CLICK HERE TO DOWNLOAD

Investor confidence has begun to return to the market, and desperate for stability, society is moving towards a new normal. A new real estate market is on the horizon, and Matthews™ is committed to keeping investors informed on current market conditions by breaking down CRE trends and the movements investors should keep on their radar.

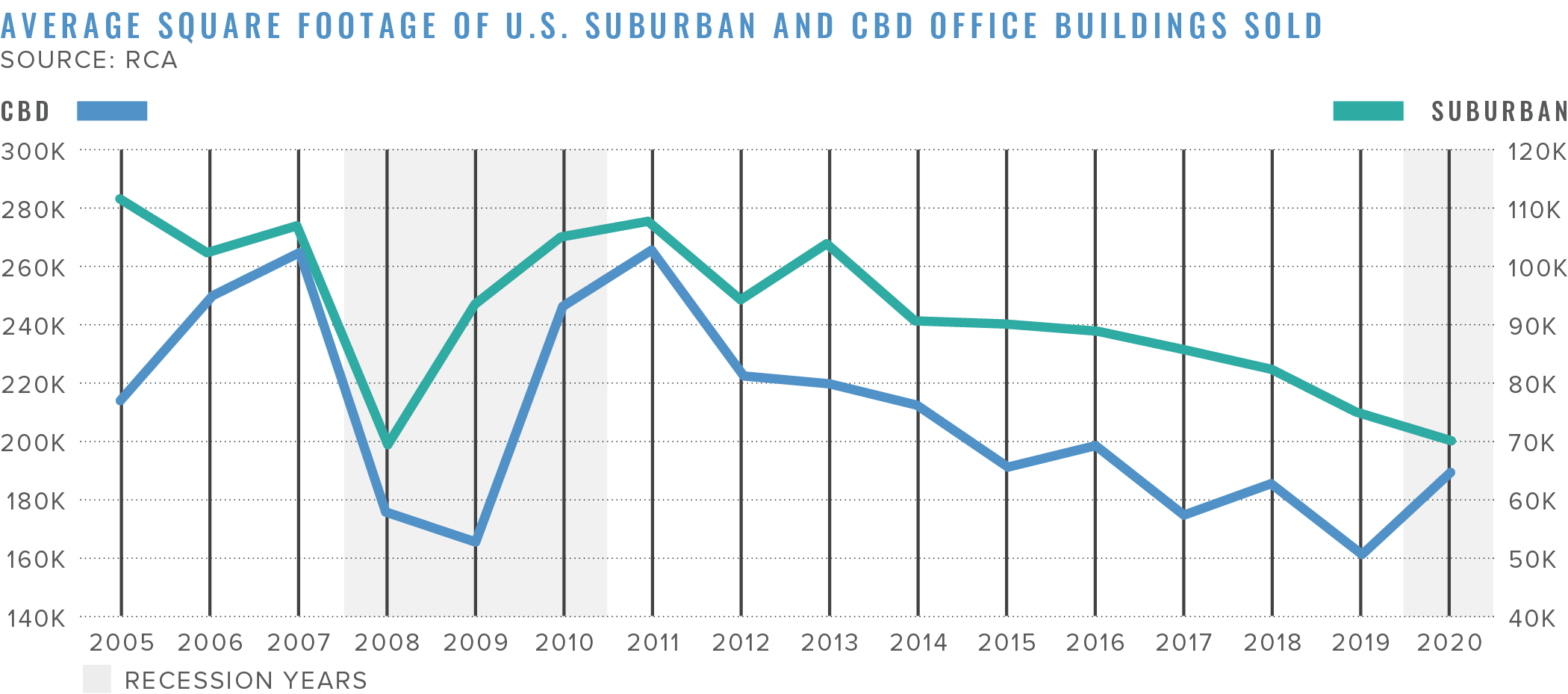

Trend #1: A New Norm & Rebound for Office

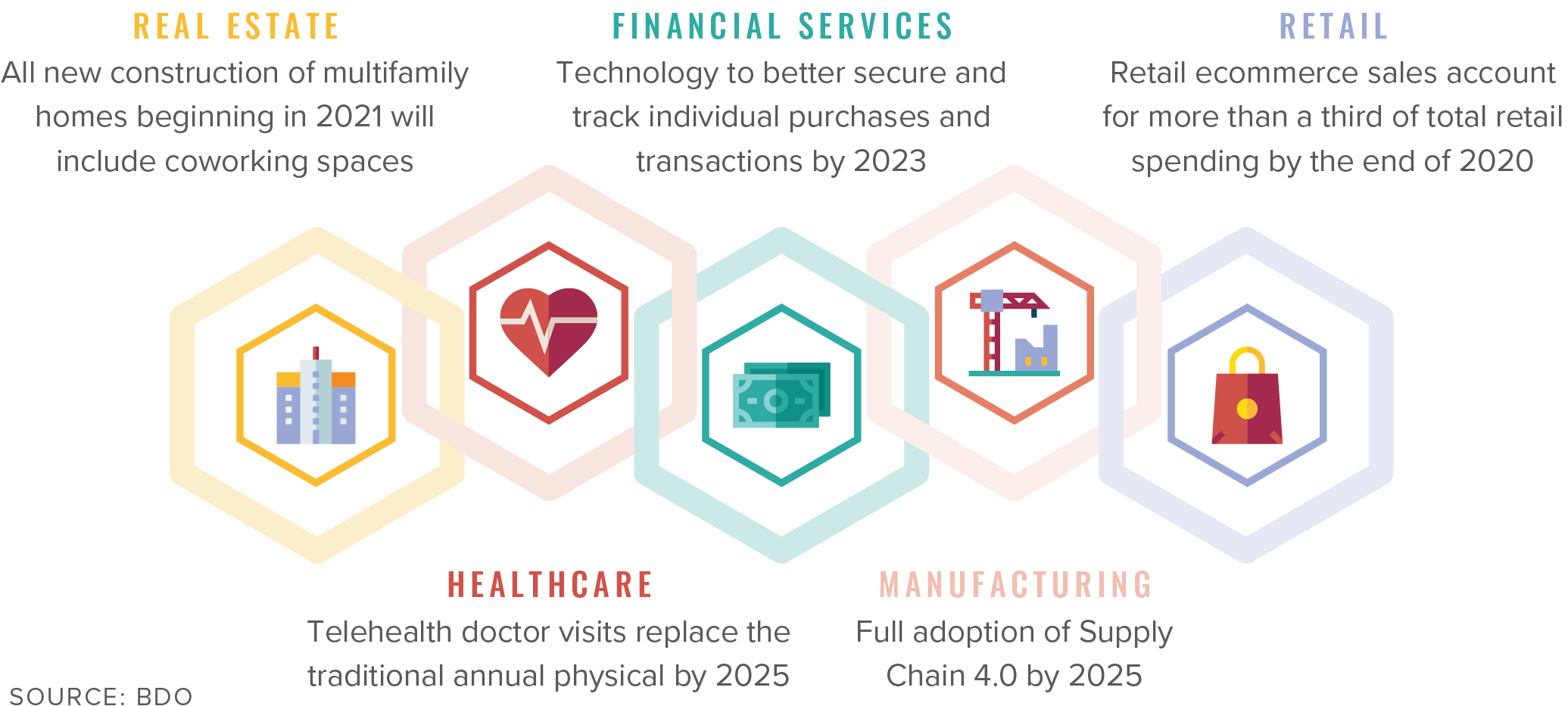

The coronavirus pandemic will have a lasting impression on the future of the workplace. Tenants are reevaluating workplace flexibility and space planning needs. The pandemic has ultimately changed how people work and how businesses get work done. We are in the midst of the largest remote working test in history. A recent Gartner poll showed that 48 percent of employees would likely work remotely at least part of the time after COVID-19 versus 30 percent before the pandemic. Landlords are working to predict the new demand for office space, while improving building operations to meet current guidelines. Tenants may need less space, which will alter office configurations for the future. We already see floorplans and workstations being reconfigured to improve social distancing. Subleasing activity in unused office space has taken off, which will likely result in businesses opting for short-term and flexible lease structures. Co-working spaces initially took a big hit but quickly adapted and offered flexibility in spaces, shifting from trendy amenities to business-to-consumer platforms. Businesses and building owners that accommodate and emphasize their employees’ health and well-being, and are thinking beyond the re-opening process, will be the most successful through this transition. Site selection and occupancy will be primarily driven by strategic objectives, such as productivity, innovation, collaboration, workforce recruitment/retention, and customer access.

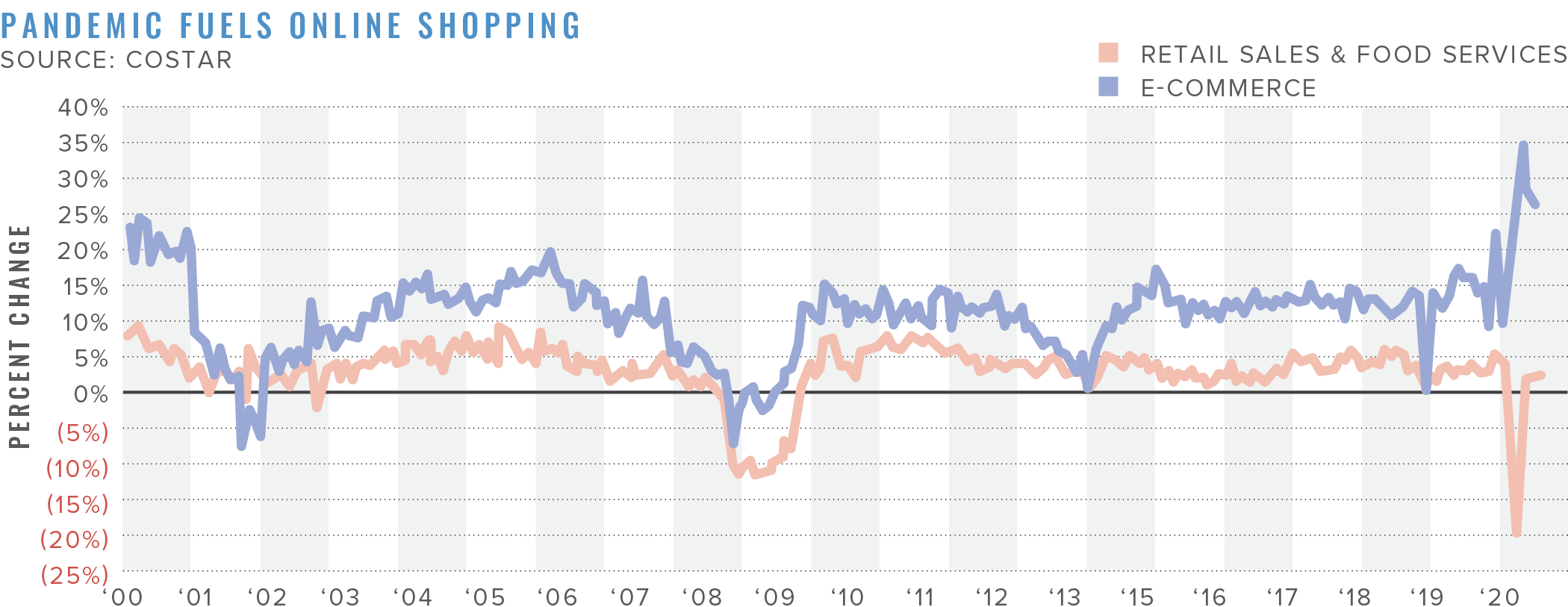

Trend #2: Industrial Fueled by E-Commerce & Teleworking

Warehouse, distribution, cold-storage, and data centers thrive in the COVID-19 environment as the pandemic is driving increased demand for these properties. Warehouse and distribution centers greatly benefit from the spike in e-commerce sales, and data and logistics centers see positive activity in direct correlation to the nation working remotely. In the first month of lockdown orders alone, Amazon cited a 26 percent increase in sales year-over-year, and e-commerce sales surged 32 percent in Q2 2020, according to CoStar. Amazon leads all commercial tenants in leasing activity, having leased over 40 million square feet of industrial space as of September 2020. The top 20 department stores currently occupy 101 million square feet of industrial space and will likely decline as department stores struggle and opt for sale leaseback negotiations to liquidate cash quickly. As e-commerce sales continue to rise and employees remain teleworking, data centers will continue to see similar activity. Data centers have enabled digital commerce and online meetings, making digital infrastructure more important than ever before. The demand for cold-storage facilities has also continued on an upward trajectory, given the impact from grocers, restaurants, and other food establishments. These tenants are requiring additional space to store frozen food to meet demand for home delivery and take-out orders.

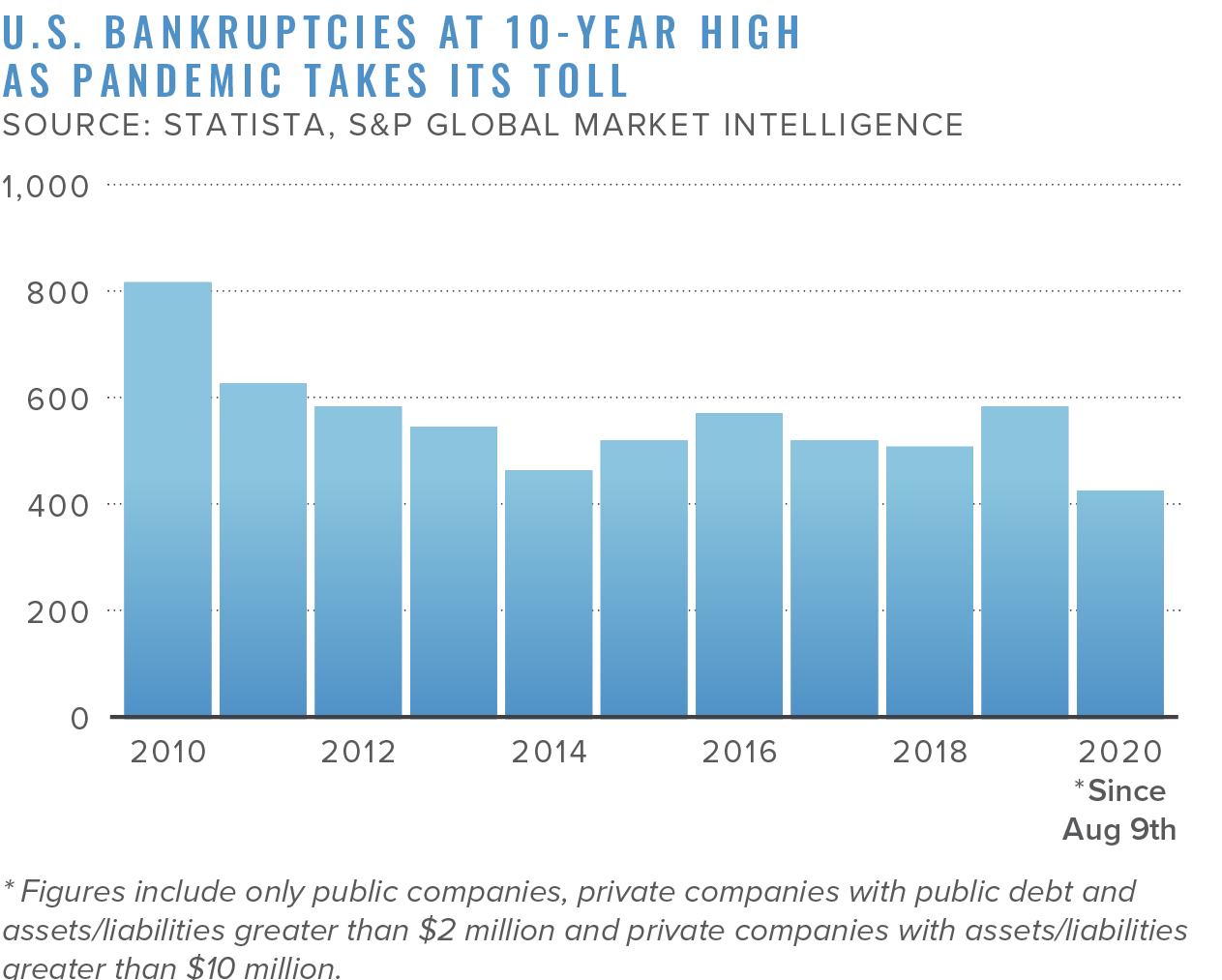

Trend #3: A New Face For Retail

As states across the U.S. ease restrictions on everyday activities, Americans are settling into a new routine. So, the question becomes, how must retailers adjust to the new normal to best serve the post-pandemic consumer. Retail was already struggling before the virus arrived. According to Cowen and Company’s research, over the past 50 years, the number of American malls grew almost twice as fast as the U.S. population, to the point that in 2015, the U.S. had ten times more shopping space per capita than Germany. In the U.S., retail is overleveraged, overbuilt, and over sprawled, which is hard to rationalize in the Amazon age. COVID-19 exposed these weaknesses, indicating a significant update is needed to revive the retail landscape. The introduction of COVID-19 caused many retailers to quickly pivot and accelerate several preexisting trends. As stores open, we see an increase in the symbiotic relationship between digital and physical. There has been a triple-digit increase in buy online, pick-up in-store (BOPIS) frequency throughout the pandemic, proving that the physical store’s role is shifting. Brick-and-mortar spaces will likely transform to create a seamless omnichannel experience, such as locations being converted to focus solely on fulfillment. COVID-19 will also accelerate big-business takeover for retailers such as Amazon, Walmart, Dollar General, Costco, and Home Depot, all of which had stock prices at or near record highs this year. Contactless shopping and payment and click-and-collect options are other trends that will dominate retail in the post-coronavirus environment.

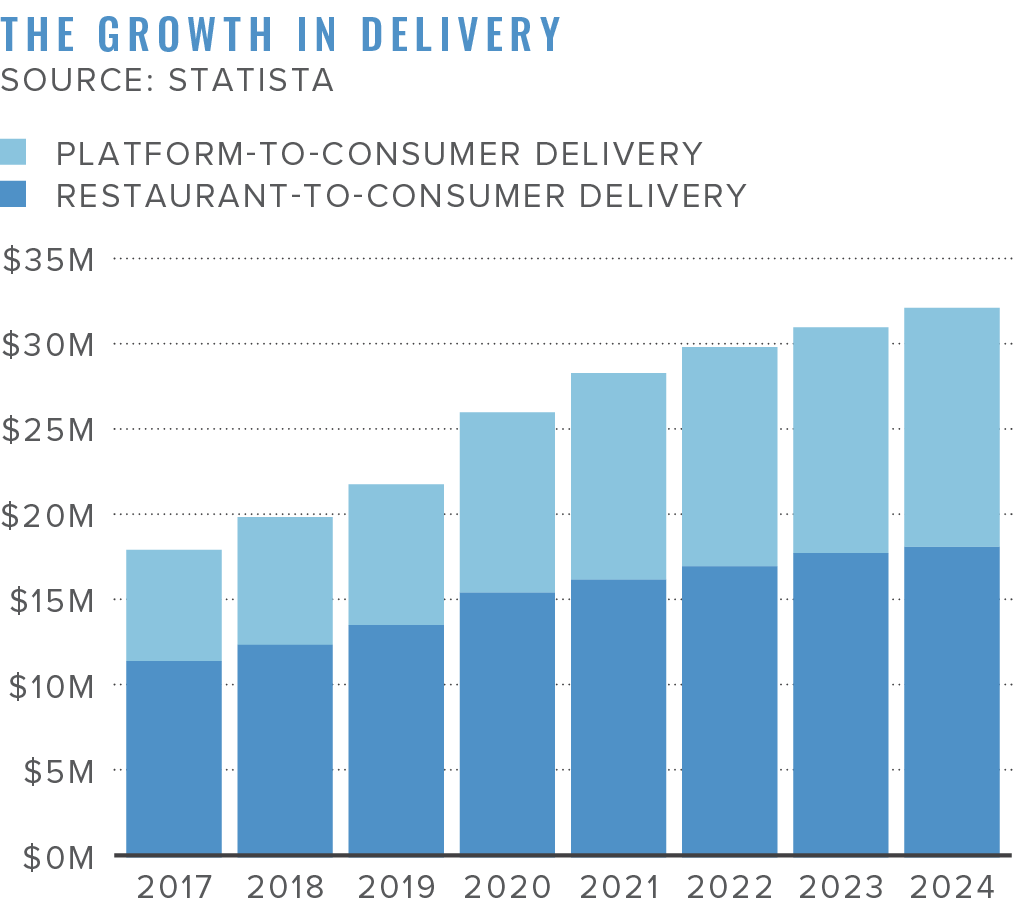

Trend #4: Restaurants Evolve to New Consumer Preferences

Restaurants have been quick to pivot. However, the road to recovery is long, with many bumps projected along the way. Americans, before the crisis, on average spent more money dining out than in grocery stores. Restaurant spending has now fallen by about 60 percent across the country, with the sharpest declines in fine-dining, lunch, and late-night food. Many restaurants have adopted digital offerings, such as scanning QR codes for menus and implementing third-party delivery. Consumers growing preference towards take-out and delivery will result in restaurants investing in curbside service, drive-thru, and pick-up window options. Patios are becoming a widespread preference for diners and will likely cause dining room footprints to decrease as outdoor dining continues to grow. Supply chains will become more localized following the disruptions brought on by COVID-19. Further, when franchisees search for a concept to invest in, they will look to how franchisors responded to COVID-19. Other restaurant trends include ghost kitchens, also known as dark kitchens or virtual kitchens. This concept will trim the costs of real estate, labor, delivery, and menu innovation by condensing the restaurant model to accommodate off-premise food sales without a traditional dine-in space. The restaurant space we knew before COVID-19 will be sure to evolve as consumer preferences adjust to the new dining norm.

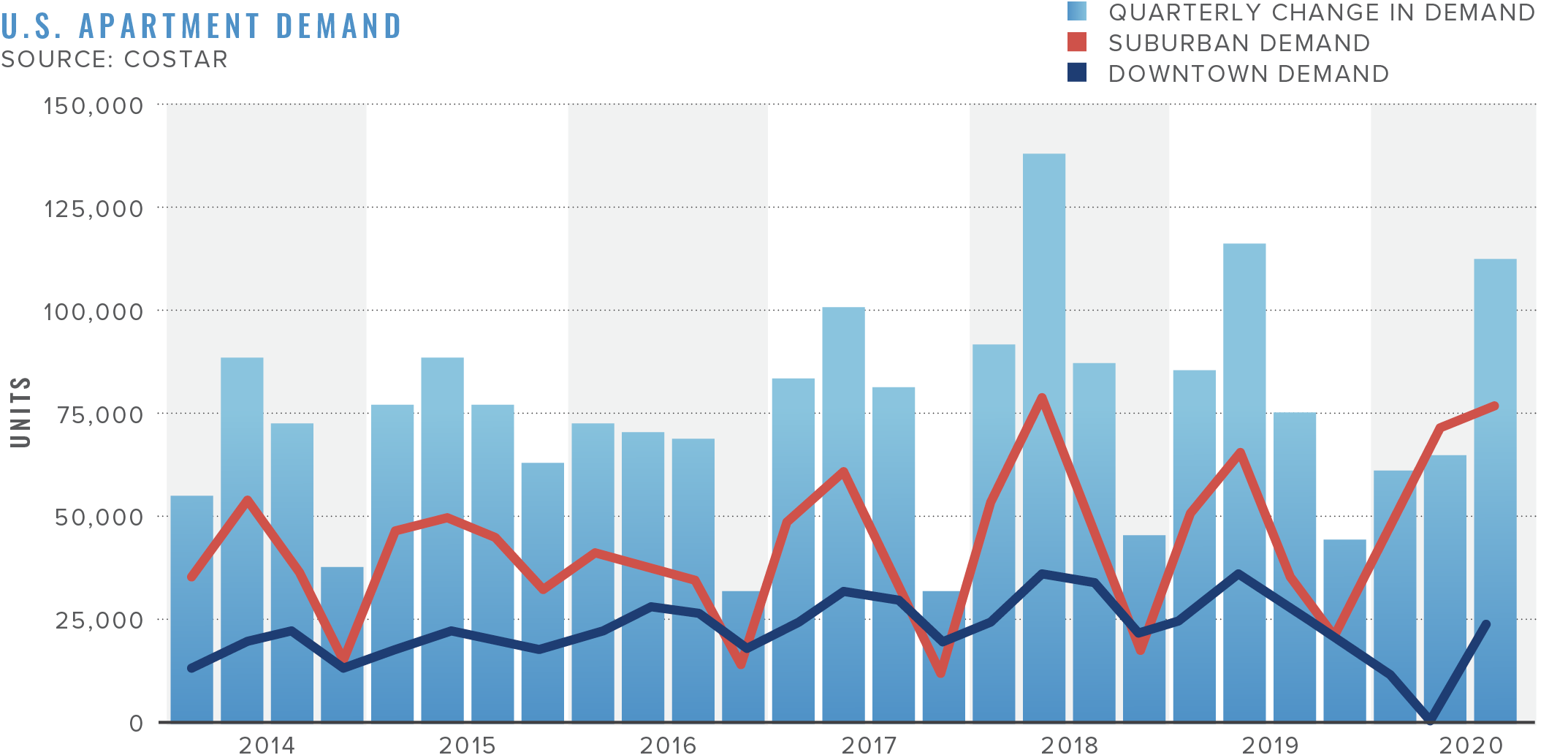

Trend #5: Multifamily Tenants Migrate to Bigger & More Affordable Units

Industries, regions, and CRE sectors will recover at different speeds, with many renters seeking cheaper markets. For a while now, developers have focused on building apartments in the urban core to meet the demand from boomers and millennials, who wanted to live closer to the action. Apartment units have served various purposes to renters during the pandemic, not only as a home but also as an office, gym, and more. Renters, who fell victim to the virus’s impact on the economy, struggle to pay rent, and in response, moved home or to more affordable suburbs. As companies worldwide enforce teleworking practices, renters desire to live close to work has diminished as it is no longer necessary to commute. Unfortunately, apartments have been moving towards smaller units. PGIM Real Estate says the percentage of studios and one-bedroom units in newly completed buildings has risen significantly. By 2018, these floorplans were more than 50 percent of all units completed. Even with higher concessions, the firm says rental growth for studios and one-bedroom units have outpaced two or more bedroom apartments in most markets. In response, the suburbs are positioned as the best alternative, offering bigger spaces for less rent. Downtown landlords are fighting this shift by slashing rents by as much as six percent in some areas. According to CoStar, apartment demand has picked back up, with sales volume reaching $18 billion for Q3 2020. However, the majority of the absorption during that same time was in the suburbs. Now that millennials are aging, suburban apartments could enjoy more robust demand. According to the U.S. Census Bureau, the population of people in their 30s will increase by 7.1 percent by 2025, while the rest of the population will only grow by 3.8 percent. With an aging millennial cohort accepting telework, apartment building demand and construction will likely increase in suburban areas. Large unit sizes may become much more popular in the next generation of new developments.

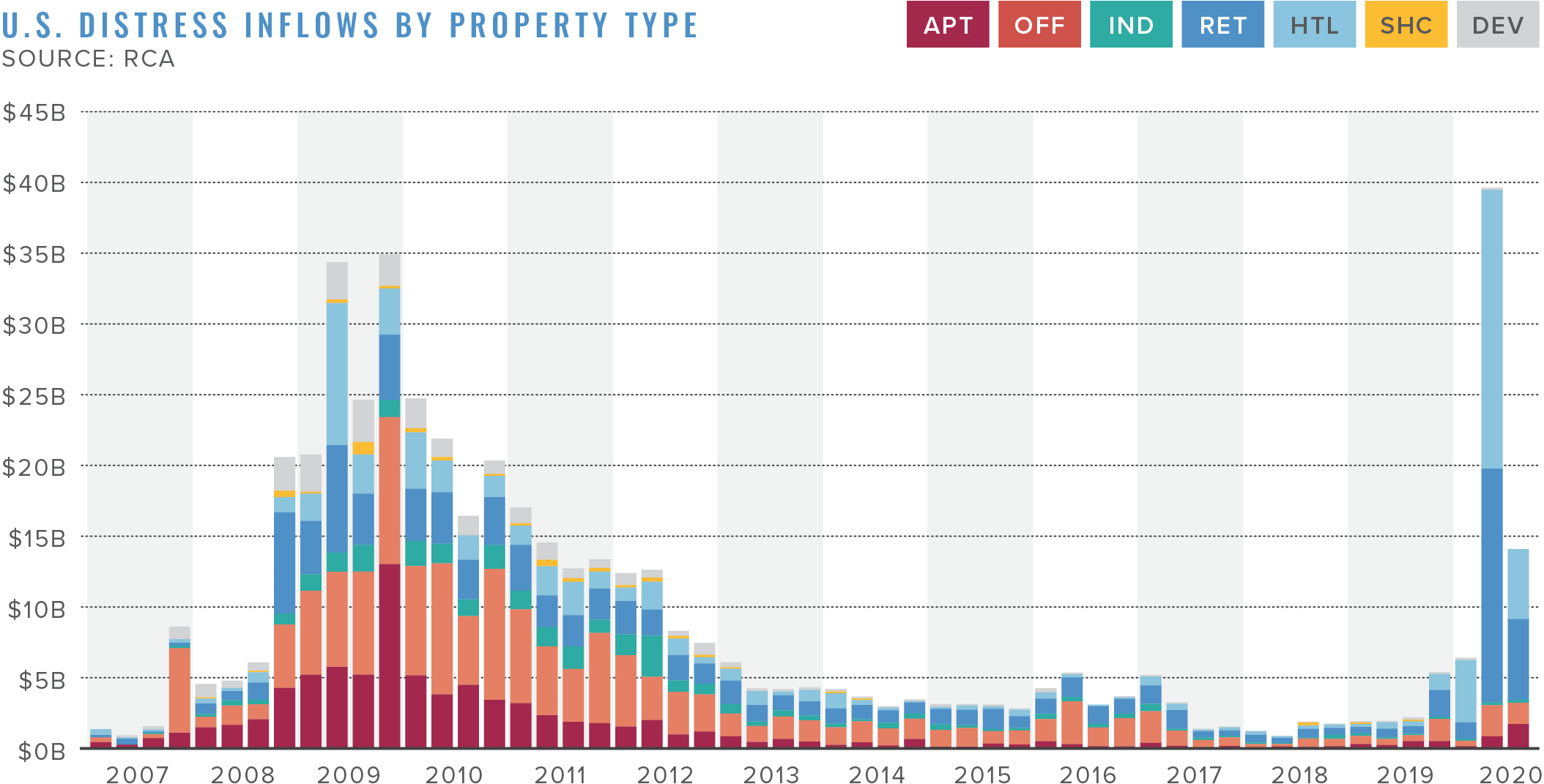

Trend #6: Adaptive Reuse is on the Rise

Thrust into the spotlight is adaptive reuse, the use of existing buildings to serve newly relevant purposes other than which they were originally built or designed for. Although repurposing buildings was popular before COVID-19, adaptive reuse is a tactful and sustainable approach for aging cities that have fallen victim to the pandemic. In the wake of economic fallout from COVID-19, urban centers could see a sharp increase in abandoned spaces as businesses are forced to close. It is unlikely that these once-popular spaces will sit idle due to the prime location and population metrics; instead, spaces left vacant by COVID-19 presents an opportunity to repurpose buildings and breathe new life into cities. COVID-19 is thought to be accelerating transitions that had already been occurring in the commercial real estate space. The future will likely hold more creative developers who will repurpose properties for their next use. Malls, for example, may have numerous other advantages for conversions to other services including, medical organizations, assisted living facilities, multifamily, or even industrial facilities. Shopping malls are typically near public transit and bus lines, which provide opportunities for repurposing projects. There is a complete revolution of retail and commercial space on the horizon, especially for restaurants. Offices are another place for ripe change, which could be repurposed into multifamily or condominiums. According to Rent Café, 65 percent of these adaptive reuse projects are aimed at middle and lower-income renters. Due to a lack of space and housing shortages, commercial-to-apartment conversions could be the solution to fix the housing crisis.

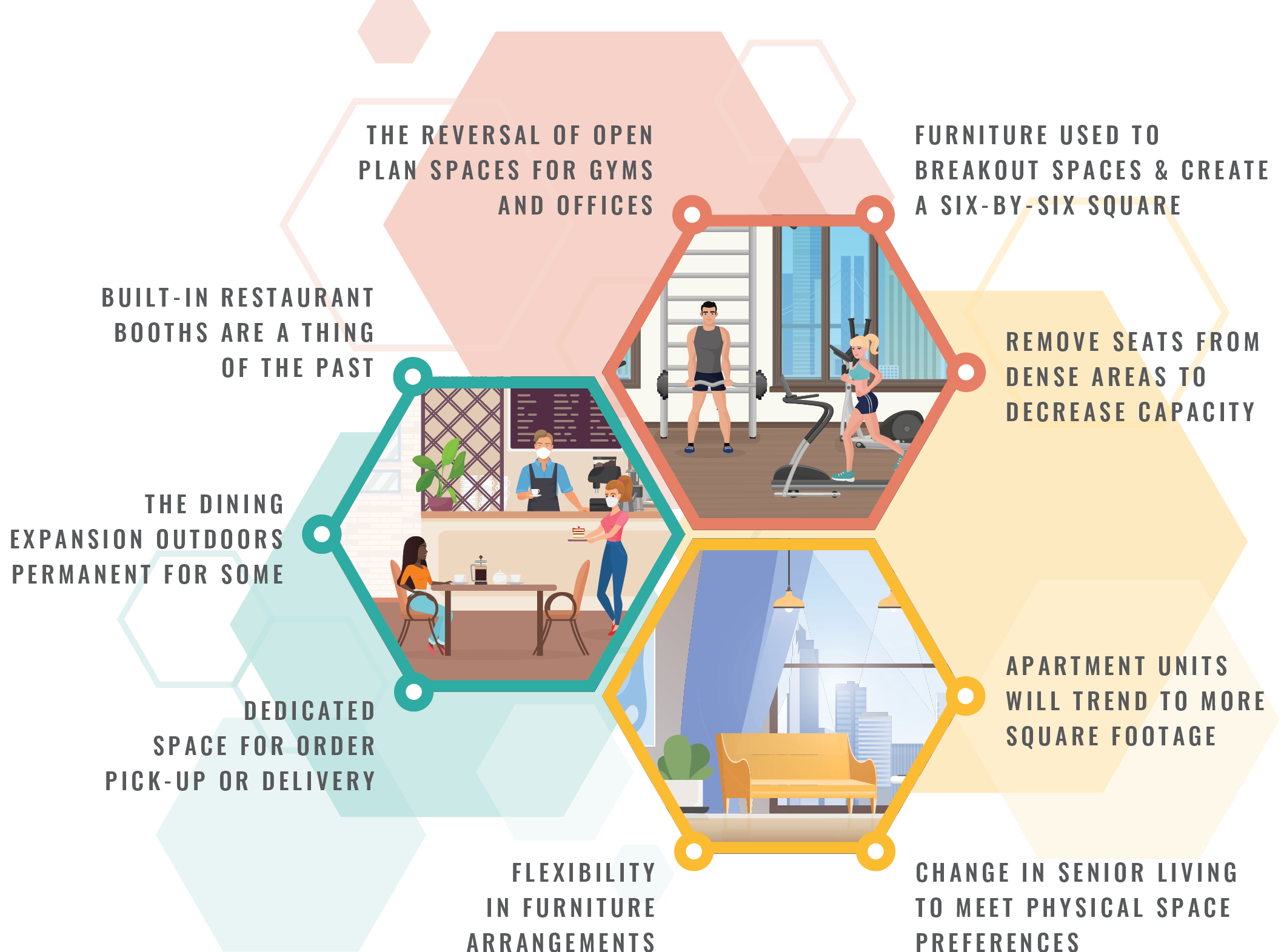

Trend #7: Space Adjustments Across CRE

The pandemic has directly impacted space demand through quarantines, social distancing, shutdowns, supply chain disruptions, employment loss, and a shattering of consumer confidence. Social distancing has changed the way people interact with physical space. We already see renters moving to the suburbs in search of more square footage and retailers adjusting space to comply with CDC guidelines. Real estate owners and operators across almost every asset class consider several potential long-term effects of the coronavirus outbreak and the changes that these shifts are likely to bring. The pandemic effects have made the demand for many types of spaces to go down, perhaps for the first time in modern memory. For example, office space may see open-plan layouts reverse and space decrease, restaurants will boast more flexible space options, senior living assets could change altogether to meet physical space preferences, and the physical store space could change. The shift to e-commerce may also further boost already high demands for industrial space. Niche asset classes, such as self-storage, could see an improvement in their unit economics as demand density goes up when more people work from home. In contrast, other asset classes like co-living may suffer due to limited personal space. According to YMA, public-health officials may increasingly amend building codes to limit future pandemics’ risk, potentially affecting standards for HVAC, square footage per person, and the amount of enclosed space required. Moving forward, we will see a significant change around what space is going to be useful and how that space is being used.

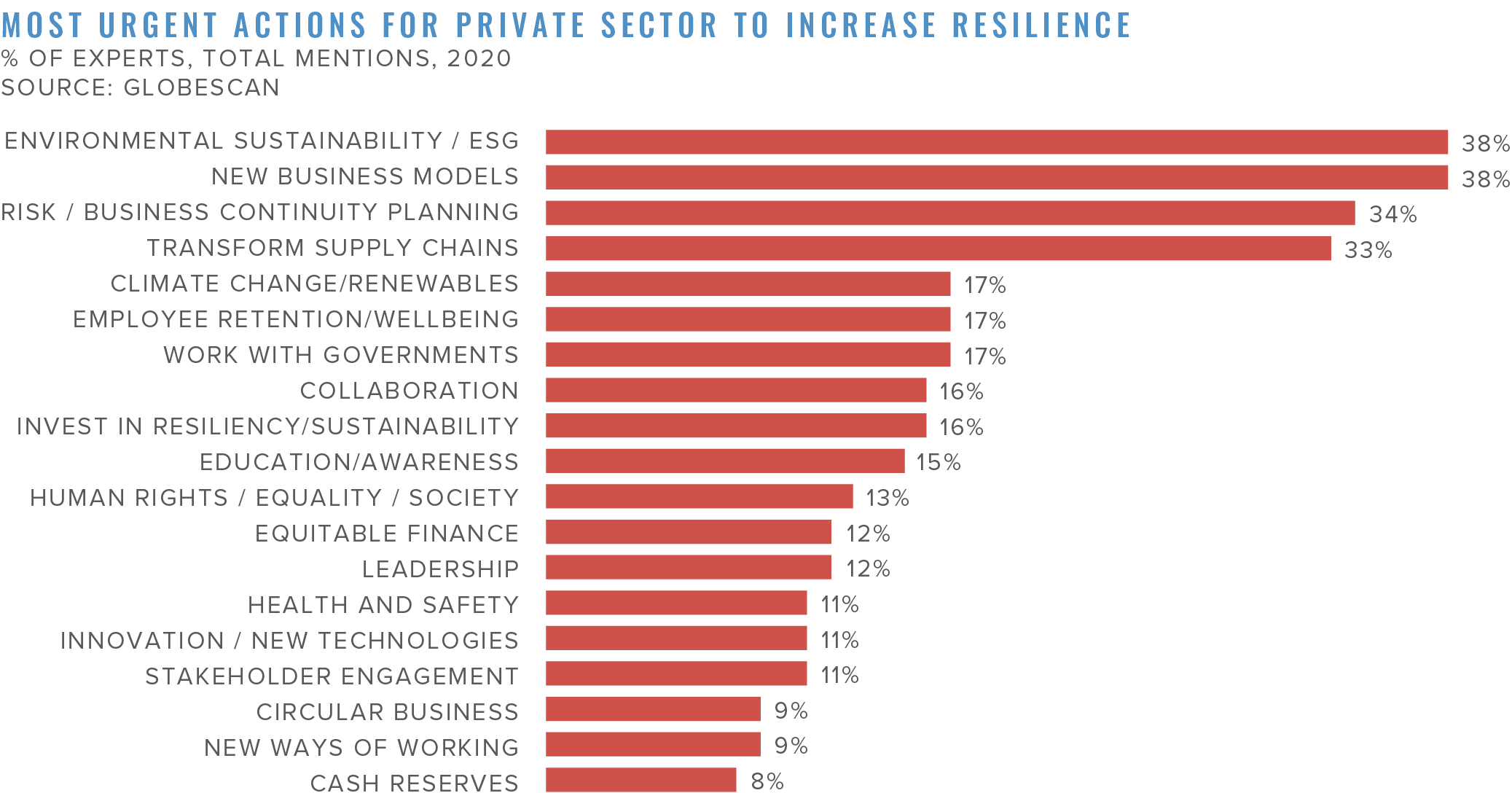

Trend #8 Sustainability & Transparency Develop During COVID-19

With a greater emphasis on corporate social responsibility and widespread use of new technologies, the commercial real estate industry is set on transparency being critical to sustainability. Highly transparent markets are driving the standards in sustainability. As companies increasingly demonstrate a commitment to corporate social responsibility during the pandemic, there is increased voluntary adoption of environmental, social, and governance measures and great acknowledgment of the need to create a sustainably built environment. The world has become increasingly concerned about climate change, and many commercial real estate professionals are beginning to recognize how buildings affect the environment. As a result, sustainability is playing a larger role in commercial real estate, which has led to growing demand for sustainable properties. Commercial buildings that do not meet modern standards for sustainability are costing landlords significantly. The government estimates that commercial buildings that utilize “green” principals can realize a 30 percent annual energy bill reduction. In contrast, those that do not employ these principals cost owners an accumulated $50 billion a year in excess energy use. Leasing decisions are also influenced by sustainability. Studies by Pew and Gallup show that consumers overwhelmingly support the sustainability movement, translating into renter preferences and demand for green buildings. This makes these properties more attractive to investors, which drives up sale prices.

Trend #9 Data & Property Technology Becomes Increasingly Important

2020 has quickly become the year where data and technology have played an essential role in the future of commercial real estate (CRE). Today, many CRE businesses face challenges similar to those of other industries – the need to do more deals, increase profitability, scale the business without an equivalent hike in cost and operations, and of course, remain competitive. Technology and data have increasingly played a large part in firms’ ability to innovate and make smarter decisions for their customers, tenants, or clients. Due to the growing magnitude of property technology, digital tools, and big data, the volume of real estate data is crucial to transparency. Although real estate markets have historically faced challenges when implementing new technology, the pandemic has led to an acceleration of new types of non-standard and high-frequency data usage in the CRE space. COVID-19 could fast-track digitization and stimulate innovation in the use of technology in properties due to the need for accurate and just-in-time data.

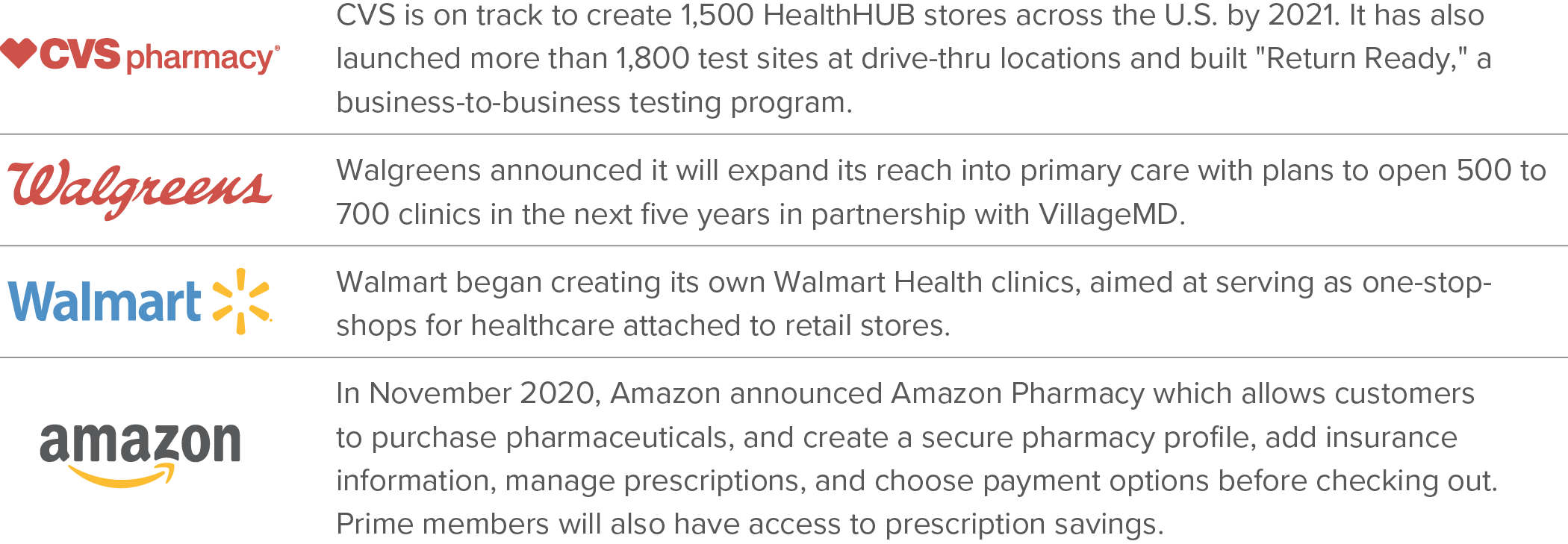

Trend #10 Health & Wellness Evolve CRE

Consumers have become primarily focused on a holistic lifestyle that includes health and overall wellness. The demand has given retailers, offices, and multifamily sectors the incentive to invest in health and wellness. This exciting growth category has been accelerated by COVID-19, directly influencing health patterns, practices, and consumer trends. This growing trend has also allowed healthcare to become more prevalent in retail environments. We see physicians now expanding their reach into retail. It’s becoming increasingly common for patients to get their weekly groceries or drop by their local Starbucks while waiting for a medical appointment. By investing in retail and multifamily properties located in proximity to designated wellness companies and brands, landlords can expect increased profitability. Finding well-appointed buildings near natural and organic restaurants, fitness facilities, and even nearby outdoor community green spaces can all influence a potential renter’s ultimate decision when signing a new lease. Health and wellness have also seeped over into the office space, where employees demand wellness benefits at their place of business. There is also a connection between wellness and property technology. Using smart building innovation, landlords can potentially help lower stress levels, boost morale, and provide an overall healthier environment for renters and customers.