CLICK HERE TO DOWNLOAD THE ARTICLE

The widespread COVID-19 crisis pushed drugstores into the delivery and virtual space, accelerating the already-expanding industry. As people began staying home and prioritizing their health, drugstores were left to meet the demand while strategizing to become more health-conscious for both employees and customers. Within the first two weeks of the virus outbreak, drugstore companies were posting stronger-than-usual sales. Let’s take a look at COVID-19’s impact on drugstores and the modifications these tenants are making to meet changing consumer needs.

Where Drugstores Make A Profit

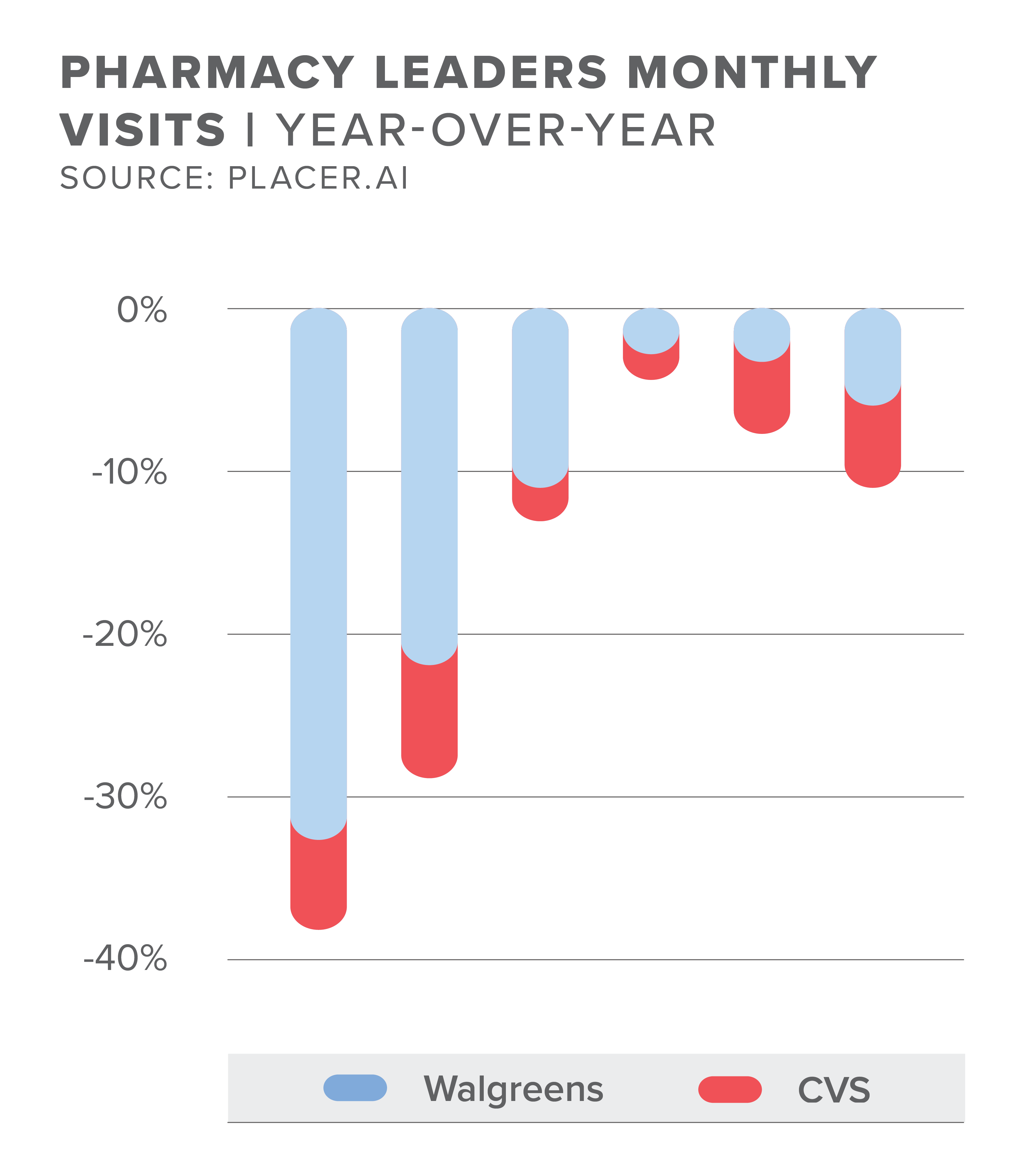

Drugstores have evolved in purpose over the years. Originally dedicated to the sale of prescriptions and over-the-counter medication, drugstores now offer a plethora of household essentials, such as beauty, wellness, and grocery products. This mix of products has kept drugstores open throughout the COVID-19 crisis, as they provide not only medication but also daily necessities. In fact, when the virus was declared a national crisis, drugstores were among the few to report increased foot traffic for the first 21 days in March, with Walgreens seeing 26 percent more same-store sales and CVS Pharmacy experiencing nearly 28 percent more visits.

Drugstores primarily profit from their pharmacy sales. From 2016 to 2019, the world’s very first pharmacy-led health and well-being enterprise, Walgreens, lost $3 billion in retail sales but gained $24 billion in pharmacy sales. In 2019, 74 percent of Walgreens’ sales were from the pharmacy, and 26 percent from retail. During that same time, CVS Health reported 76.7 percent of revenue from pharmacy alone. Following consumers’ favoring pharmacy over retail products in drugstores, the two major players are making deals focused on patient experience and pharmacists’ roles through acquisition and partnerships.

The Impact of COVID-19

For the majority of 2020, the pharmaceutical industry suffered from lockdowns that disrupted the global production and supply chains for an assortment of drugs. While brand-name drugs can rely on reputable supply chains, generic drugs are taking a bigger hit. Drugstores are seeing significant price increases for medicine as the cost of raw materials for drugs rises. This is impacting smaller pharmacy businesses as they are unable to acquire credit or equity funding. However, for larger name-brand drugstores, such as Walgreens and CVS Pharmacy, this means less competition in the market. With the upper hand, investors have begun showing interest in these investment-grade tenants.

Drugstores have long seen the incredible profit from pharmacy sales, and with the introduction of a widespread virus, have now positioned themselves to be more healthcare-oriented. To combat the disruptions by the coronavirus, CVS Health waived fees for prescription home deliveries. The company also went on a hiring spree back in March, employing 50,000 people across the U.S., and again in October for an additional 15,000 employees to ramp up for flu season. Revenues grew eight percent year-over-year in Q1 2020 to $67 billion, thanks to the expansion activity with CVS’s MinuteClinic and Walgreen’s VillageMD. By May, CVS Health saw retail prescription deliveries increase by more than 1,000 percent.

Walgreens was not able to match CVS Health’s growth patterns, as their online sales grew a mere 22 percent in Q3 2020, compared to the 500 percent increase in CVS Pharmacy online sales. Past sales performances and the arrival of COVID-19 have illustrated the importance of access to healthcare services and medication. In response, Walgreens has pivoted focus on front-end store expansion and made partnerships with the likes of Kroger and FedEx. Conversely, CVS Pharmacy partnered with Target in a $1.9 billion acquisition, where CVS Health took over Target’s in-store pharmacy and clinic business in 2015. Walgreens plans to remove some floor space currently devoted to retail items to make way for clinics. Additionally, the drugstore giant has recently undergone a number of deals to diversify its product offerings and strengthen its retail pharmacy business.

Drugstore Partnerships

CVS Pharmacy

CVS Health has been making strides in the industry to implement and focus on healthcare services in their locations. In 2019, they closed 46 of their locations and another 22 of their underperforming stores in 2020. CVS Pharmacy has over 9,900 retail locations and adopted the growth-by-acquisition tactic, partnering with Aetna and MinuteClinic.

Aetna

In 2018, CVS Health acquired Aetna, a health insurer, for nearly $70 billion. Anyone insured by Aetna will receive discounts on health-related items at CVS Pharmacy, free prescription delivery, and 24-hour access to a pharmacist helpline. In September, Aetna announced The Aetna Connected plan, which will promote CVS Pharmacy locations by allowing members to make appointments at MinuteClinics and HealthHUBs.

HealthHUB

The drugstore giant has remodeled locations to equip better health services, known as HealthHUBs. This service allocates 20 percent of the retail space in stores and offers treatments for patients with chronic conditions, diabetic screenings, and sleep apnea assessments. The remodels to transition CVS Pharmacy locations into HealthHUBs have started in 50 U.S. metro areas where Aetna plan members reside. Already, they have seen a 15 percent increase in visits for treatments at HealthHUBs, which also fed into increased in-store purchases, according to J.D. Power. CVS Health plans to roll out 1,500 HealthHUB stores by 2021, with at least 650 openings in 2020.

MinuteClinic

As the largest retail-store-based chain in the country, MinuteClinic, was founded in 2003 and offers treatment for common conditions such as strep throat, mono, flu, and bladder, ear and sinus infections. There are 1,100 walk-in MinuteClinic stores, and they charge $59 per visit, with payment options for uninsured patients. COVID-19 testing has acted as a gateway to MinuteClinics, as one million patients who screened for the virus were first-time visitors. Flu season could feed into trajectory or keep it relatively the same.

Walgreens

Walgreens’ average store size is 13,500 square feet across their 9,021 locations, and the retail sales area encompasses 10,500 square feet. This means that more than 75 percent of the store’s square footage accounted for only 26 percent of its sales in 2019. Already, Walgreens is experimenting with small-format pharmacies in urban, suburban, and rural locations.

Walgreens recognized that primary care physicians saw patients once a year, while pharmacists were visited more frequently, at least 25 to 30 times a year. Physicians can influence a patient’s choice of medication by providing recommendations such as alternative remedies. The impressive pharmacy sales combined with customer relationships with physicians has caused Walgreens to shift all strategies to be more oriented towards healthcare services.

VillageMD

Recently, Walgreens announced their $1 billion partnership with VillageMD, a national provider of primary care. After the investment is complete in the next three years, Walgreens will hold a 30 percent stake in the company. The partnership fulfills the pharmacy chain’s goal to shift healthcare delivery trends and entails full-service clinics that employ family doctors on a large scale. Physicians and local pharmacists will be co-located in areas with professional health shortages and will offer primary care services and 24/7 telehealth and at-home visits. Walgreens plans to build 500 to 700 primary care clinics by their physical stores over the next five years, each ranging in size as little as 3,300 square feet and up to 9,000 square feet.

Rite Aid

When Walgreens announced the acquisition of the third largest retail drugstore, Rite Aid, in 2015, it made headlines. Although the deal fell through, Walgreens ultimately purchased over 2,000 Rite Aid stores and three distribution centers for $5.2 billion. Still, it deterred investors from drugstore properties with concerns of mass store closures with additional mergers and acquisitions. Market terms increased from three to five months to six to 12 months. However, the supply of long-term leased properties decreased from 25 percent of the market in 2019 to 15 percent as of November 2020. This will likely reflect in transactions as they occur less frequently, while demand remains the same.

As part of its deal with Rite Aid, Walgreens prioritized pharmaceutical business and services. Currently, the remaining 2,400 Rite Aid locations are undergoing a full remodel. The pharmacy will be featured as an Apple Store Genius Bar-inspired design that promotes a pharmacist’s value and revitalizes the retail and digital consumer experience.

Outlook for Drugstores

Although COVD-19 remains on the horizon, there is still opportunity. In November 2020, the U.S. Department of Health and Human Services has partnered with local and national chain pharmacies to maximize the access and affordability of COVID-19 vaccines. According to the Associated Press, the agreement entails collaboration with both Walgreens and CVS Health.

While Walgreens and CVS Health have dominated the drugstore space for some time, another competitor is entering the market. In 2020, Amazon announced its online pharmacy, where customers can order common medication and prescription refills to be delivered in just a few days. Amazon is a master in all things e-commerce and poses a threat; although this will likely inspire new ideas as the drugstore behemoths remain competitive. However, CVS Pharmacy and Walgreens have a loyal customer base, especially among elders, who are unlikely to transition, and already have delivery services in place. While the appeal of convenience may lure in customers, Amazon does not offer in-clinic physician services on the same scale as Walgreens and CVS Health.

What This Means For Owners

Lenders and owners can now review nearly a year’s worth of pandemic data to see a property’s rent activity, emphasizing the importance of submitting on-time mortgage payments. Drugstore’s reputation, combined with precaution from lenders to underwrite for nonessential businesses, boosted the sector’s activity. Properties with essential tenants will be viewed differently from those considered nonessential, which will enhance the drugstore’s value. So long as owners maintain rents, mortgage payments, and sales, their drugstore value will grow.

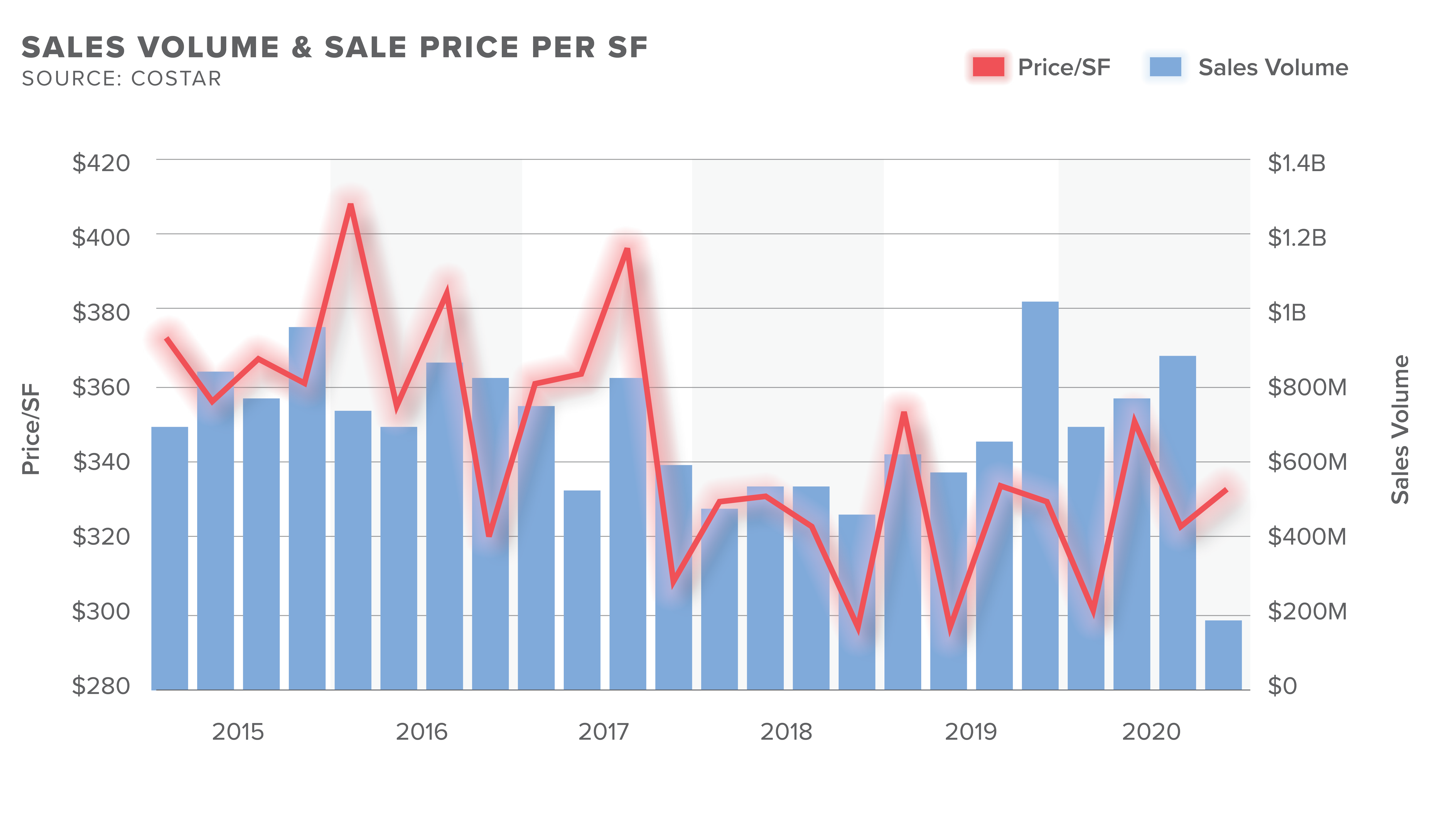

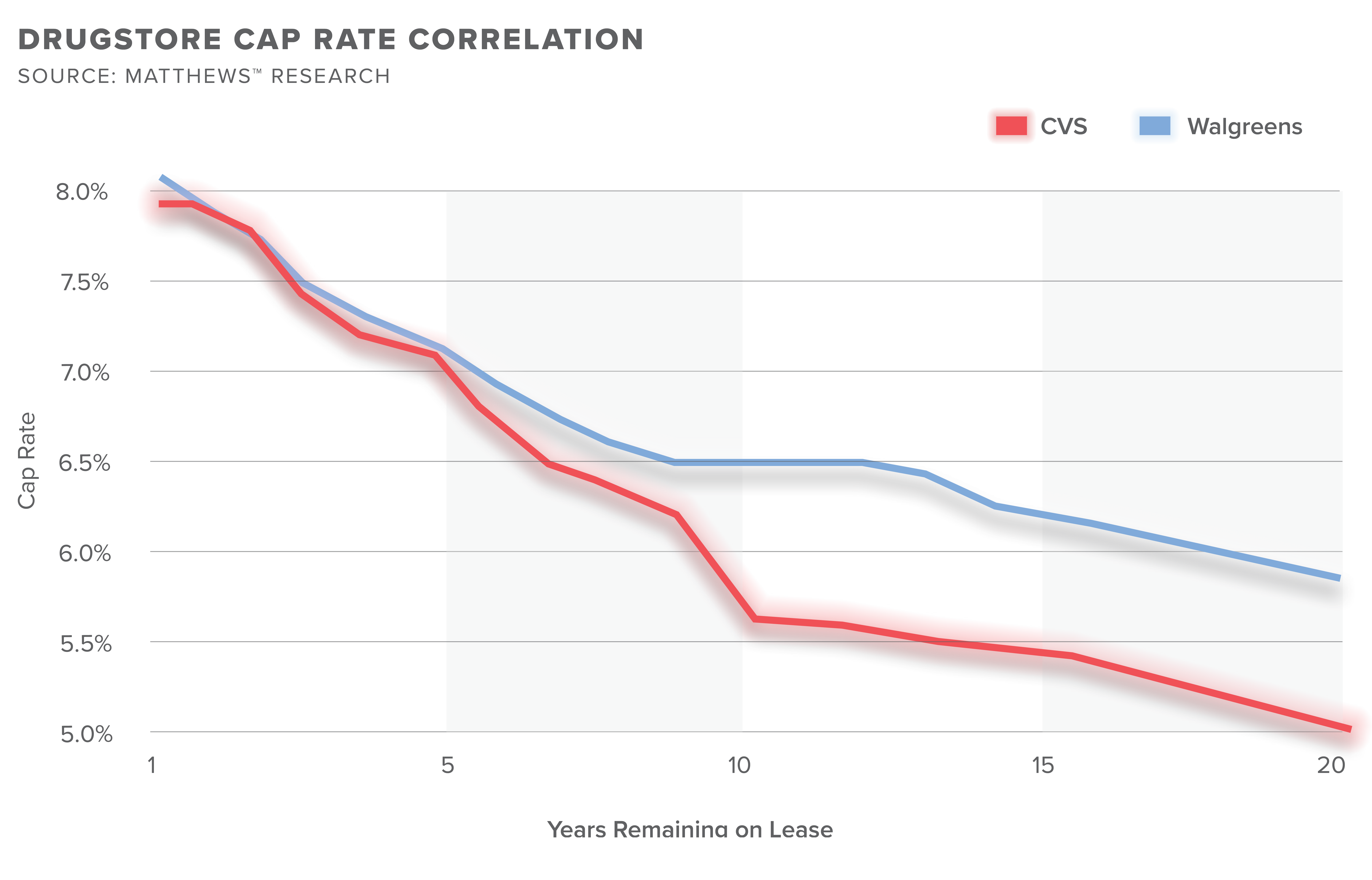

The drugstore sector’s latest activity is from private and 1031 Exchange investors hunting for stable cash flow. Industry experts do not anticipate seeing new physical drugstores in the coming years, and as investors favor essential retailers, the increased drugstore transactions have depleted the sector of quality assets. In 2019, drugstore leases with 15 years remaining accounted for 25 percent of the market, compared to 15 percent in 2020. As of Q3 2020, the average remaining lease term had dropped to ten years, thus increasing cap rates.

CVS Health has proven they can be profitable beyond their physical pharmacy locations as they calibrate their online sales process and expand their HealthHUBs footprint. After Walgreens realized that 75 percent of its sales came from a small section of their store, the pharmacy chain looks to decrease their portfolio by using less square footage to maximize profits.

While COVID-19 boosted drugstore sales, industry players were making big moves before the crisis. The drugstore industry is working vigorously to meet all patient’s needs through partnerships that unlock and utilize primary care doctors and pharmacists. These megamergers and partnerships are feeding into the value of key drugstore players, CVS Health and Walgreens.