The Rush to Single-Family Rentals

Apartment rents rose at the fastest pace in June 2022 since 1986, contributing to the record-high inflation. The overall rent increase was 5.8 percent year-over-year, a 0.8 percent increase from May 2022. In May 2022, the median home price reached $407,600, and mortgage rates have double since January.

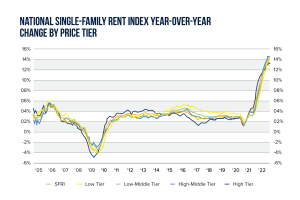

With these soaring costs, prospective homebuyers are sidelining ownership and turning to single-family rentals as an affordable alternative. Single-family rents increased for 14 consecutive months through May 2022, a 13.9 percent increase in the last 12 months, according to CoreLogic. As a result, private equity is snatching up single-family homes to rent out. According to the National Association of Realtors, institutional investments are taking up a significant portion of existing home sales, accounting for 13.2 percent of residential sales in 2021.

Where is Rent Growth Most Prominent?

Of the top 20 metros recorded by CoreLogic, Miami’s single-family rents posted the highest year-over-year increase in May 2022, recording a 39.5 percent growth. Orlando and Las Vegas were right behind, recording 24.8 percent and 16.7 percent, respectively. Contributing to the outstanding rent gains is the shortage of available existing homes. Housing starts fell 14.4 percent from April to May, according to the Commerce Department. The National Association of Home Builders reported that home builder confidence in the U.S. fell for the sixth straight month in June, the lowest in two years.

Analysts say that the current rate of rental growth is not sustainable as renters are being pushed to their financial limits, according to Moody’s Analytics. In fact, average rents in 23 percent of U.S. metros require renters to pay more than 30 percent of their income, a notable increase from eight percent in 2019. Experts anticipate that if the rents continue to progress any higher, it will lead to renters doubling-up in apartments or houses, raising vacancies and stagnating rent growth.