The Hospitality Sector

Last year documented the bounce back of the decade for the hospitality sector. According to CoStar Group, 2022 ranks as the second-highest annual sales total in U.S. history, reaching $48.6 billion. The industry saw an increase in buyers, and experts predict continued demand in 2023, specifically for high-end properties that are seen as recession resistant. In addition, hospitality is receiving the green light from lenders in a tight capital market environment. Overall, the sector is experiencing its strongest Q1 start in years, and investors are intrigued.

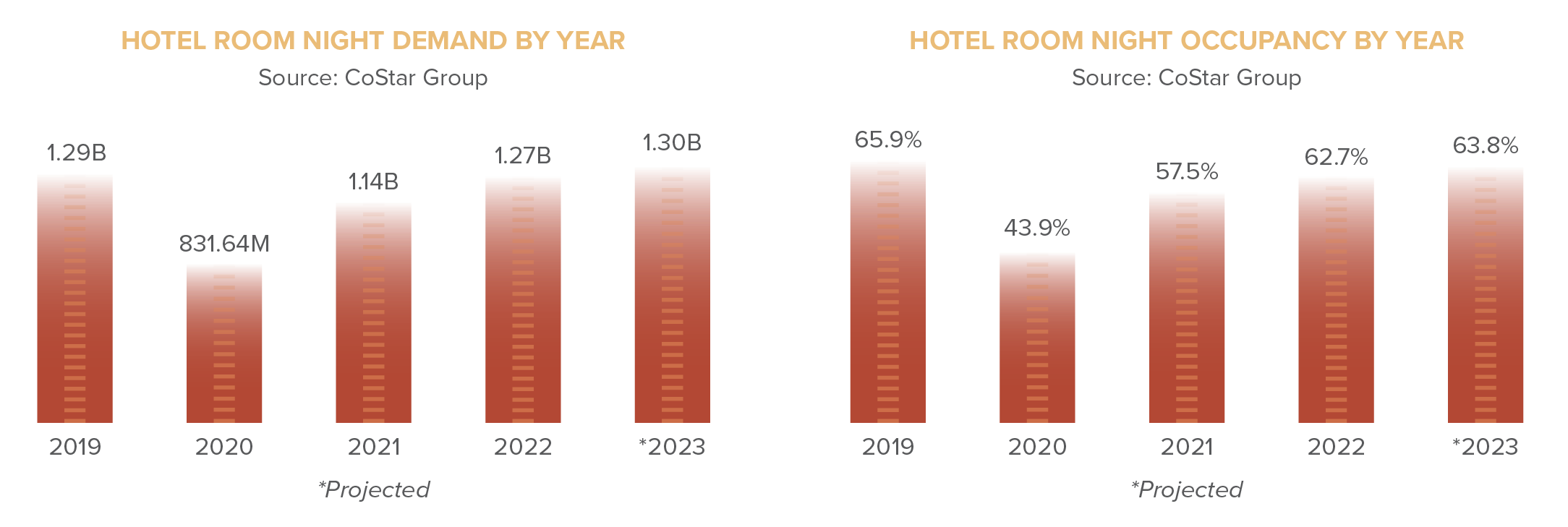

Demand Moves Forward

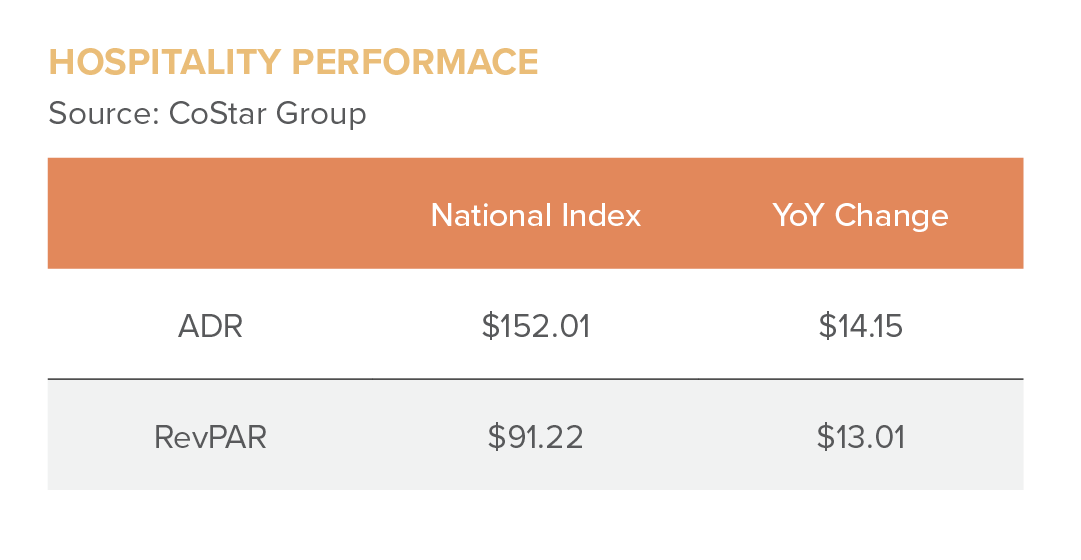

Despite high inflation, hotel demand remains strong, increasing occupancy and encouraging higher-priced room rates. The travel site Hopper reported that U.S. hotel prices averaged $212 per night in January 2023, a 54 percent increase year-over-year. This increase is likely due to the pent-up demand to travel after years of restrictions and lockdowns. Consumers don’t seem to be trimming their vacation budgets as historically seen in down markets. In fact, Q1 2023 will be the first time RevPAR will increase during a recessionary period.

In a survey of its users, Hopper found that 37% of people plan to spend more on travel in 2023 compared to 2022, while 43% of people said they plan to spend the same amount.

Although the overall hospitality market is reporting strong numbers, business hotels are struggling to gain the same momentum as leisure hotels, as remote work decreases the need for business travel. Although corporate events and group travel are increasing, the rate of recovery has been much slower than that of other hotel subsectors.

A slow development pipeline and limited deliveries also contribute to the hospitality sector’s high demand. COVID-19 weakened the already laborious and expensive timeframe for hotel construction, and now the sector is trying to play catch up. Pricey capital, fewer land sales, and expensive labor make developing large properties like hotels less appealing when other asset classes can be brought to market for much cheaper and have faster turnaround. According to CoStar Group, more than 155,000 rooms are under construction across the U.S.

Who’s Buying

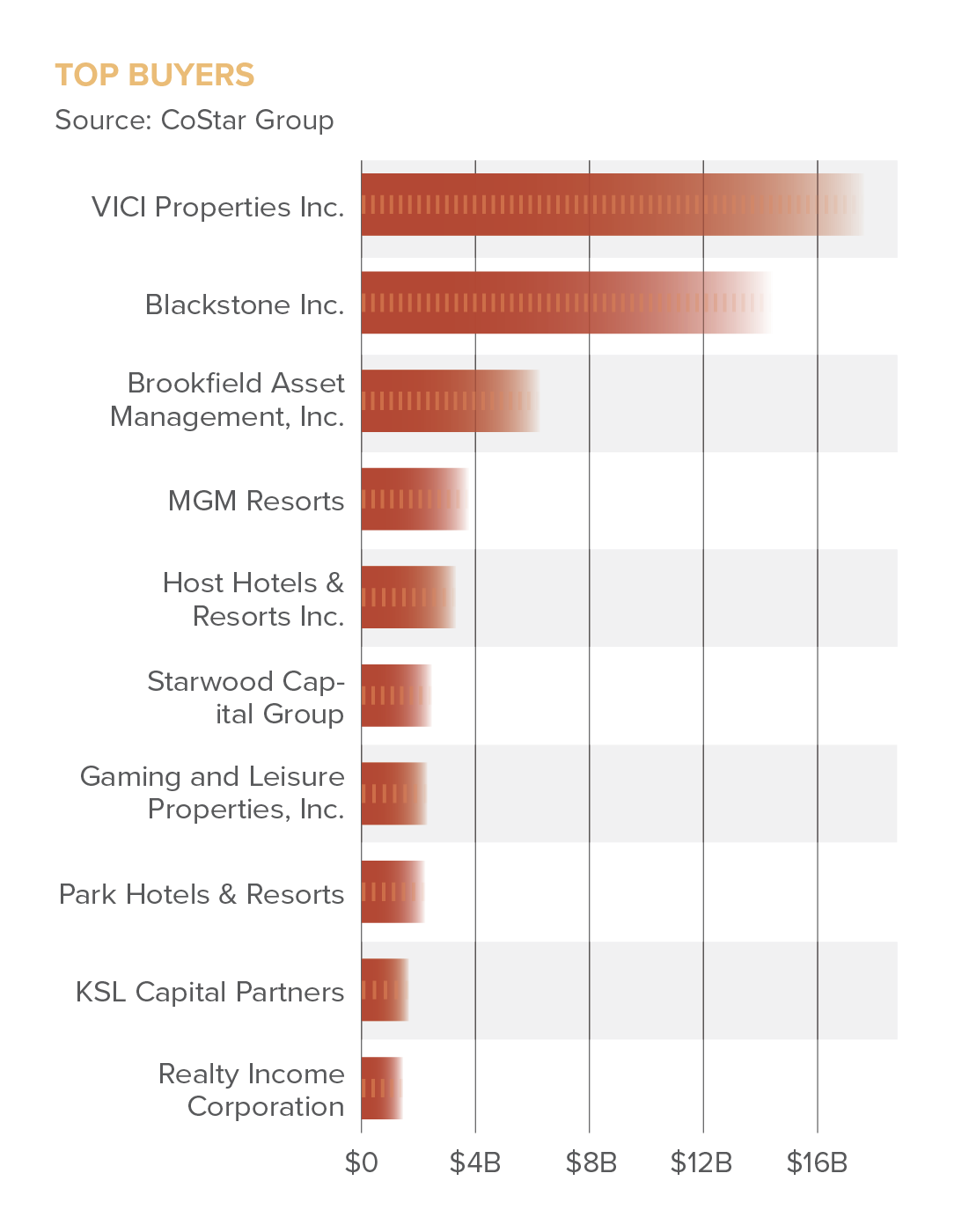

Investors see hotels as a long-term growth option that will outweigh the near-term capital markets challenges. As other commercial real estate sectors experience cap rate compression, hotels become more attractive to buyers since they are able to reprice rooms daily, fighting the high price of inflation. This pricing flexibility isn’t seen in long-term lease assets such as offices, multifamily, industrial, and retail. So, who are hospitality’s most prominent players?

Institutional Capital

Due to the vast amount of capital needed to purchase a hospitality asset, institutional investors have dominated the space for the last five years. Although, this may change as REITs pivot strategies to account for the high-interest rate market and they most likely become more selective. VICI Properties Inc., a New York-based REIT, boasts the most transaction volume since 2018, buying over $16 billion in hospitality assets.

Private Equity

Private equity groups are becoming a well-known buyer group for the sector in recent years. These investors typically look for Class B and C properties that are underperforming or distressed with the potential for improvement, which they can acquire at a discount and then invest in to increase their value. Private equity firms may also look for hotels in attractive locations with high growth potential. Some major private equity firms buying in the sector are Blackstone Inc. and newcomer KHP Capital. Private equity firms typically hold onto their hotel investments for several years before selling them to another buyer or taking them public through an initial public offering.

What’s Next?

With increasing rates and steady demand, the hospitality sector is expected to have a high-performing 2023. As other commercial real estate property types struggle to get financing, lenders seem bullish on hotels, seeing their strong fundamentals as less risky. Consumers plan to increase or spend the same on travel and tourism in 2023, which will help hotels keep occupancy and RevPAR high. The biggest challenge facing hotels is labor shortages as help becomes increasingly difficult to find and more expensive to retain. Hotel owners must invest in their employees and guest services to succeed. High-interest rates will affect the hospitality buying pool as investors, and lenders get more selective, but increasing profit should help balance the high debt costs.