Movement in Industrial Markets

In recent years, there has been a noticeable slowdown in industrial development in several markets, while others have seen notable market growth. This growth is attributed to high industrial demand, resource availability, increased investment activity, favorable government policies, and strong demographics. Slower markets are facing the aftereffects of setbacks seen in Q4 2022, including truck tonnage and several imports declining, construction labor and material shortages, and the deceleration of e-commerce sales. However, as inflation eases, construction is anticipated to pick up again and push new developments into late 2023 and 2024.

Industrial Market Overview

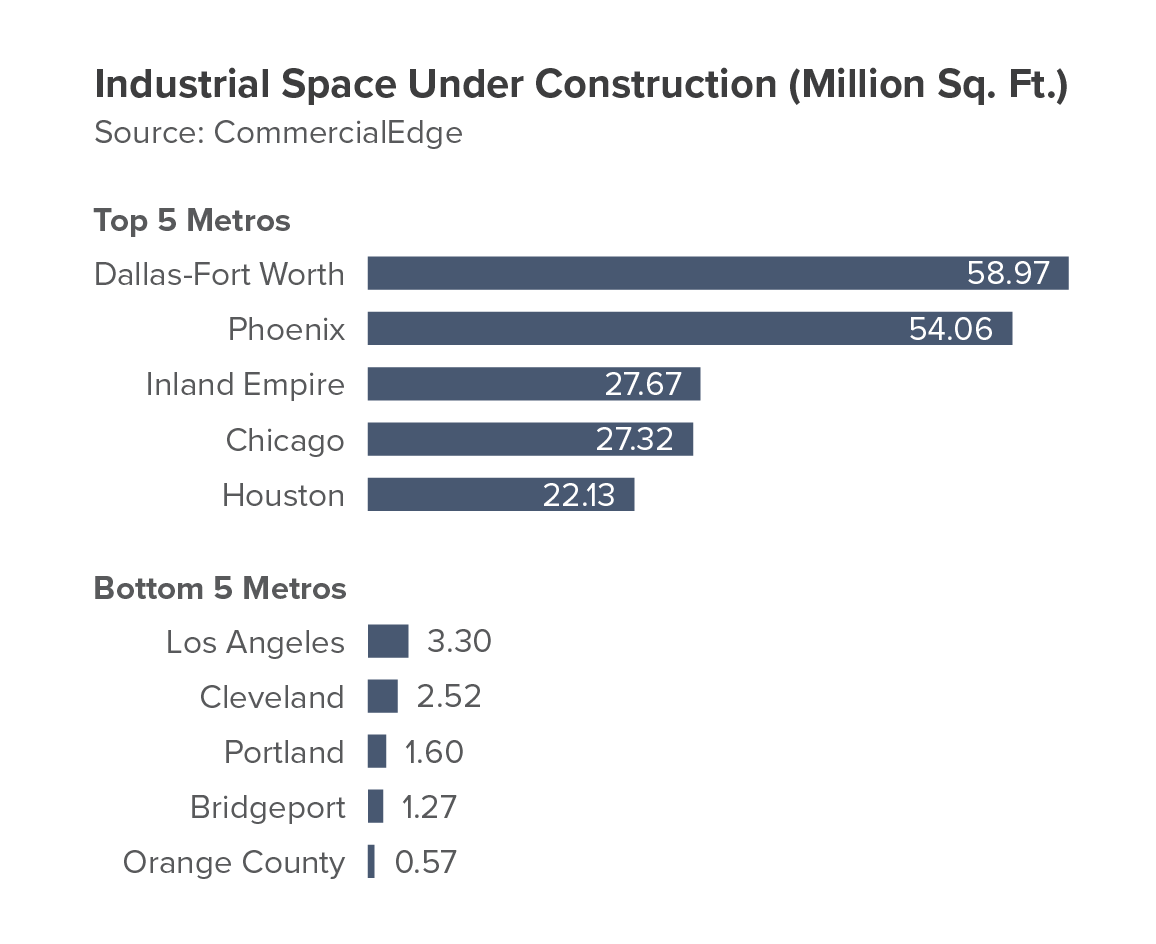

In 2022, 415 million square feet of industrial space was delivered. As of March 2023, 624 million square feet of new industrial supply was under construction in the U.S. and is on track to exceed completed deliveries seen in 2022, according to Costar Group. Reports conducted at the end of March 2023 state that developers in the U.S. have delivered approximately 73.4 million square feet of industrial space this year. Although a robust pipeline, the distribution is imbalanced, with major metros, especially throughout the Sunbelt region, taking on the majority of projects while others fall to the wayside.

The U.S. industrial market is expected to experience a slight downturn in Q2 2023, with net absorption slowing down in the first quarter due to caution over the economic outlook. However, there is potential for net absorption to lift in the future due to seasonality and strong retail sales.

Although U.S. industrial rent growth remains close to record highs with a 10.1 percent year-over-year increase, the quarterly gains pace has slowed in recent months. This is due to the national vacancy rate no longer decreasing as rapidly as it did in late 2021 and early 2022. Consequently, the quarterly rent growth has moderated from three percent in mid-2022 to slightly less than two percent in the first few months of 2023.

Nevertheless, the industrial market’s longer-term outlook is positive, with major metro areas picking up the slack. Rent growth is unlikely to increase in the near future, given the anticipated acceleration in new development completions for the remainder of 2023. Additionally, the opening of more than 18 electric vehicle, battery, and semiconductor plants throughout the country in 2024-2025 could generate millions of square feet of additional space for lease over that period. Increased consumer interest in EVs will continue to drive demand for manufacturing, storage, and packing facilities nationwide.

Drivers Influencing Development

One significant factor that has affected industrial development in the U.S. is the availability of natural resources. Regions with abundant natural resources, such as oil and gas reserves, have seen a surge in industrial growth. For example, states such as Texas and North Dakota have experienced rapid industrialization due to their vast oil and gas reserves.

The level of investment in infrastructure and technology is also playing a significant role in industrial development in the U.S. Regions that invest heavily in modern infrastructure, such as transportation networks, broadband, and energy systems, tend to attract more industrial development. Additionally, investments in cutting-edge technology, such as robotics and automation, can increase productivity and efficiency, making certain regions more attractive for industrial growth.

Favorable government policies, including tax incentives, regulatory streamlining, and government funded research and development, can stimulate growth in specific industries and regions. Conversely, unfavorable policies, such as increased taxes and burdensome regulations, can hinder industrial growth and drive investment away from certain areas as they increase construction timelines, costing developers more money.

Regions with a growing population and a well-educated workforce tend to attract more businesses and investment, leading to higher levels of industrial growth. For example, regions such as the Pacific Northwest saw a surge in development in recent years.

Key Trends Affecting the Industry

Increased Demand for Same-Day Delivery

The current-day consumer can sit on their couch, open an app on their phone, and buy a new TV for same-day delivery in under one minute. As more and more consumers purchase items for shortened delivery timelines, the demand for shallow-bay centers that can complete these orders is in high demand. Shallow-bay industrial properties, primarily ranging from 50,000 to 120,000 square feet, act as both warehouse and distribution facilities, and investors’ interests are peaked. In the future, firms are expected to purchase numerous shallow-bay centers in dense metros, drifting away from traditional 300,000-square-foot fulfillment centers on the outskirts of town. Having numerous smaller, more-centralized facilities decrease timelines and allows for more imports, increasing business.

Affordability of Land

Land affordability is crucial for the development and profitability of industrial facilities in the U.S. Expensive land costs may lead to higher rental rates and hinder the industry’s growth. Conversely, affordable land enables developers to invest in more modern facilities with attractive amenities, making them more appealing to potential tenants, resulting in higher occupancy rates and profitability. Hence, developers must consider land costs carefully when selecting facility locations.

Sale-Leasebacks

In 2022, many owners utilized this strategy for industrial properties because of its stability and attractive cost. The use of a sale-leaseback has become a crucial tactic for releasing hidden value and positioning a company for future expansion. This widely used financing tool enables owner-operators to release their locked-up cash and put it to better use. The capital return is fantastic for reinvesting in the company, funding expansion and additional locations, or even paying off debt.

In 2022, the number of sale-leaseback transactions surpassed the previous highest levels achieved in 2019 and 2021 by 11%. Additionally, the total dollar amount of these transactions reached a new record of $31.4 billion. – Source: ConnectCRE

Thriving Industrial Markets

There are numerous regions throughout the country where the industrial market is thriving, including the Sunbelt, along the East and West coasts, and densely populated cities. Areas seeing the widest spreads include logistics hubs and port markets.

Construction along the Sunbelt is growing exponentially, primarily in Dallas-Fort Worth (DFW) and Phoenix. DFW is currently leading the nation in development with a 59.97 million-square-foot pipeline. The DFW metro was pushed to the top of industrial markets due to the influx of logistics, e-commerce, and manufacturing firms entering the market. Amazon is also a huge contributor to the market’s growth. As a central location in the U.S., DFW has access to highway and rail networks, and top-tier airports, all of which are attractions for companies and drivers of industrial growth. Like DFW, Phoenix is a transportation hub due to its proximity to West Coast ports, a major driver for the industrial sector. Phoenix also boasts one of the largest average lot sizes compared to other cities in the U.S. According to Phoenix Business Journal, the city ranks third among U.S. cities with the most vacant land, helping developers find affordable options. A recent study by CommercialCafe also stated that Phoenix possesses 15,897 empty land plots, which amount to 53,022 acres in total. This equates to an average of 3.34 acres per plot.

Additionally, the Inland Empire is expected to grow, with net deliveries projecting 40.2 million square feet in 2023. The Inland Empire has managed to entice the largest amount of capital, making it the leading region in the country. Over one-fifth of the total industrial sales volume across the nation can be attributed to sales in this area. In Atlanta, industrial rents are rising, sitting at 7.2 percent, well over the national average of 6.9 percent. The high growth reflects Atlanta’s growing population, lack of inventory, and high demand. Along the East Coast, New Jersey recorded the second-highest sales volume among leading markets in 2022 at $149 million. The high demand for space in the Midwest can be seen in Columbus, OH, which recorded the second lowest vacancy rate nationwide at 1.7 percent.

As of February 28th, 2023, Inland Empire had the highest year-over-year sales volume in the entire country, which amounted to $855 million. – Source: Commercial Edge

Markets with access to ports with affordable construction costs are in high demand for investors. Some regions sparking investor and large company interest include North Central Florida, North Carolina, and South Carolina. According to Commercial Search, 7.5 million square feet of industrial space were under construction in North Central Florida at the end of 2022, accounting for 16.8 percent of the total inventory. Additionally, North Carolina, specifically Charlotte, is thriving thanks to its diverse industry base, which saw a large jump in employment, rising 5.1 percent in trade and utilities in 2022. In South Carolina, industrial success can be attributed to its prime location nearby major interstates and transportation corridors, making it a desired state for hubs that transport goods.

Some of the widest spreads between new leases and market rent were in Los Angeles ($7.26 more per square foot), the Inland Empire ($6.06), Orange County ($5.43), New Jersey ($3.61), Nashville ($3.35), and Miami ($3.31). – Source: Commercial Edge

Industrial’s Future

The industrial sector continues to thrive in several markets despite supply chain disruptions and rising construction costs. Investors should expect a slowdown for the first part of the year, but deliveries and sales volume are on track to surpass 2022 numbers. Large metros that service nationwide distribution hubs will likely continue seeing development growth. Overall, industrial development is expected to overshoot demand on a national level, but not at an alarming rate.