Market sale price per square foot also accelerated, reaching $190, slightly higher than the national average of $165.

Another attribute of industrial’s performance is its diversification of property types and reach across industries. Warehouse and manufacturing space proved to be pivotal during the pandemic, but the lack of supply caused almost all industrial properties to increase in value. Tenants began adapting to the market, leasing spaces previously deemed unsuitable because the options were limited. Rising construction costs, labor shortages, and rising interest rates are all affecting commercial real estate development, but Phoenix industrial is still strong, and outlook remains positive.

“As of March 2023, Phoenix ranked number two for most industrial real estate under construction”- AZ Big Media

As more facilities are built around the Valley, land constraints have appeared. In-demand neighborhoods like Scottsdale Airpark, an 8.6 square mile area with over 2,900 businesses, have little land left to develop, a problem that was nowhere near fruition a few years ago. Phoenix also saw a shift in building sizes as large Fortune 500 companies started moving into the market. To accommodate the influx, developers focused on producing big-box industrial properties and scaling back on smaller facilities. Once again, the lack of availability has pushed pricing up, and small industrial properties are going for top dollar. In addition, land constraints have spurred developers to look into repurposing existing structures as new builds become more expensive and regulated.

Investment Opportunities

The biggest obstacle facing Phoenix industrial investors is rising prices and the rat race of competitive offers coming in across all product types. Arizona gained popularity due to its affordability compared to nearby coastal markets. However, despite the continued appeal of Phoenix’s long-term value proposition to investors, the impact of higher interest rates and economic uncertainty has started to affect sales volume. According to a local industrial broker, the market conditions are characterized as unclear, with a lack of agreement on the future direction of interest rate policies widening the gap in expectations between buyers and sellers. This has resulted in a stagnant transaction climate at present.

Investors should consider growing submarkets like North Phoenix and the East and West Valley to obtain assets at a lower price per square foot with a potential upside. However, the further out, the greater risk, as some regions bring fluctuating vacancy and less leasing demand. Another point to remember while investing in Phoenix industrial is that the amount of supply waiting to enter the market is higher than the majority of the country, which could potentially limit an owner’s leverage to raise rents once vacancy heightens.

The Self-Storage Market

The self-storage asset class climbed the ranks rapidly at the start of the pandemic and has continued its dominance throughout the U.S. Phoenix boasts one of the most vital self-storage pipelines, with 13.3 percent of existing inventory underway, making it a top five metro for development in the nation. The demand for self-storage facilities has also experienced a notable rise in places like Phoenix, Gilbert, and Mesa. Even during the pandemic and its aftermath, interest in self-storage stayed consistent and increased, largely due to the remote work trend, which appears to be reinforcing its popularity nationwide, with remote workers constituting 11.5 percent of the local workforce, based on data from the U.S. Census. Consequently, there has been a significant surge in online searches related to self-storage in Phoenix, with a remarkable 236 percent increase observed in 2022 compared to 2019, according to AZ Big Media. This places Phoenix ahead of other cities in Arizona in terms of self-storage interest. Additionally, this trend is reflected in the average of 5.1 monthly searches per 1,000 residents in 2022. According to Yardi Matrix, total revenue for self-storage products is increasing by double-digit percentages nationally.

Investment Opportunities for Self-Storage

As with any real estate, the most crucial factor self-storage investors should consider is location, location, location. Phoenix is seeing a slight shift in consumer trends but still offers plenty of valuable opportunities within the storage market. Single-story facilities with larger units see longer-term tenancy and strong demand throughout the Valley. These types of properties are comparable in strength to three-story Class A climate-controlled facilities. Phoenix is also a thriving market for boat and RV storage facilities. With most of the new housing being in HOA communities, homeowners need a place to store recreational vehicles and boats due to the strict storage and parking policies in regulated communities.

Recently, Matthews™ completed the sale of a 35-acre, 1,200+ vehicle storage lot in the growing West Valley of Phoenix. Since rent rates continue to increase in the area, the deal was completed at a very aggressive cap rate. Even with the large space count, the property was 98% full at the time of sale.

The Retail Market

The thriving local job economy combined with the market’s population growth has helped Phoenix’s retail sector quickly recover from the impact of COVID-19 and increase its popularity among investors. Leasing volume is substantial, with 4.2 million square feet absorbed within the last 12 months, according to CoStar Group. This is the strongest 12-month period since the period prior to the Great Recession. Smaller, niche tenants are performing well and rapidly growing. Boutique gyms such as F45 or popular local coffee joints like Dutch Bros and Black Rock Coffee are storming the Valley and offering investors a smaller retail footprint solution. Rents are steadily increasing and are above the national average, as Phoenix’s same-store asking rents increased 7.9 percent year-over-year while the U.S. average increase is 3.3 percent.

Investors are entering the market as new development and redevelopment projects pop up across the region, especially in growing submarkets. One of the largest retail redevelopments, PV, a mixed-use complex set to complete its first phase by 2024, is in North Phoenix and will offer a 400-unit multifamily building in addition to various retail fronts, hospitality, and entertainment venues. With growing opportunities and increased competition, pricing has increased, reaching an average of $245 per square foot.

Investment Opportunities in Retail

Phoenix’s tremendous rent growth has driven values well beyond what most experts had predicted. Fortunately, continued growth is expected as the population and retail demand continue to increase, meaning investors should look to take advantage of the market conditions. It’s important to keep in mind the majority of tenants in Phoenix are food and beverage, meaning the product type is performing well but could become oversaturated. Overall, consumers are craving a more personal and experiential shopping, dining, and workout experience, which means some brands will cater to new generations better than others. Boutique fitness facilities, quick-service restaurants, and technology-savvy retailers will continue to gain popularity and offer a secure and profitable business model for investors.

The Phoenix retail market is thriving and performing exceptionally well as of Q2 2023. It is essential that investors work with a specialized and knowledgeable agent to understand what product types fit long-term financial, management, and portfolio goals, in addition to what parts of the Valley present thriving opportunities.