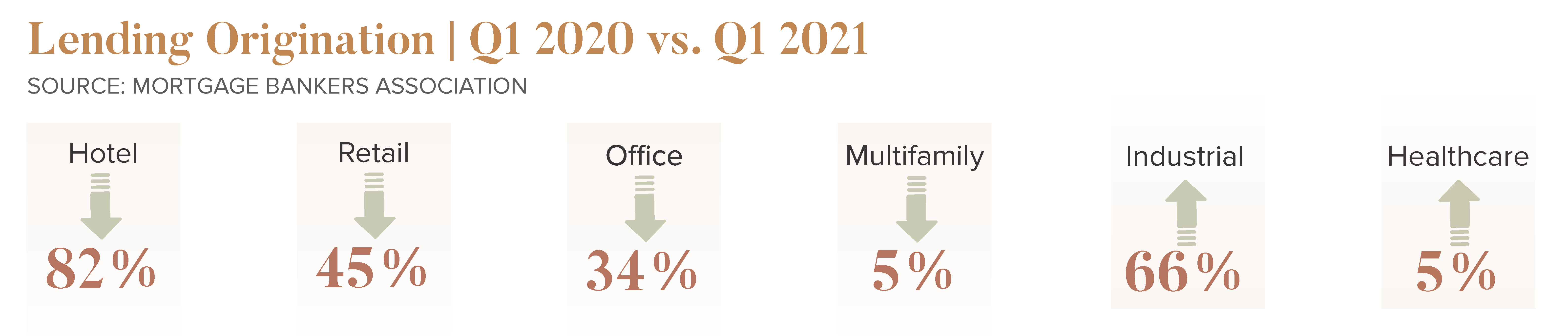

Commercial and multifamily mortgage loan originations decreased 14 percent in the first quarter of 2021 compared to the same time last year, according to the Mortgage Bankers Association. The good news, deal activity is climbing and lending conditions are improving as U.S. banks become more optimistic about the economic outlook for the second half of 2021. According to Real Capital Analytics (RCA), commercial property sales are up 73 percent from a year earlier in May. As the recovery matures, banks expect loan demand to increase.

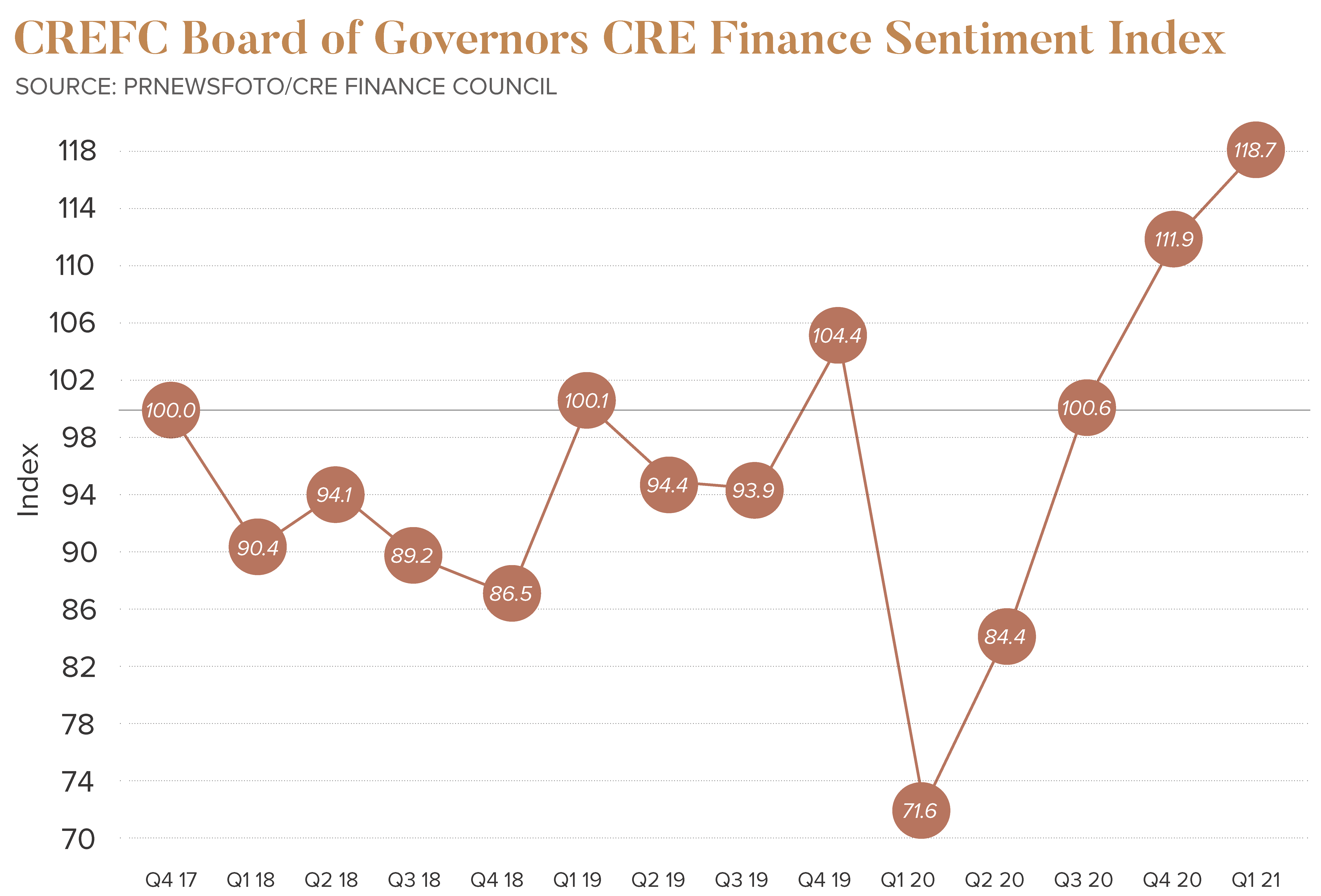

The CRE Finance Council (CREFC) reported a strong upward surge in a positive outlook for lending. 88 percent of CREFC board members expected overall lending to be higher in 2021 than 2020, with more than half (56 percent) expecting volumes for full-year 2021 commercial and multifamily real estate lending to increase by at least 20 percent over 2020’s tally. The BOG index equally weights the responses to questions regarding the overall lending environment and then sums those weighted responses to create a single index.

Increased Liquidity

One year ago, the economic environment was vastly different than what it is today. Last summer, people nationwide saw no resolution in the slowing spread of COVID-19 as the pandemic resurged in many major markets. Furthermore, the pandemic’s effect on commercial real estate was still largely unclear. In response, traditional commercial debt providers slowed their lending pace and tightened their lending standards.

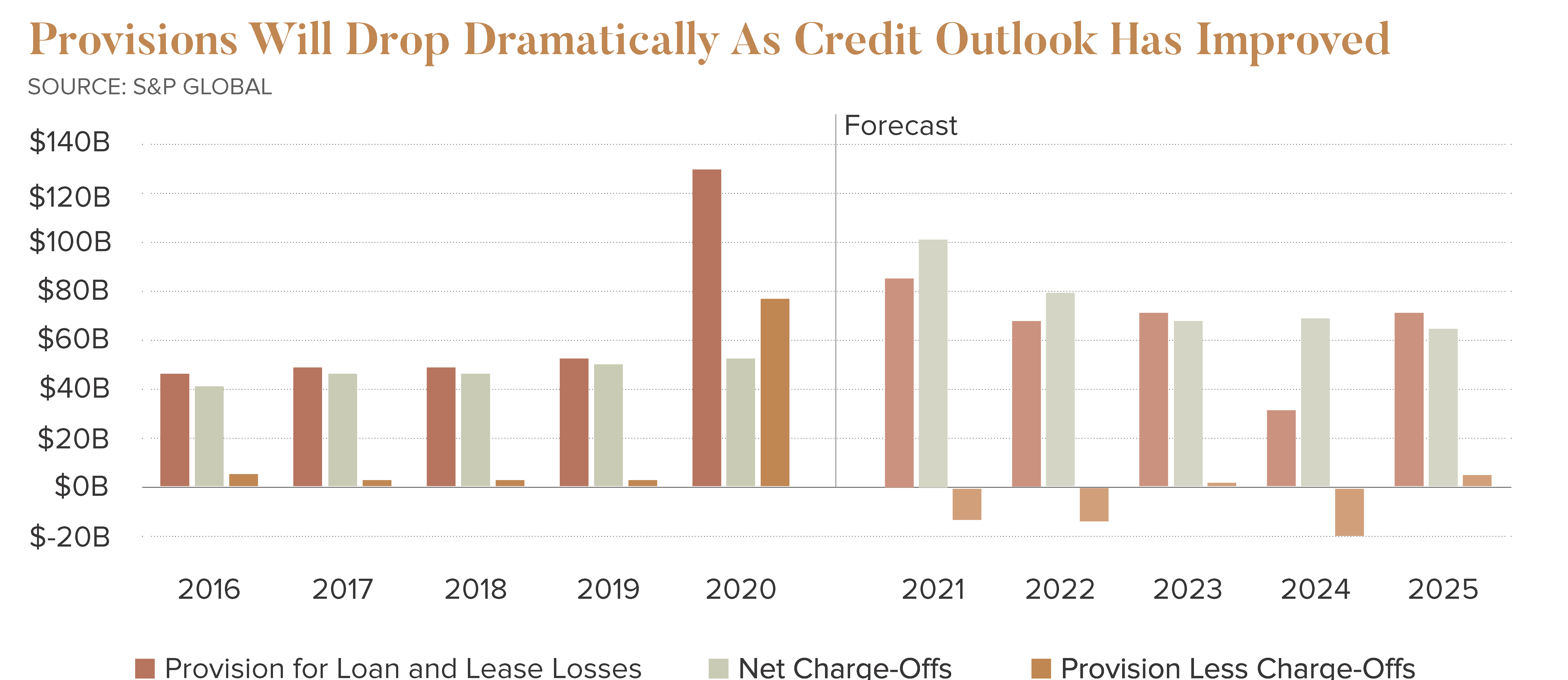

Large U.S. banks saw their loan books shrink until now. Despite a three to four-month lending stint in 2021, U.S. banks are now lending in full force. Besides the traditional players, newcomers are also entering the space, including private equity and debt fund vehicles; even operators are investing into parts of the capital stack. Considering the low-rate environment, investors are looking at the risk-adjusted returns, and these new debt funds offer decent yields. There is seemingly no end to capital markets’ reach these days as funds are granted for construction, office, and even hotels despite their poor performance in 2020. According to the Mortgage Bankers Association, industrial and multifamily properties continue to attract the most significant interest, scoring even better terms than pre-pandemic.

The Federal Reserve’s latest Senior Loan Office Opinion Survey on Bank Lending Practices showed that banks reported robust demand for construction and land development and multifamily loans. Multifamily fundamentals, including leasing and rent growth, have largely recovered from the pandemic, and lenders have noticed.

Multifamily Lending Trends

- An increase in bridge lending transactions

- A surge in equity & financing solutions

- A renewed emphasis on affordable housing

Lenders are also completing more office deals, even though the future is admittedly still unclear. A similar situation is seen in retail, where strip centers and restaurants are attracting funding. Furthermore, there is money available in the hotel space from an equity and debt perspective. Although it might take longer for corporate travel to return, leisure travel is returning reasonably quickly. Another niche product type coming out of the woodwork is self-storage, which proved more resilient to COVID-19 than expected. To say that competition is high in the debt market is an understatement. However, although deals are getting done in the office, retail, and hotel space, most of the capital is chasing specific asset types. Lenders focus on the tenants’ health, analyzing tenant financials and the resiliency of cash flow coming out of the pandemic. A fall in loan originations for hotels, retail, and office led to the overall decrease in commercial lending volumes.

Distressed Investment Popularity

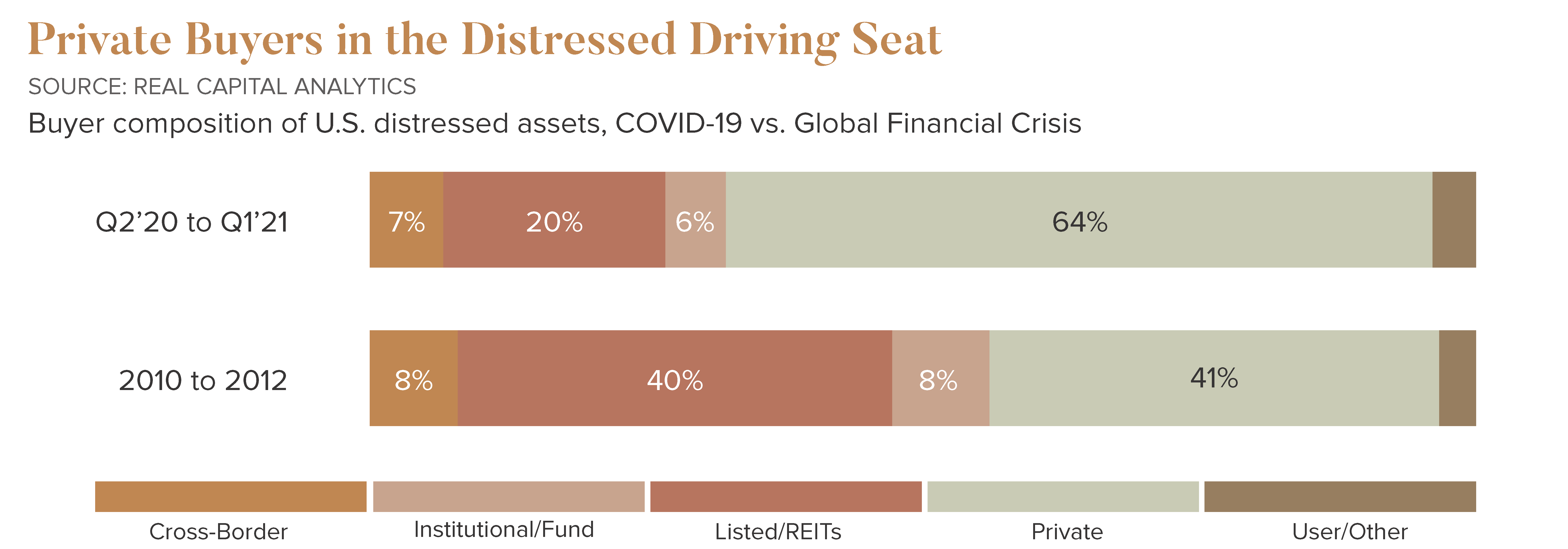

Even distressed asset borrowers are finding the necessary capital, thanks to the plethora of demand and funds dedicated to this particular asset class. Preliminary RCA data shows that through the first five months of 2021, investors acquired 12 percent of distressed assets with the intent to redevelop. With most property owners well-capitalized before the crisis, many find success through repositioning assets that lack income prospects.

Facing Inflation Fears

Investors have recently expressed inflation concerns. The Federal Reserve expects the personal consumption expenditures index (PCE) to rise three percent in Q4 2021. In the short run, owners and investors will need to confront management challenges if inflation pressures continue to build in the economy. Investors worry that this change in the macroeconomic environment could undermine their investments. However, over the long term, commercial real estate prices will keep pace with broader inflationary trends. According to RCA, the last time the U.S. dealt with high inflation was in the 1970s. Owners who purchased before the inflationary spikes did well as they could pay off mortgages using devalued currency, and overall commercial prices kept up with and outperformed inflationary trends. However, this period was not an excellent time for lenders as mortgage rates increased to excessive levels as they struggled with high inflation and high interest rates. In the aftermath, commercial real estate prices underperformed relative to inflation for the next decade. Contributing to the underperformance was a new tax policy which led to a surge in new construction, with new supply coming to the market in the 1980s well above the pace needed by the economy. With too much supply, rents fell, and with high mortgage rates and cap rates, values plummeted. Given this information, investors anticipate the same sort of lost decade for price growth experienced from the 1980s to the mid-1990s. However, supply is still under control today, and there is little risk in the near term that the regulatory changes that helped construction in the past will return. The Wall Street Journal’s economic forecasting survey shows that the CPI will grow at a 2.3 percent annual pace by the end of 2023.

Concerns with New Construction Financing

Lenders remain cautious about new construction. This, of course, has always been the case since the events seen in the 1980s. Further, there are numerous risks in the market today that could delay or halt project completion, including increased material prices, trouble with approvals, and labor shortage. As a result, borrowers require more from lenders on ground-up development and vice versa. Therefore, the equity may not be able to achieve the necessary yield for ground-up construction. Typically, the loan-to-value for a construction loan is 60 percent, 65 percent, or 70 percent.

A new trend in the development space is developers turning to private equity providers, essentially removing the “middleman” to create more profit and less investment dilution.

Looking Ahead

The capital markets have undergone a 180-degree turn from 2020 to 2021, but much remains to be seen as the pandemic’s recovery takes shape. In the coming months, the market will see the beginning of rising interest rates and a steeper yield curve.