Revenge Travel

Hospitality’s Rebound

Years of lockdowns, restrictions, and limitations have consumers eager to get out and explore the world again. Packing up bags, hopping on planes, or hitting the road, people are itching to vacation and travel no matter the long wait times or headaches of cancellations. With travel and tourism back at all-time highs, commercial real estate’s hospitality sector is thriving, recovering quickly from the detrimental effects of COVID-19. But with purchasing power down, will the influx of travel hold as consumers tighten the purse strings? Hospitality’s miraculous recovery is promising, but what should investors look out for as discretionary spending weakens and families begin to shift budgets?

“Analysts say vacation-starved Americans are making up for lost time during the pandemic, and there’s even a new term for it: revenge travel. Revenge Travel: slang term for leisure travel that follows a period of being unable to travel. Specifically, the term originated to refer to vacationing following the lessening of COVID-19 restrictions. “- NPR

Bookings Bounce Back

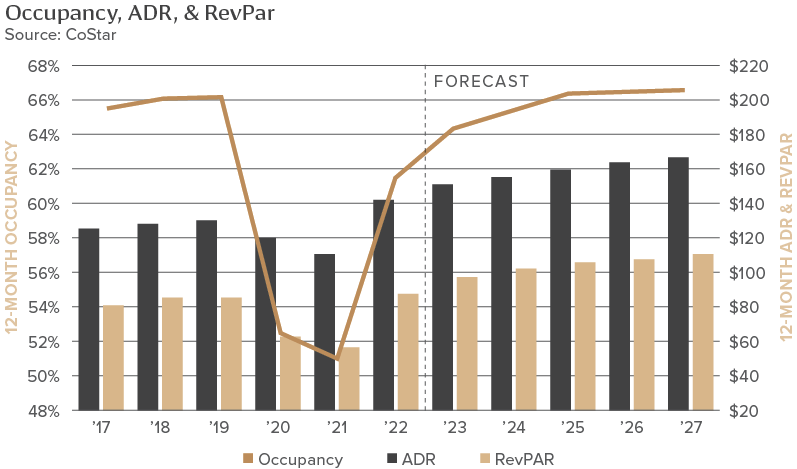

Continued improvement in travel has helped hospitality recover rapidly, posting fundamentals that surpass 2019 stats in some markets. Revenue per available room (RevPAR) is performing well, with nominal RevPAR up 30 percent year-over-year. The 12-month average daily rate (ADR) is also strong at $142.09, according to CoStar. Short-term rental RevPAR is above 2019 numbers as well in 140 defined markets. Defined as furnished properties that are available to rent for a limited time, short-term rentals are now considered a subsector of hospitality real estate.

Although the hospitality sector fundamentals are higher than in previous years, it’s important to note that recent inflation rates have made it difficult for operators to match 2019 profit. Experts predict profits will meet previous levels by 2025 as inflation weakens.

“Demand for hotel rooms through the first half of 2022 matched bookings from the same period in 2017 and 2018, and only 3% lower than 2019’s bookings”. – CoStar

Occupancy has remained steady at 62.8 percent and above 70 percent for several weeks in major tourist destinations like Los Angeles, San Diego, New York City, Seattle, and Oahu. Full-service hotels, hotels that offer supplementary services like food and beverage, fitness room, gift shop, etc., are seeing business travel return but at a slower rate than it was pre-pandemic. However, corporate and networking events have bounced back, making up for any lost profit.

“Over the last few months, the difference between the monthly group room demand for high-end meeting hotels has been only 1 million group rooms, when compared to the same month in 2019”- CoStar

Betting Big on Hospitality

Transaction activity for the hospitality sector hit a record high in Q2 22, with the $17.8 billion sale of MGM Properties LLC making up a large portion of the total sales volume. Investors are confident that hospitality is back with a vengeance, providing security and high yields. Below is a SWOT analysis of the hospitality sector and what investors should consider while making an investment decision.

Travel’s Biggest Threat

With revenge travel being hospitality’s biggest opportunity, its absence is the industry’s biggest threat. The hospitality industry relies on a high percentage of the population having disposable income, which is threatened by the current economic climate. As inflation rages on, travel will become less affordable for average-income families. Without high levels of travel, hotels and short-term rentals will struggle to keep rates as high as they currently are in a high-demand market. It’s unclear whether the rebound of travel will outpace inflation, but so far, inflation’s impact has yet to be seen, and travelers are charging ahead with plans.

The hospitality sector is both challenging and rewarding. Hotels and short-term rentals offer immense opportunity, giving customers an escape from everyday life that can go for a high price tag, even in difficult times. Hospitality’s resilience is unmatched, and as consumers shift budgets, some will continue to make travel a priority, especially in major markets.