Multifamily Viewpoint: What do Rising Rates Mean for Owners?

Current Fundamentals in Multifamily

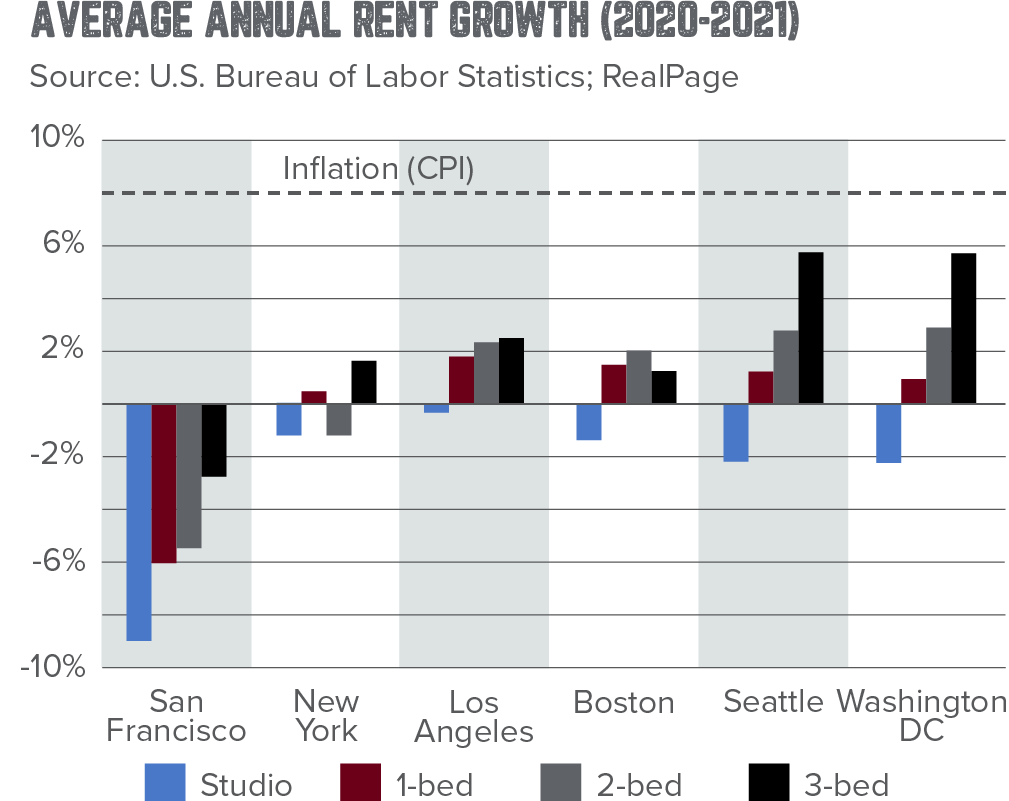

For the most part, the multifamily market performed significantly better than other product types during COVID-19. Although coastal markets and smaller units saw a downturn in rent growth as demand shifted toward larger units in the Sunbelt and other secondary markets, multifamily rebounded quickly. The pandemic-induced environment had a positive impact on real estate. With limited supply on the market, few viable investment alternatives, and the country flushed with liquidity, apartment investors became increasingly tolerant of risk in their search for yield. As such, apartment transaction volume reached record levels, increasing 128 percent in 2021 to $335.3 billion, according to Real Capital Analytics (RCA).

Current Headwinds for Multifamily

In March 2022, the Federal Reserve raised interest rates a quarter of a point and, in an inflation-fighting move, has communicated possibly increasing interest rates seven more times in 2022. To hedge inflation, the Fed had no choice but to act swiftly. The effect of rising interest rates in the coming year will depend, in part, on just how much the Fed decides to raise interest rates, and how long-term rates will respond. Simultaneously, the Fed is in a precarious position to ensure the hikes aren’t too aggressive as to put a damper on economic growth or cause a recession, which could adversely impact property value and place upward pressure on cap rates. At the same time, the Fed must not be passive to the point where the economy ends up with hyperinflation.

How Will Rising Rates Impact Multifamily Cap Rates?

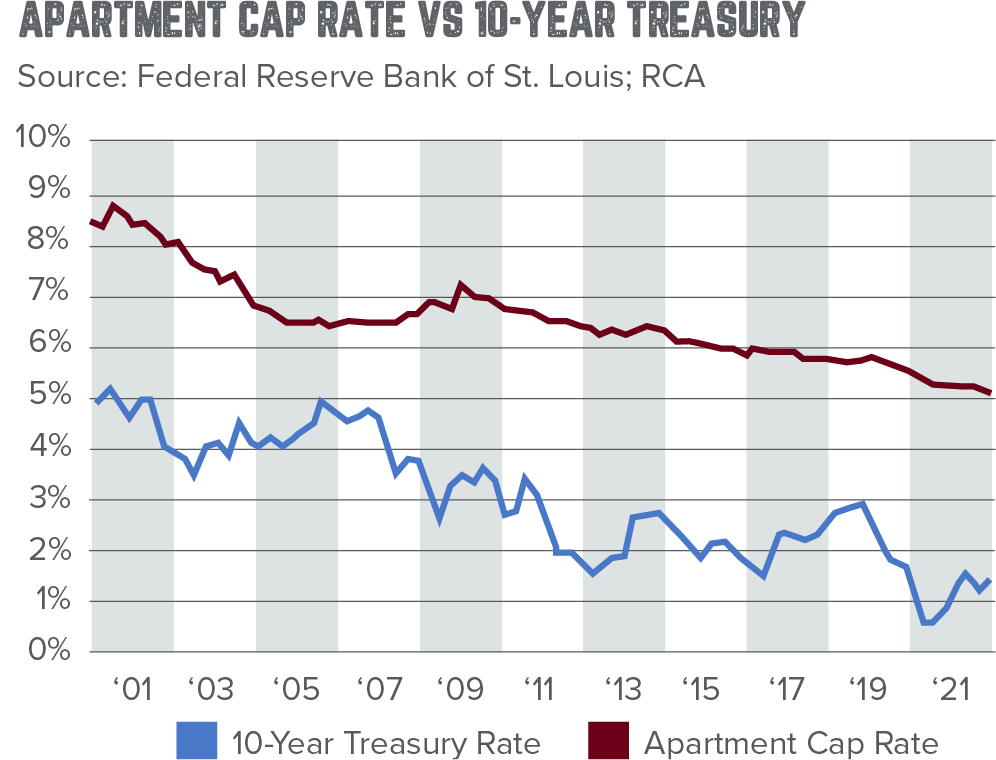

Over the past two decades, cap rates have trended down in nearly every market. According to apartment transaction data from RCA, cap rates reached 4.7 percent in Q4 2021, down 30 basis points from the prior year. This was recorded as the lowest rate since RCA began collecting data in 2001. Currently, the national cap rate average for multifamily properties sits at 4.8 percent.

Many investors worry that increasing interest rates in the coming year might negatively impact multifamily property values as high inflation persists and the Federal Reserve turns more hawkish. For many years, declining long-term interest rates have bolstered the value of apartment properties, causing cap rates to decrease but the correlation between the two is not particularly strong.

Due to the short duration of a typical apartment lease, owners and operators are uniquely positioned to reprice their rents to keep up with inflation. While the consumer price index (CPI) rose 7.1 percent year-over-year in 2021 and 7.9 percent in 2022, rents in professionally managed apartment buildings increased by 10.5 percent for new leases and 8.1 percent for renewals as of November 2021, according to NMHC research notes. However, at the same time, tenants’ discretional income is being impacted as they battle inflation at the grocery stores and the gas pump. The question now arises – will tenants be able to handle both increases in daily costs and rents? It is typical for 50 percent or more of income to go towards rents, but with the direction the economy is heading, the ratio may be pointing towards 65 percent.

If higher borrowing costs are offset by growth in rental rates and net operating income (NOI), cap rates should remain unchanged. In other words, cap rates can be thought of more as a real rate of return, which is affected by changes to the real interest rate. However, the change in interest rates will not dampen the availability of financing or the surge of investment. There is still a lot of investor demand in the market in addition to the national housing shortage.

What is Causing the Housing Shortage?

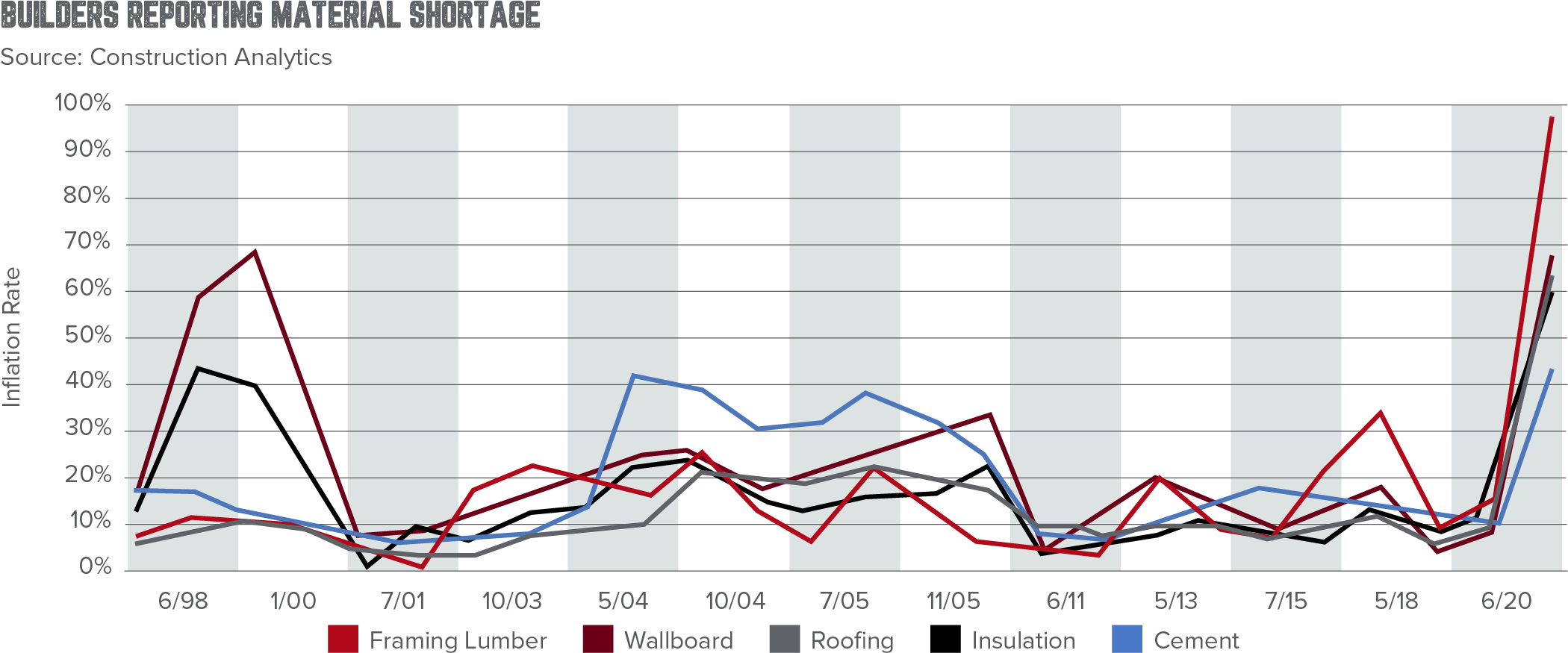

Currently, the country is facing a housing shortage caused by numerous factors such as supply and demand imbalance, supply chain shortages, high material prices, and a tight labor market. As policymakers and businesses look for solutions, developers and renters are becoming more and more burdened by increased pricing across all industries.

The industry is also plagued with delays from local municipalities, NIMBY sentiment, permitting, and entitlements, so developers face headwinds to complete projects on time and within budget. In a recent survey conducted by NMHC, a constant response was the widespread lack of materials when asked what impacted construction the most. For example, 75 percent of multifamily developers report construction delays in their jurisdiction, up from 57 percent in October 2020. The good news, multifamily absorption across the country persists. According to RCA, in the four quarters of 2021, apartment starts totaled 630,000 units, just 4,200 units less than the peak level seen in the prior quarter.

Does Multifamily Serve as a Hedge Against Inflation?

Commercial real estate is generally a fantastic hedge against inflation because it holds intrinsic value, is in limited supply, and is a yielding asset. Multifamily is one of the best performing asset classes in commercial real estate because lease structures in multifamily are far better positioned to benefit from an increase in inflation. To illustrate, other commercial real estate assets might have lease durations of five, seven, or even ten years, but multifamily leases can be reset every month, six, nine, or 12 months. As the leases reset, owners/operators in select municipalities can reprice rents as prices increase.

Similar to the purpose of grocery stores that ensure everyone has food, multifamily ensures everyone has a roof over their head. There is also tremendous friction (cost, effort, and time) for people to move.

What’s Next for Multifamily?

In the coming year, multifamily will continue to outperform as an asset class. Investors will eye properties in red states with less regulation and where landlords have the upper hand. They will also target value-add properties in core areas as demand is still present. It is anticipated that the change in interest rates will not dampen the availability of financing or the surge of investment. There is still a lot of investor demand in the market in addition to the national housing shortage. During an inflationary period, multifamily assets tend to perform well because they can always increase rents as units turn at the end of their lease. One will want to keep a close eye on investors that have debt coming due within the next 12-18 months and have struggled in growing net operating incoming since purchasing or refinancing. It is anticipated that investors who are highly leveraged will be in a very tough position as they will either need to bring capital to the table to satisfy lenders requirements or have to dispose of the asset. Some operators have struggled growing their net operating income over the last couple of years due to COVID-19, which will result in some difficult decisions that have to be made for the future of the asset. It’s also important to note that with interest rates rising, cap rates may follow.