Here’s How to Claim Your Stake in the Metaverse

The metaverse is a hot topic as of late. While some believe it may already be too late to enter the game, we’ve constructed a guide on how to claim your stake in the ever-evolving and growing metaverse. While there is no immediate benefit to buying virtual land in the metaverse, the potential return on investment has piqued the interest of thousands of investors. The concept functions similarly to a non-fungible token (NFT), where you own the digital asset, and anyone can verify its authenticity since it exists on the blockchain. The virtual land can be sold later as it appreciates or can be rented out.

In order to buy real estate in the metaverse, a user must have a digital crypto wallet. When selecting the platform to buy virtual land, there are some similar factors to physical real estate. Such factors include location, usage, and long-term potential. After selecting the desired platform to purchase the land, the user must verify if the wallet supports the cryptocurrency.

There are several methods to purchasing metaverse real estate, including:

-

Using the platform’s direct marketplace

Every metaverse platform with land for sale will list it on their marketplace. While the format will vary, they generally provide information like the parcel’s coordinates on the map, asking prices on available properties, and proximity to business districts, popular sites, roads, virtual mass transit, and more. The only downfall is that sales history won’t be accessible.

-

Using a third-party marketplace

There are some large third-party marketplaces with the option to explore, review, compare, and purchase virtual real estate. The most commonly used are OpenSea and Non-Fungile.com. These marketplaces provide historical property sales and currently listed properties within any metaverse, giving the option to purchase from various platforms or narrow down options with data.

-

Using a metaverse real estate agent

Metaverse agents are hard to come by, despite there being no licensing requirements at this time. Typically, they are real-world real estate agents with a significant interest in the metaverse. Not only can they help investors find suitable metaverse parcels, but these agents can also help find a buyer or renter for projects.

Real Estate Investment Trusts in the Metaverse

The first tokenized real estate investment trust in the metaverse, MetaSpace Real Estate Investment Trust (MREIT), launched in December 2021. MREIT focuses on buying, leasing, and minting (creating) virtual real estate in the metaverse and links profits to token holders through smart contracts. These smart contracts are programs stored on a blockchain that run when predetermined conditions are met.

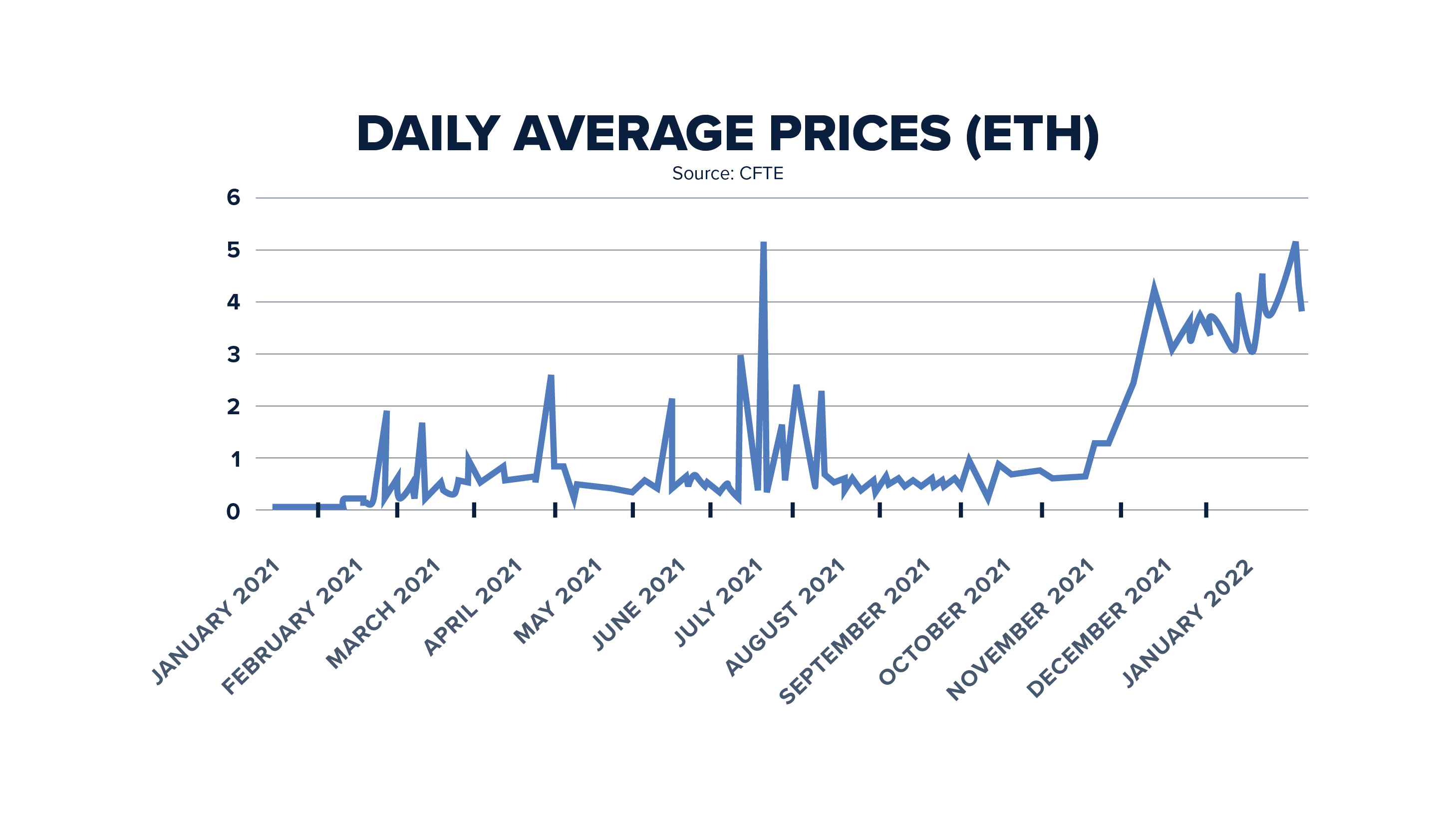

Pricing for virtual land is hastily increasing and soon will no longer be affordable. According to Forbes, metaverse real estate prices rose 700 percent in 2021. Between November 2021 and January 2022, 8,000 parcels were sold monthly at an average of 3.5 Ethereum, or $13,000. By January 2022, the average price of metaverse land transactions exceeded 5 Ethereum, or $18,000.

Musician Snoop Dogg is building out his very own Snoopverse, with 22 plots of land, 67 plots of premium land, and three estates that allow landowners to build on their land and profit off other residents who visit. In December, a fan paid $450,000 just to be neighbors with the hip hop artist. On Decentraland, investors have seen some parcels trade for 150 percent of their purchase price from months before. The average price for virtual land parcels doubled in the second half of 2021 alone, with JPMorgan reporting a digital parcel costing $6,000 in June 2021 had increased to $12,000 by December. Investors who see the metaverse’s appeal and business potential are placing more value and interest in virtual real estate.