Car Wash Industry Overview

In just a few short years, car washes have become a popular asset among net lease investors. As a service-based business, it is naturally internet-resistant, provides high profit margins, and requires minimal labor. Thus, it has also become increasingly attractive for investors seeking secure long-term, passive investments. With increased consolidation and rapid development in the car wash space, supply has increased significantly, and investors have become more comfortable with the product type. During COVID-19, real estate investors began flocking to the safety of the asset type.

Car washes were once a labor-intensive model, taking up 45 minutes of a consumer’s time to wash their car thoroughly. Now bolstered by technology, car washes have transformed into conveyor-style express car washes, taking about ten minutes to wash a car fully. Subscription-based memberships have played a big role in this transition, by allowing operators to generate recurring revenue and loyal customers by offering unlimited monthly washes to the customer.

Self-Service Car Wash: These are manual car washes, where equipment is provided to the customer to clean the car themselves.

In-Bay Automatic Car Wash: These are contactless car washes, where the customer remains in the car and machinery performs the cleaning process. There is rarely labor onsite.

Flex-Service Car Wash: A hybrid model that offers the automated express wash conveyor and full-service detailing option where employees will detail the car’s interior.

Express Car Wash: The most automated car wash that features a tunnel wash using a conveyor belt to move the vehicle through the tunnel and often offers self-service vacuums at the exit.

Full-Service Car Wash: Once dominating the industry, full-service car washes are now on the decline. Using the most employees and manual labor, they boast the highest price for customers.

The Rising Star – Express Car Washes

Express car washes are the fastest-growing segment within the car wash industry. Full-service car washes are very high-contact in terms of people in and outside their car, forcing customers to rethink how to get their cars cleaned. The express model takes less than three to five minutes to wash cars and offers minimal to no interaction with other people. According to Grand View Research, the in-bay car wash segment held a revenue share of more than 42% in 2022, dominating the car wash market.

Why Private Equity Targets Express Washes

Private equity groups have been flooding the express wash market, which has led to increased consolidation. These equity groups purchase a car wash portfolio and then sell the real estate through a sale leaseback transaction, which has created a large market for NNN car washes.

Profit Margins – Express car washes have significantly high-profit margins when compared to other business models. An NYU report on U.S. margins revealed the average net profit margin is 7.71 percent across different industries. In some instances, profit margins for express car washes can range from 40 percent to as high as 60 percent, an astounding comparison to other business models.

Subscriptions – When analyzing the risks of owning a car wash, one glaring risk is the weather and seasonality. The weather highly influences car washes as most consumers do not wash their vehicles if the weather will soon dirty their car. The monthly subscription model mitigates the weather risk associated with owning a car wash. By allowing the consumer to get unlimited washes, they have the opportunity to wash their car at any time without worry.

Sale Leasebacks – These transactions could possibly be the most attractive factor for the equity groups buying express car wash businesses. Large car wash operators will recoup a significant amount of their investment in the business by executing long-term leases and then selling off the real estate to a private investor. This process allows big operators to leverage their strong corporate guarantee and cash in on the value of their real estate.

Recent Activity

A Grand View Research report found that the global car wash services market was valued at $15.21 billion in 2022 and is expected to reach $23.79 billion by 2030, at a CAGR of 5.7% during the forecast period. IBISWorld reported that there are currently 56,773 car washes and auto detailing businesses in the U.S., which showcases an increase of 0.4% compared to 2022.

More than 8 million vehicles are washed at car washing establishments each day. Source: Grand View Research

Recently, private investors have been drawn to car washes for their attractive lease structures and depreciation benefits. New sale leasebacks are typically absolute NNN, with no landlord responsibilities. Furthermore, they have long-term leases, averaging 15 to 20 years, with annual rent increases that provide a hedge against inflation. Car washes are often offered below replacement costs of the building and businesses. Express washes typically cost anywhere from $3 million to $5 million to develop, and this cost is rising.

Moreover, net lease car washes have attractive depreciation benefits. The Tax Cuts and Jobs Act, under Section 179, permits car wash owners to deduct all first-year expenses for new equipment. Section 179 also accelerated depreciation over 15 years, as opposed to 30 years. The only other net lease property that compares to this depreciation is convenience stores with gas stations.

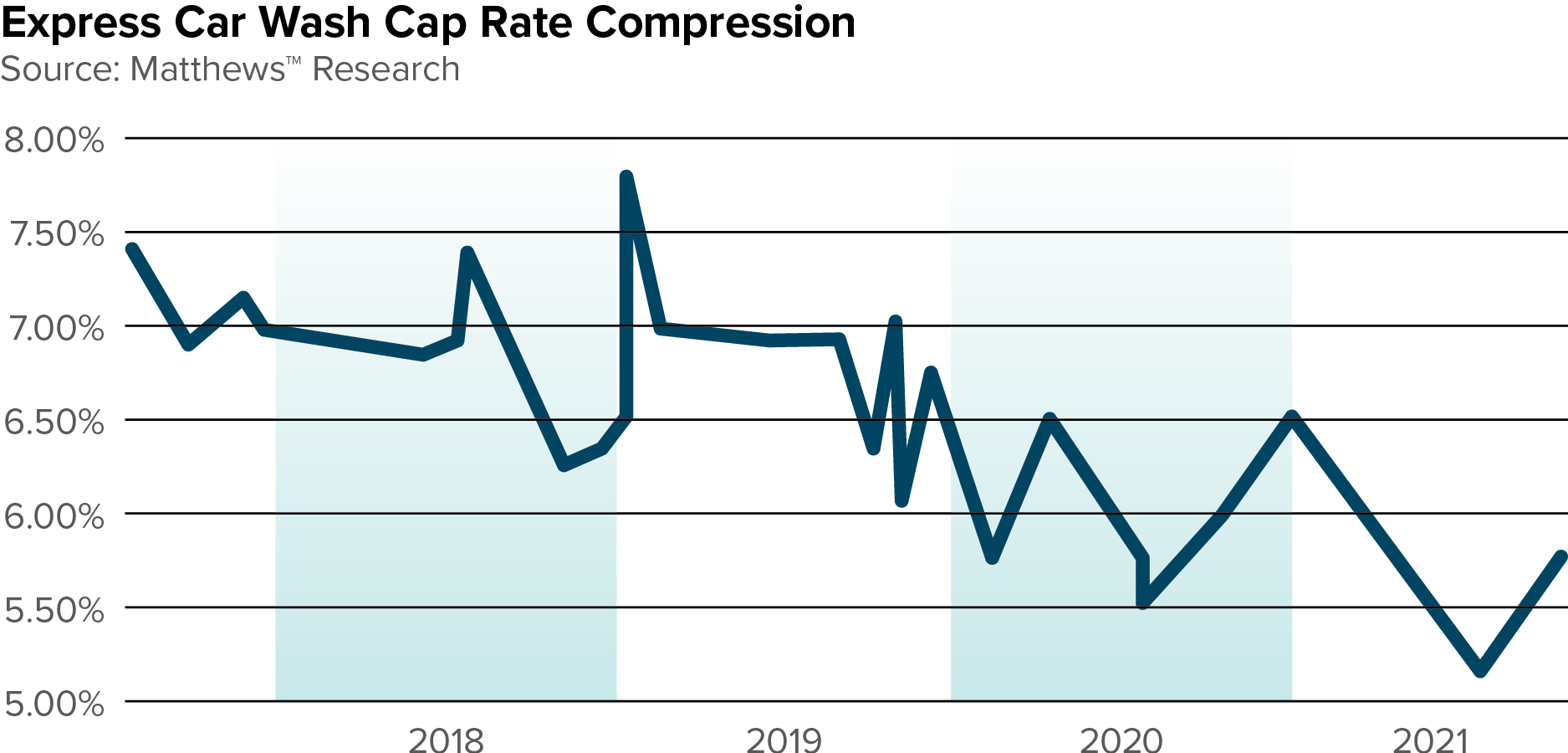

Due to their natural resistance to e-commerce and being a service-based model, cap rates for car wash properties are at historic lows and are projected to compress in the future.

Development Trends

With the flood of private capital entering the industry, car washes are expanding through ground-up development, redevelopment, or consolidation of smaller car wash chains. However, developers will find that car washes need multiple permits, including landscaping, demo/grading, and a Stormwater Pollution Prevention Plan, among others. While zoning varies from city to city, it is the most significant barrier to car wash development and can take years to resolve in some cases. As a result, it has become increasingly common for investors to target a site with a car wash already in place and then redevelop or update it into the new highly demanded express wash model.

Targeted Markets

Backed by private capital, car washes are growing in several markets across the U.S. Customers view car washes as an essential service, with the average customer visiting a car wash twice a month. Experts believe the car wash market is not yet saturated, claiming there is still room for growth in many markets. Along with California and Arizona, the Southeast has been heavily targeted in Georgia, North Carolina, and South Carolina. The markets seeing the most saturation in big operators are Atlanta and Phoenix.

Once a segmented industry dominated by small, independent owners, car washes are seeing heightened interest from private equity due to high-profit margins, monthly consumer subscriptions, and sale leaseback opportunities. This activity has created a large market for net lease investors seeking secure long-term, passive investments. This sector will likely continue to grow and gain popularity among real estate investors. Car washes’ scalability has been compared to other net lease retail properties, including dollar stores, quick-service restaurants, and convenience stores.